IFRS - Leases

IFRS - Leases

Insights and analysis on the impact of the new leases standard, IFRS 16.

Insights and analysis on the impact of the new leases standard, IFRS 16.

Fundamental changes to lease accounting

The new standard requires companies to bring most leases on-balance sheet, which could have a significant impact on financial KPIs and systems and processes. The standard is effective for accounting periods beginning on or after 1 January 2019. Early adoption will be permitted, provided the company has adopted IFRS 15 Revenue from Contracts with Customers.

The HKICPA issued HKFRS 16, which is a word-to-word copy of IFRS 16.

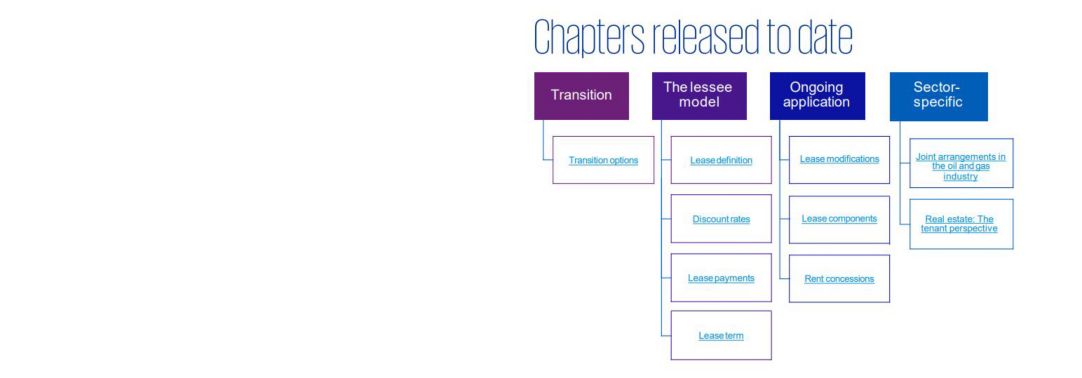

Our materials help you understand the new requirements as well as assessing the impact on your business to get you ready for 2019.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia