Just when we thought we’d seen enough corporate reporting change in the UK, the Financial Reporting Council (FRC) issues FRED 82.

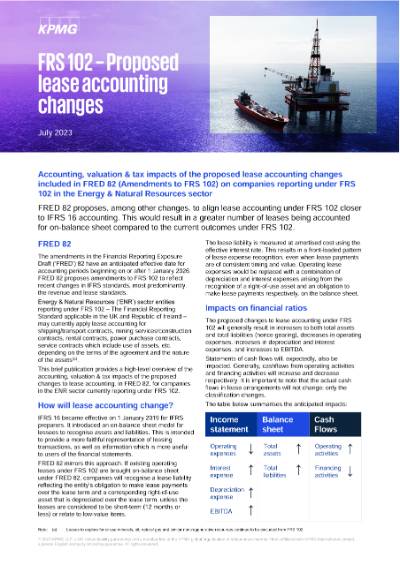

FRED 821 is the FRC’s proposal to bring IFRS revenue and lease accounting into FRS 1022. It represents the “second wave” of IFRS 15 and 16 adoption for UK companies. No longer will private companies be able to avoid the 5-step revenue model or the balance sheet treatment for leases.

Energy businesses are particularly vulnerable, especially when it comes to leases. Whether it’s FPSOs, gas storage facilities, pipelines, retail forecourts or vehicles on mine sites, ENR businesses are heavy users of leases.

Many private UK energy businesses have chosen to adopt FRS 102 as a more attractive alternative to IFRS. It’s seen as simpler to apply with lower costs of compliance. The introduction of IFRS 15 and 16 accounting could significantly erode these benefits.

When these changes were adopted into IFRS, they had a significant impact on ENR businesses – IFRS 16 alone added £bns of debt to the balance sheet of UK plc! Their implementation may require significant time and resources. Some of these changes are transformational in nature and could impact the entire organisation – from record keeping, systems, processes and controls to performance measurement, results and communication.

The proposed effective date is 1 January 2026. This feels like a long way off, but is against a backdrop of significant corporate reporting changes for UK ENR companies. There are the proposed FRC changes to significantly enhance the UK Corporate Governance Code which, if implemented, would also take effect for financial years beginning on or after 1 January 2026 along with two new global International Sustainability Standards Board (ISSB) disclosure standards which (subject to formal UK endorsement) will apply to the first set of reports published in 2026. Now is the time to start thinking about the potential impacts of FRED 82 and how you’ll plan for the change.

KPMG is perfectly placed to support you. We can help assess the impact and develop an implementation roadmap. Read “FRS 102 – Proposed lease accounting changes” for further insight and get in touch if you’d like a conversation.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia