In the first quarter of 2023, the Thai economy grew by 2.7%, faster than forecasted, accelerating from the 1.4% growth seen in the previous quarter. The National Economic and Social Development Council (NESDC) forecasted that the GDP growth will expand in the range of 2.7% to 3.7% in 2023(1), compared to 2.6% last year. This growth was facilitated by an upturn in private spending, the recovery of the tourism sector, and the expansion of both private and public investments, which offset a downturn in exports. The recovery of the tourism-based economy has made progress in recent months as Chinese tourists have returned, thereby boosting employment opportunities and domestic demand. Investor confidence is expected to increase if there is a swift successful formation of a new government following the election.

The headline and core inflation rates fell from 5.8% and 3.2%, respectively, in the fourth quarter of 2022 to 3.9% and 2.2% in the first quarter of 2023, respectively, as a result of falling energy and food prices. A slow but steady drop in inflation is expected to continue, with a target rate of 2.5% in 2023 and 2.4% in 2024. Additionally, the Monetary Policy Committee (MPC) of the Bank of Thailand (BOT) announced a further increase in the policy rate by 0.25 percentage points, from 1.75% to 2.00%. The decision to raise the rate is driven by growing economic activity, increased demand pressures, and higher cost pass-through from supply pressures, all of which contribute to inflationary threats. The Committee believes that a continuation of gradual policy normalization is necessary to counterbalance the economic rebound and inflation.

Regarding the BOT’s financial measures, the BOT issued soft credit facilities to 63,187 debtors, amounting to a total of THB236 billion as of 15 May 2023. This represents an increase of 3,296 debtors, or 5.5%, compared to 13 February 2023(2). The asset warehousing program ended on 9 April 2023, with a total of 500 debtors and debt amounting to THB74 billion issued. Financial institutions are maintaining their capital and loan loss reserves at high levels, demonstrating ongoing support. With the revival of the economy, both households and businesses are now in a better position to manage their debt. However, certain SMEs and households, facing rising living expenses and increased debt burdens, continue to experience financial instability. The Committee emphasizes the importance of implementing targeted measures and sustainable debt resolution options in place for vulnerable groups and urges financial institutions to continue their efforts in debt restructuring.

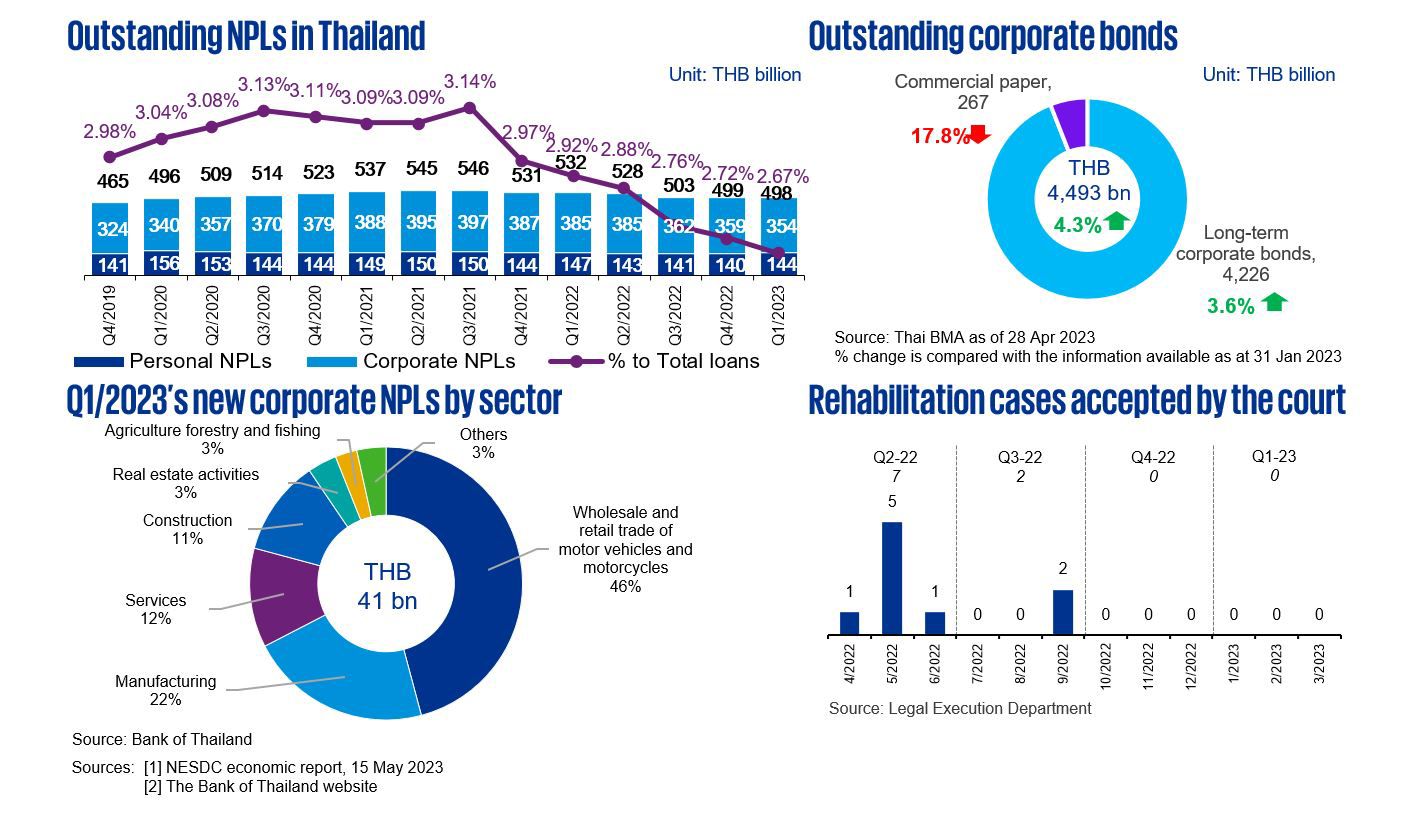

Outstanding Non-Performing Loans (NPLs) experienced a slight decrease from THB499 billion to THB498 billion in the first quarter of 2023 compared to the fourth quarter of 2022. Moreover, the percentage of NPLs to total loans continuing to decline, decreasing from 2.72% to 2.67%. According to the release published Thai Bond Market Association (Thai BMA) in April, the value of long-term Thai corporate bonds increased by 1.6% year over year to THB270 billion in the first quarter of 2023. This growth can be attributed to the ongoing improvement in the economy, which has enabled businesses to secure funds at lower costs. The Thai BMA also projected that corporate bond issuance for this year would exceed THB1 trillion. These positive signs of economic recovery have encouraged businesses to implement robust turnaround plans to address financial distress. With stakeholders supporting out-of-court debt restructuring, no new rehabilitation cases were accepted by the Central Bankruptcy Court in Q4-22 or Q1-23.

Data criteria

- The value data provided in the ‘Outstanding NPLs in Thailand’ chart represents the total value of non-performing loans (NPLs) outstanding for both corporate and individual consumers in financial institutions. The percentage to total loans indicates the proportions of outstanding NPLs to the total outstanding loans.

- The pie chart ‘Q1/2023’s new corporate NPLs by sector’ represents the new and re-entered corporate NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has deemed eligible for consideration. The court may reject applications for rehabilitation.

KPMG Deal Advisory

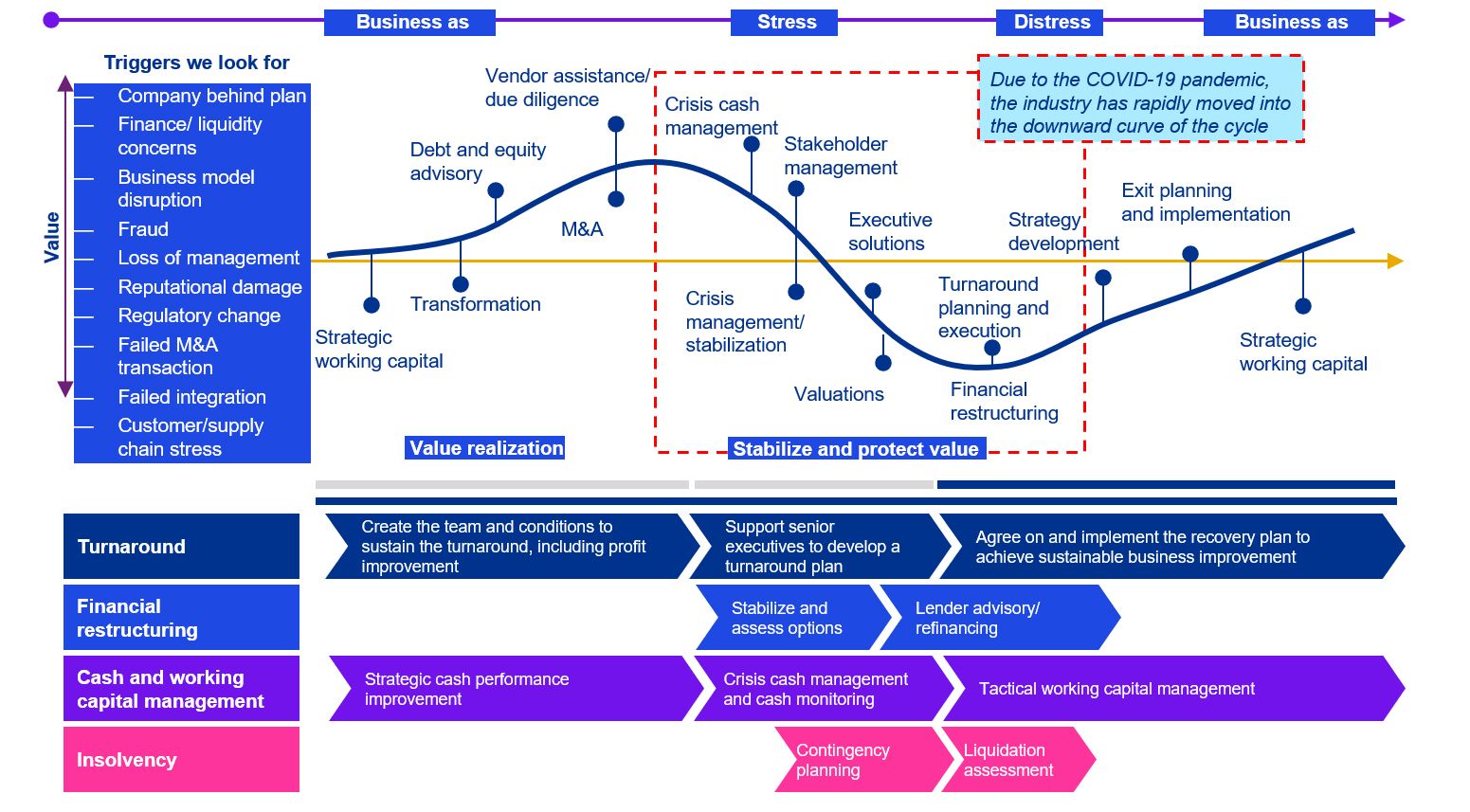

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed phase of the cycle. Our experienced approach brings valuable insights and guidance to help you to stabilize and protect value, and then prepare the business for a successful emergence.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia