KPMG and REC, UK Report on Jobs - October 2023

Permanent staff appointments fall at softer pace in September

Permanent staff appointments fall at softer pace in September

Key findings

Permanent placements decline at weakest rate in three months

Temp billings return to growth

Pay pressures ease as staff supply continues to increase

Data collected September 12-25

Summary

Uncertainty over the economic outlook and rising costs continued to weigh on hiring decisions in September, according to the latest KPMG and REC, UK Report on Jobs survey, compiled by S&P Global. Permanent placements fell again as companies were often reluctant to commit to permanent hires, but the rate of decline was the weakest in three months. Improved demand for short-term staff meanwhile helped to drive a modest uptick in temp billings that was the most pronounced since April.

Turning to candidate supply, the availability of workers improved at a softer, but still sharp rate, with recruiters often linking this to redundancies. Concurrently, pay pressures continued to weaken, with rates of starting salary inflation and temp wage growth edging down to 30- and 31-month lows respectively.

The report is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Downturn in permanent staff hiring eases, temp billings rise

Recruitment consultancies across the UK signalled a softer, but still solid decline in permanent staff appointments during September. According to panellists, companies remained hesitant to commit to new permanent hires due to ongoing economic uncertainty and efforts to control costs. A preference for short-term staff meanwhile supported a fresh rise in temp billings at the end of the third quarter.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Save, Curate and Share

Save what resonates, curate a library of information, and share content with your network of contacts.

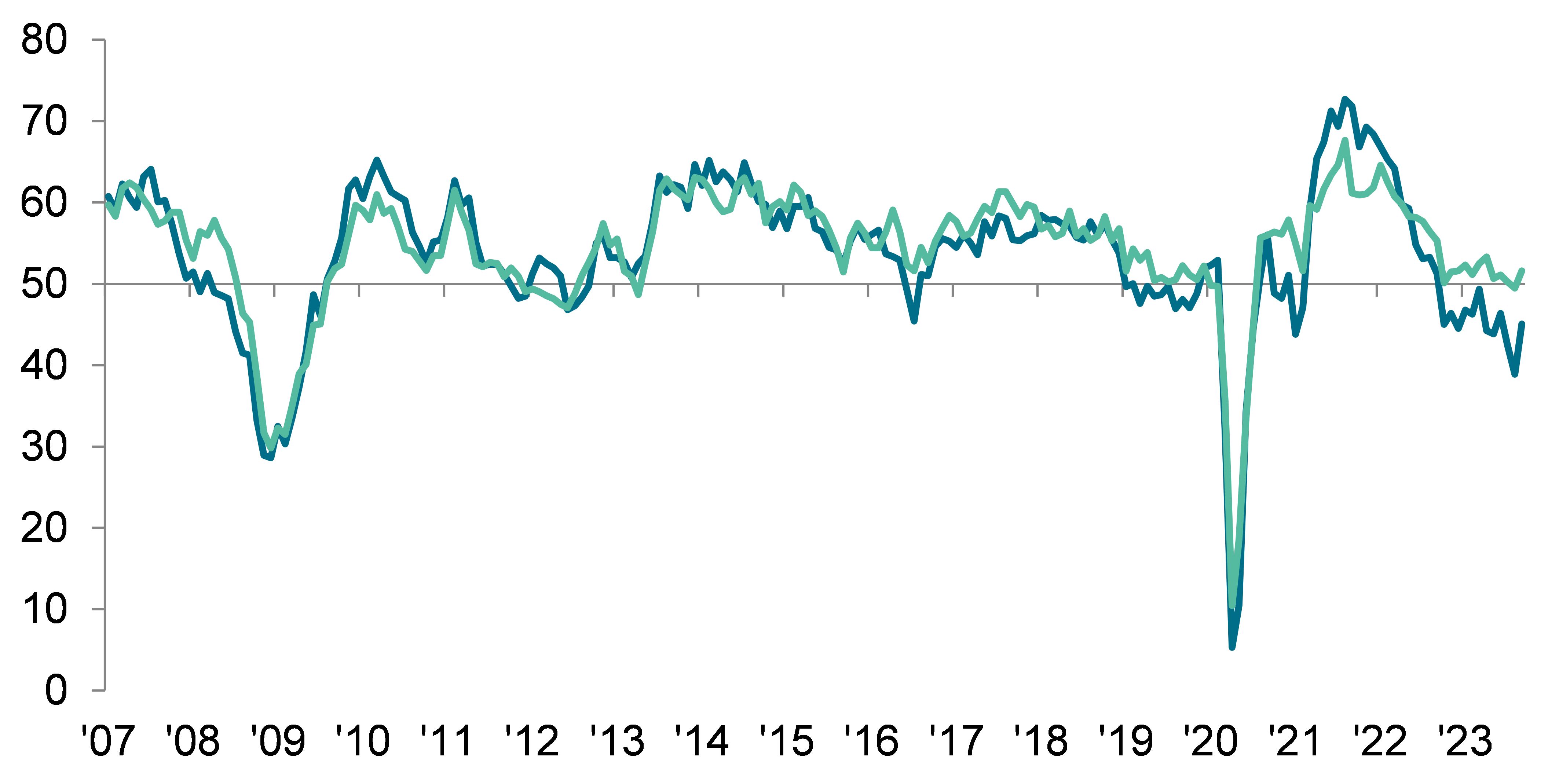

Permanent Placements Index

Temporary Billings

50.0 = no-change

Softer increases in starting pay...

September survey data pointed to a further easing of overall pay growth across the UK. Though sharp, the rate of starting salary inflation edged down to a two-and-a-half-year low, while temp wages increased at the slowest rate in 31 months. While competition for skilled workers and the higher cost of living continued to place upward pressure on pay, there were some reports of greater strain on clients' budgets.

...amid further improvement in candidate availability

The overall availability of candidates improved again in September. Although the pace of expansion softened further from July's recent high, both permanent and temporary labour supply increased at historically strong rates. Anecdotal evidence generally linked the latest upturn to redundancies and a slowdown in market conditions.

Overall vacancies fall slightly in September

Total vacancies slipped into contraction territory in September, marking the first fall in overall demand for staff since February 2021. The rate of contraction was only marginal, however. Underlying data revealed a fresh reduction in permanent vacancies, albeit one that was slight, while growth of demand for temp staff moderated to a four-month low.

Regional and Sector Variations

All four monitored English regions recorded declines in permanent placements, though in all cases rates of contraction slowed from August.

Temp billings increased in all four monitored English areas bar the South of England during September. The quickest expansion was recorded in the capital.

Demand for permanent staff fell across both the private and public sectors during September, with the latter noting by far the steeper rate of decline. Divergent trends were meanwhile seen for temporary vacancies. In the private sector, demand for short-term staff rose at a softer, but still solid pace, but decreased across the public sector.

Permanent staff vacancies increased in five of the ten broad employment categories during September, led by Hotel & Catering. The steepest reductions in permanent labour demand were meanwhile seen in the Retail and Construction sectors.

Demand for temp staff rose in five of the ten employment sectors covered by the survey. Nursing/Medical/Care registered the strongest rise in vacancies overall. Sharp deteriorations in demand were meanwhile signalled for Retail and Executive/Professional workers.

Comments

Commenting on the latest survey results, Claire Warnes, Partner, Skills and Productivity at KPMG UK, said:

“A concerning feature of this month’s data is that demand for staff is losing momentum, with total vacancies falling for the first time since February 2021 amid a fresh reduction in permanent vacancies. While both reductions are slight, employers are clearly nervous due to the long-term economic uncertainty and budget constraints that are impacting businesses everywhere. This in turn is leading to a continued reliance on temporary staff.

“For several months, strong pay growth has been a consequence of a tight labour market. But strains on employers’ budgets are now affecting the rate of starting salary inflation which is at a two-and-a-half-year low, while temporary wages increased at the slowest rate in 31 months.

“Skill shortages across a range of sectors – from permanent IT staff to temporary nursing roles – also continue to be an area of long-term concern for the economy.

“The labour market is starting to look slightly precarious again and recruiters will be wondering and hoping that the recent slight calming of inflation rates positively impacts the outlook for both employers and jobseekers.”

Neil Carberry, REC Chief Executive, said:

“Employers tell us they are feeling better about themselves as the year moves on, and today’s data does suggest the possibility of a turnaround in hiring over the next few months. Permanent placements have been falling for a year now from abnormal post-pandemic highs. While permanent hiring activity continues to slow, fewer firms reported a slowdown last month, leading to a much shallower rate of decline than most months recently. Likewise, temporary hiring remains robust with billings growing marginally in September – as they have most months this year.

“This feels like a market that is finding the bottom of a year-long slowdown. And the relative buoyancy of the private sector is likely to be driving this more positive outlook – while vacancies are now dropping they remain robust in the private sector by comparison to the public. Some sectors such as hospitality, engineering, logistics and healthcare continue to experience very strong and growing demand. Along with high inflation, this is likely to be contributing to the growth of pay for temps and perms alike.

“As we move towards the Autumn Statement, action to help people find high quality roles is essential as the picture varies so widely from sector to sector. The REC would like to see a focus on skills, finally reforming the system to deliver a mix of high-quality courses within the levy framework, and action to tackle inactivity – like extending the Restart programme which has helped recruiters place thousands of long-term unemployed people into work. Both of these could form part of a long-overdue people and growth strategy. From reforming government procurement to better and more effective regulation, there is a lot government could do in partnership with recruiters to drive growth and prosperity.”

Contact

S&P Global

Annabel Fiddes

Economics Associate Director

S&P Global Market Intelligence

T: +44 (0)1491 461 010

Sabrina Mayeen

Corporate Communications

S&P Global Market Intelligence

T: +44 (0) 7967 447030

Methodology

The KPMG and REC, UK Report on Jobs is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

For further information on the survey methodology, please contact economics@spglobal.com.

Full reports and historical data from the KPMG and REC, UK Report on Jobs are available by subscription. Please contact economics@spglobal.com.

KPMG LLP, a UK limited liability partnership, operates from 20 offices across the UK with approximately 17,000 partners and staff. The UK firm recorded a revenue of £2.72 billion in the year ended 30 September 2022.

KPMG is a global organization of independent professional services firms providing Audit, Legal, Tax and Advisory services. It operates in 143 countries and territories with more than 265,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

About REC

The REC is the voice of the recruitment industry, speaking up for great recruiters. We drive standards and empower recruitment businesses to build better futures for their candidates and themselves. We are champions of an industry which is fundamental to the strength of the UK economy. Find out more about the Recruitment & Employment Confederation at www.rec.uk.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world.

We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today. www.spglobal.com.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the data.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.