Thai capital market performance

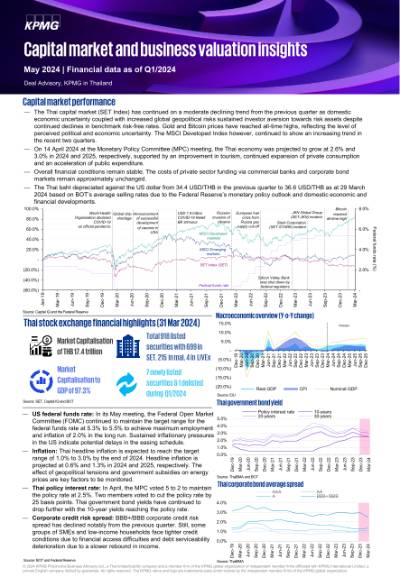

- The Thai capital market (SET Index) has continued on a moderate declining trend from the previous quarter as domestic economic uncertainty coupled with increased global geopolitical risks sustained investor aversion towards risk assets despite continued declines in benchmark risk-free rates. Gold and Bitcoin prices have reached all-time highs, reflecting the level of perceived political and economic uncertainty. The MSCI Developed Index however, continued to show an increasing trend in the recent two quarters.

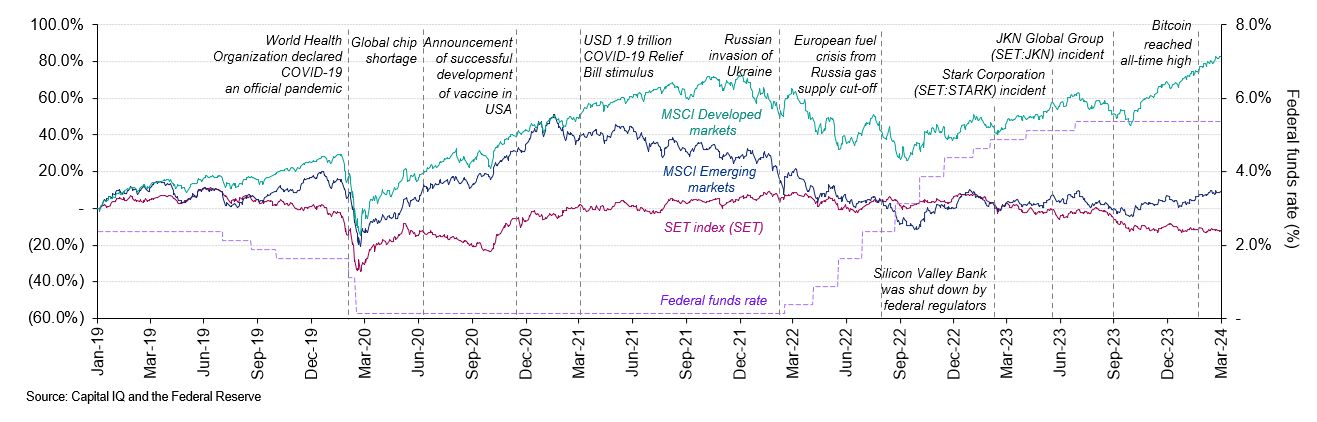

- On 14 April 2024 at the Monetary Policy Committee (MPC) meeting, the Thai economy was projected to grow at 2.6% and 3.0% in 2024 and 2025, respectively, supported by an improvement in tourism, continued expansion of private consumption and an acceleration of public expenditure.

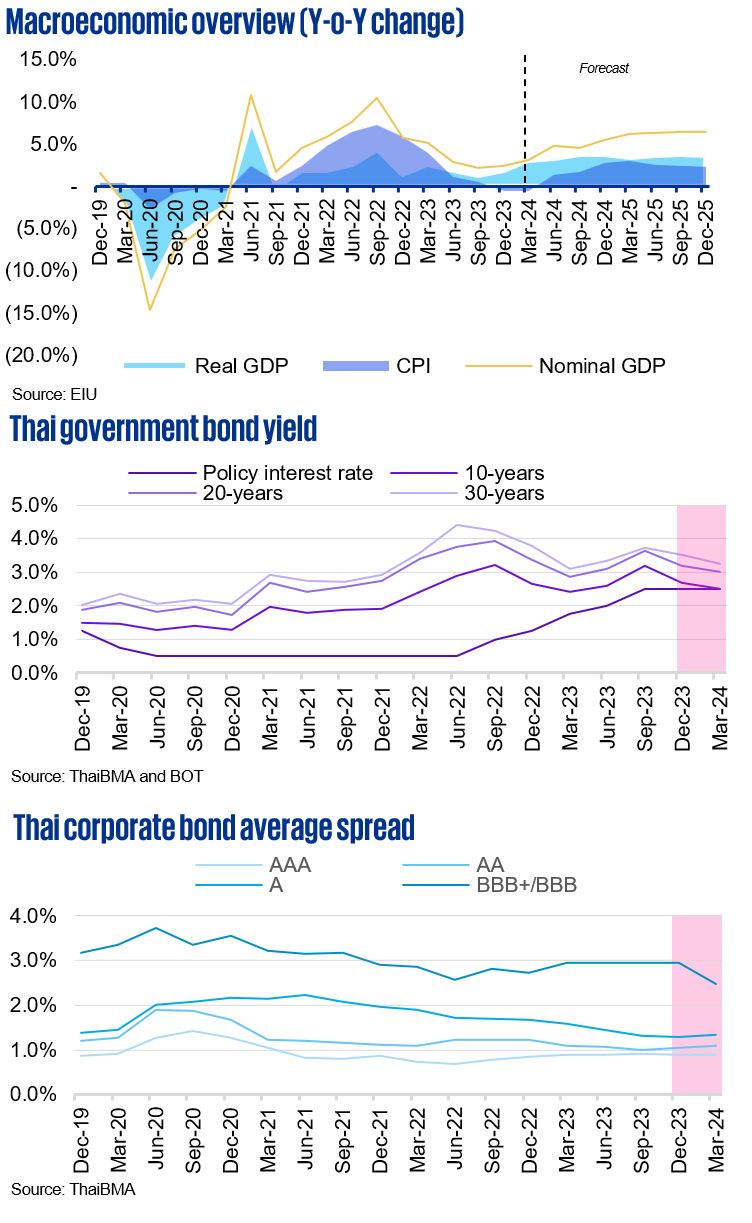

- Overall financial conditions remain stable. The costs of private sector funding via commercial banks and corporate bond markets remain approximately unchanged.

- The Thai baht depreciated against the US dollar from 34.4 USD/THB in the previous quarter to 36.6 USD/THB as at 29 March 2024 based on BOT’s average selling rates due to the Federal Reserve’s monetary policy outlook and domestic economic and financial developments.

- US federal funds rate: In its May meeting, the Federal Open Market Committee (FOMC) continued to maintain the target range for the federal funds rate at 5.3% to 5.5% to achieve maximum employment and inflation of 2.0% in the long run. Sustained inflationary pressures in the US indicate potential delays in the easing schedule.

- Inflation: Thai headline inflation is expected to reach the target range of 1.0% to 3.0% by the end of 2024. Headline inflation is projected at 0.6% and 1.3% in 2024 and 2025, respectively. The effect of geopolitical tensions and government subsidies on energy prices are key factors to be monitored.

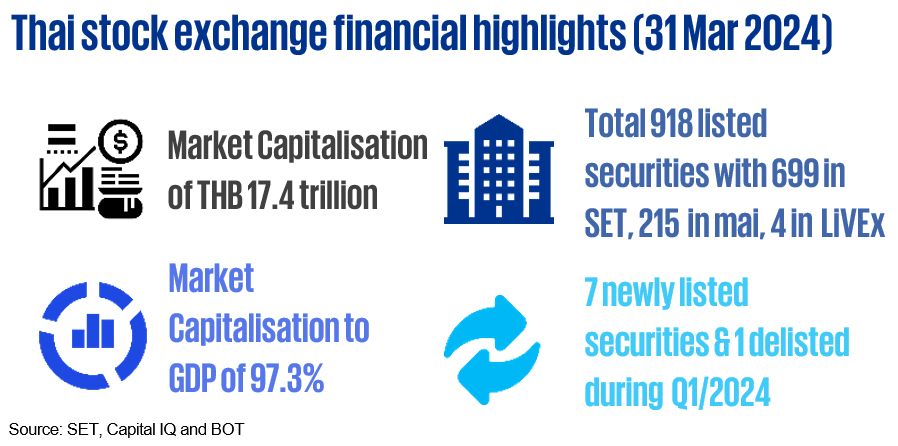

- Thai policy interest rate: In April, the MPC voted 5 to 2 to maintain the policy rate at 2.5%. Two members voted to cut the policy rate by 25 basis points. Thai government bond yields have continued to drop further with the 10-year yields reaching the policy rate.

- Corporate credit risk spread: BBB+/BBB corporate credit risk spread has declined notably from the previous quarter. Still, some groups of SMEs and low-income households face tighter credit conditions due to financial access difficulties and debt serviceability deterioration due to a slower rebound in income.

Source: BOT and Federal Reserve

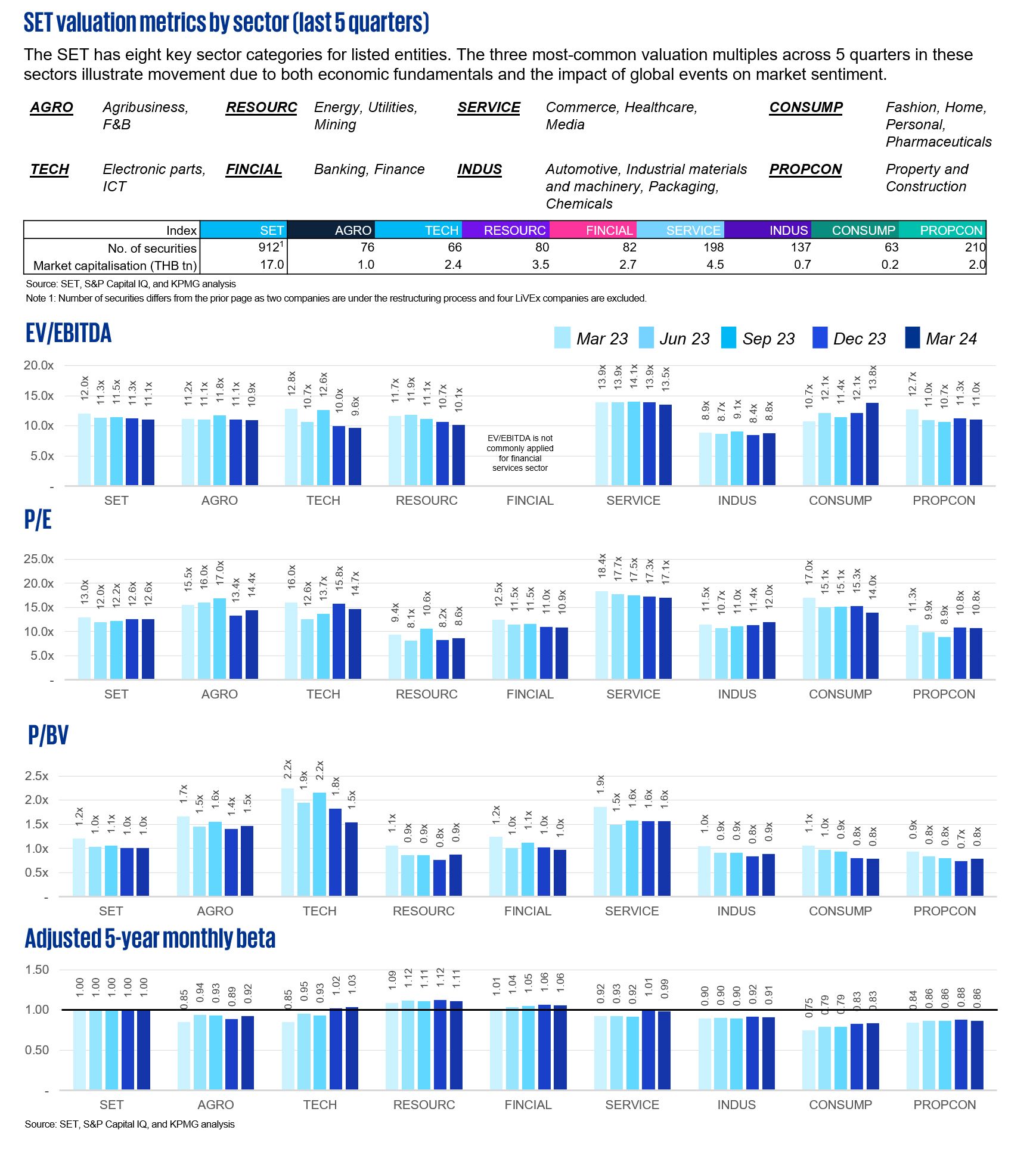

SET valuation metrics by sector (last 5 quarters)

The SET has eight key sector categories for listed entities. The three most-common valuation multiples across 5 quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

The multiples in Q1/2024 show a sideways trend from the previous quarter in almost all of the sectors, except the declined multiples of TECH.

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The betas in the past 5 quarters have shown a trend of convergence towards the market beta of 1.0. Increasing betas in the services and consumption-related sectors indicate rising volatility in response to uncertainties in expected government support and initiatives.

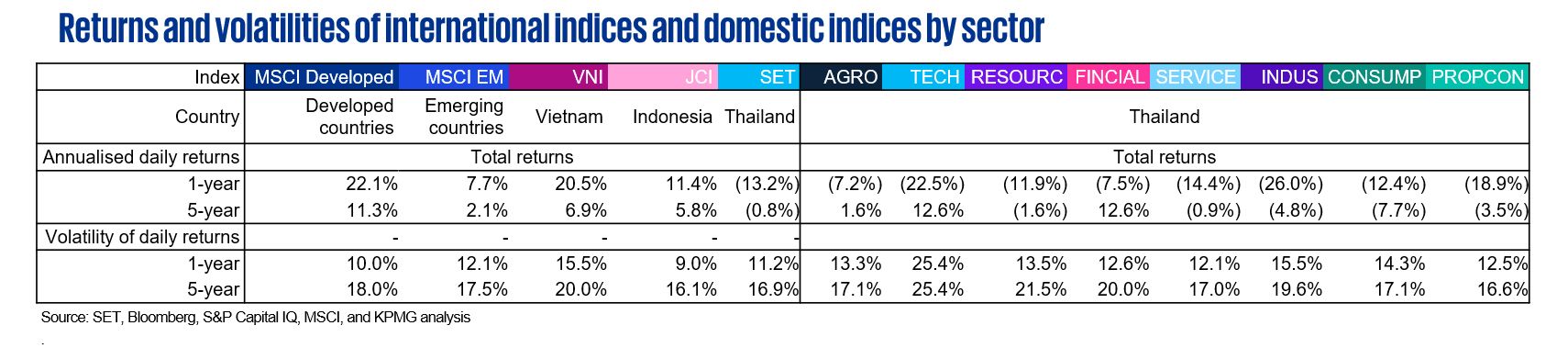

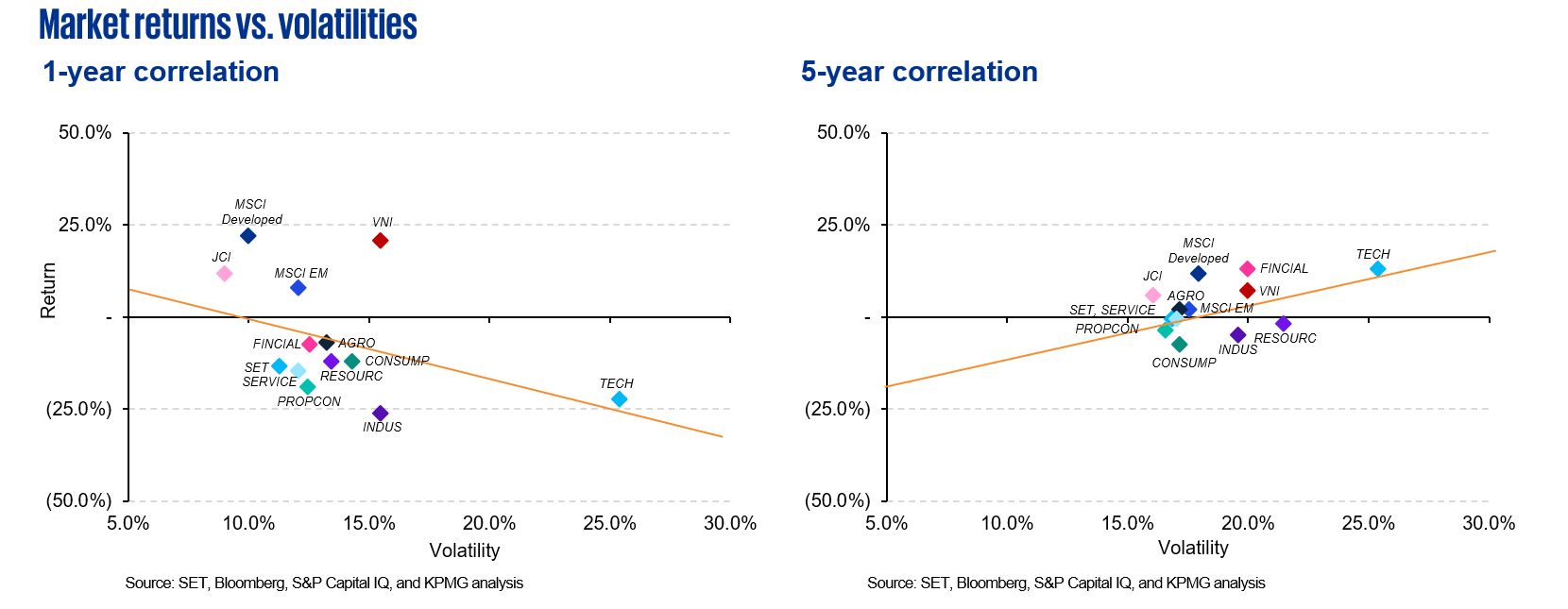

- The SET lagged behind all other illustrated indices over the 1-year and 5-year observation periods. MSCI Developed appeared to have the best performance for both 1-year and 5-year annualised daily returns. 1-year annualised return of VNI has exceeded 20.0%, comparable to the return of MSCI Developed. JCI had the lowest 1-year and 5-year volatilities among the indices while still outperforming MSCI EM.

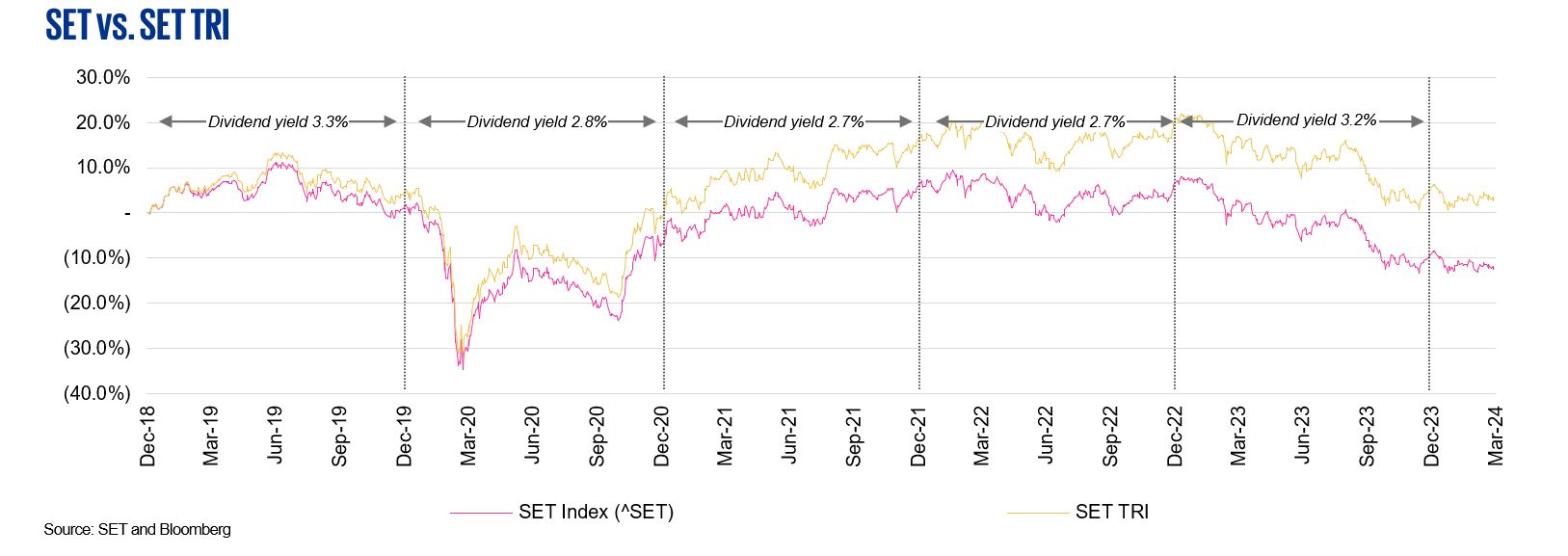

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises (1) a return arising from the change in value of the securities or “capital gain/loss”, and (2) dividends paid, assuming they are reinvested in the securities.

- Dividend yield in 2023 was higher than the previous 3 years and comparable to the 2019 period.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The sector valuation multiples and beta are based on the respective median.

- 12-month trailing multiples are derived from Q1/2023 to Q1/2024.

- Q1/2024 multiple is based on the latest available financial statement information as at Q4/2023.

- Data in historical periods may change according to Capital IQ’s retrospective adjustments.

Regression on returns and volatilities

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 April 2019 – 31 March 2024.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia