Thai capital market outlook

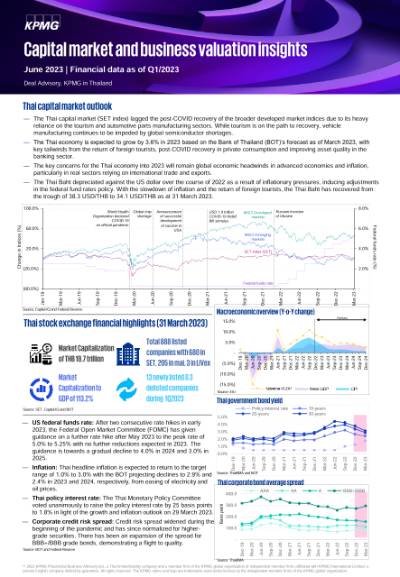

- The Thai capital market (SET index) lagged the post-COVID recovery of the broader developed market indices due to its heavy reliance on the tourism and automotive parts manufacturing sectors. While tourism is on the path to recovery, vehicle manufacturing continues to be impeded by global semiconductor shortages.

- The Thai economy is expected to grow by 3.6% in 2023 based on the Bank of Thailand (BOT)’s forecast as of March 2023, with key tailwinds from the return of foreign tourists, post-COVID recovery in private consumption and improving asset quality in the banking sector.

- The key concerns for the Thai economy into 2023 will remain global economic headwinds in advanced economies and inflation, particularly in real sectors relying on international trade and exports.

- The Thai Baht depreciated against the US dollar over the course of 2022 as a result of inflationary pressures, inducing adjustments in the federal fund rates policy. With the slowdown of inflation and the return of foreign tourists, the Thai Baht has recovered from the trough of 38.3 USD/THB to 34.1 USD/THB as at 31 March 2023.

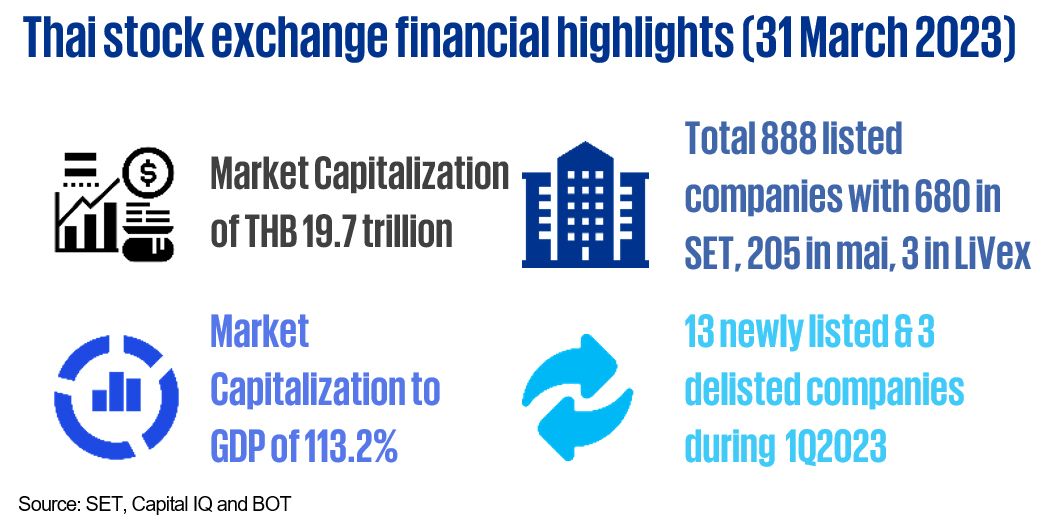

- US federal funds rate: After two consecutive rate hikes in early 2023, the Federal Open Market Committee (FOMC) has given guidance on a further rate hike after May 2023 to the peak rate of 5.0% to 5.25% with no further reductions expected in 2023. The guidance is towards a gradual decline to 4.0% in 2024 and 3.0% in 2025.

- Inflation: Thai headline inflation is expected to return to the target range of 1.0% to 3.0% with the BOT projecting declines to 2.9% and 2.4% in 2023 and 2024, respectively, from easing of electricity and oil prices.

- Thai policy interest rate: The Thai Monetary Policy Committee voted unanimously to raise the policy interest rate by 25 basis points to 1.8% in light of the growth and inflation outlook on 29 March 2023.

- Corporate credit risk spread: Credit risk spread widened during the beginning of the pandemic and has since normalized for higher-grade securities. There has been an expansion of the spread for BBB+/BBB grade bonds, demonstrating a flight to quality.

Source: BOT and Federal Reserve

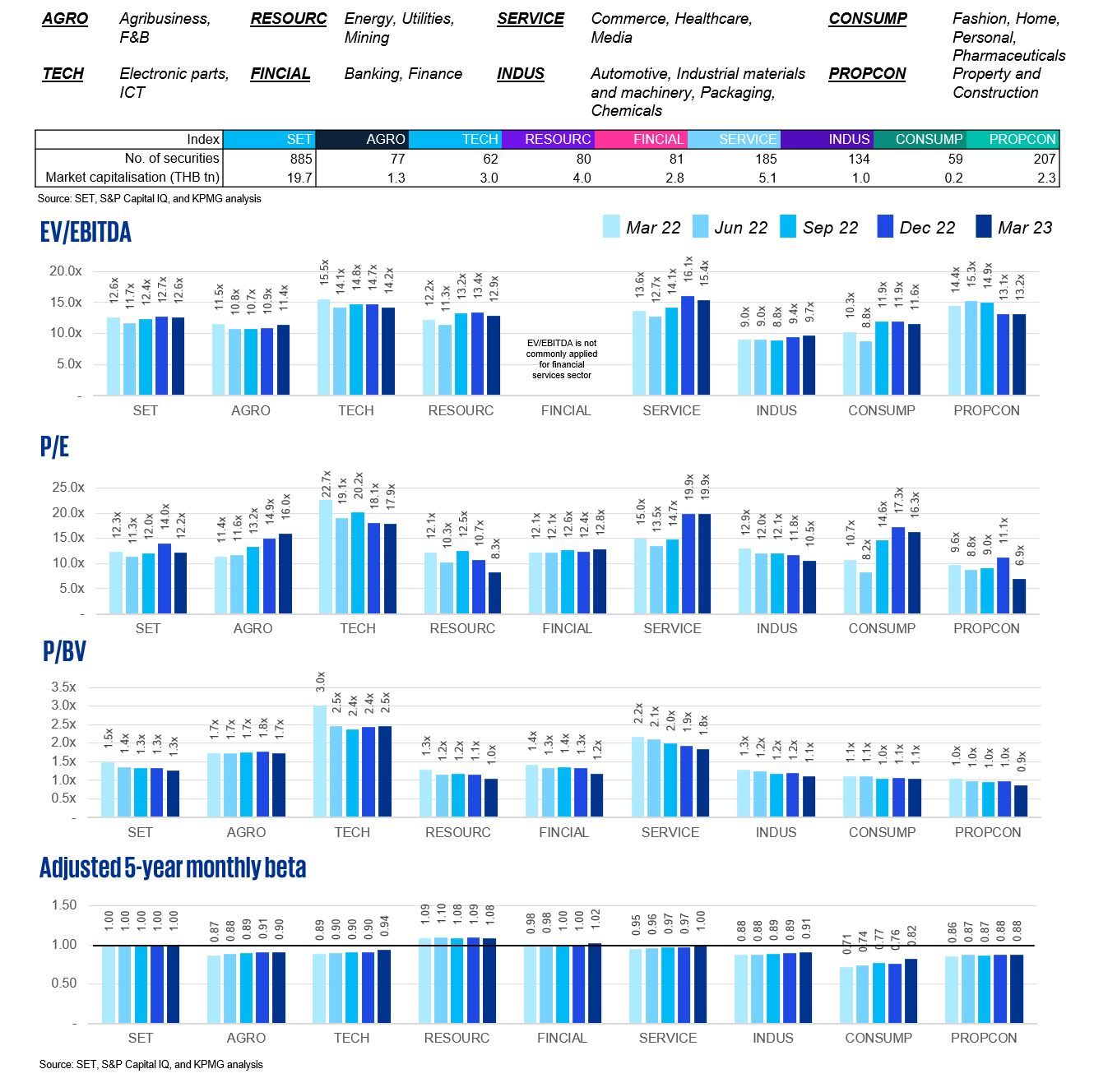

SET valuation metrics by sector (last five quarters)

The SET has eight key sector categories for listed entities. The three most common valuation multiples across five quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

By March 2023, the SET index had seen a return of earnings multiples to March 2022 levels with AGRO, SERVICE and CONSUMP sub-segments driving increases in earnings multiples. This appears to have been driven by earnings pressure as P/BV multiples have experienced a general decline across all sub-segments of the SET, indicating continued valuation pressures in the market.

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The beta in the past five quarters has shown a trend of convergence towards the market beta of 1.0.

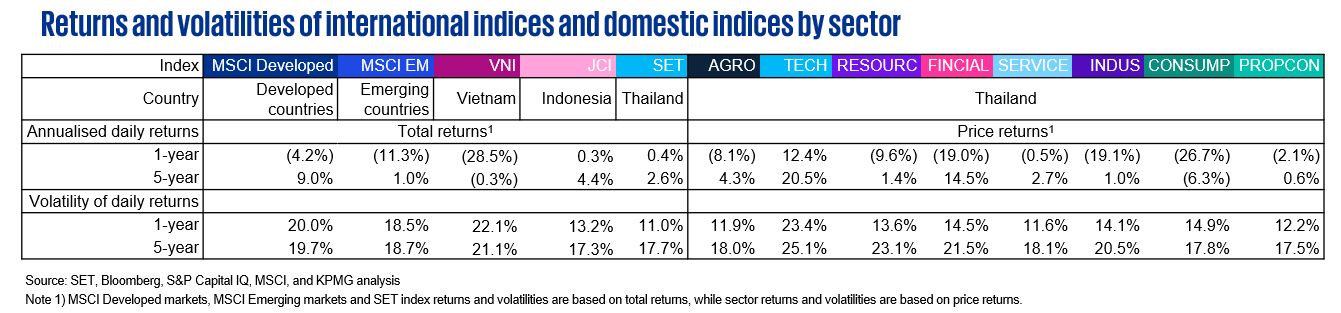

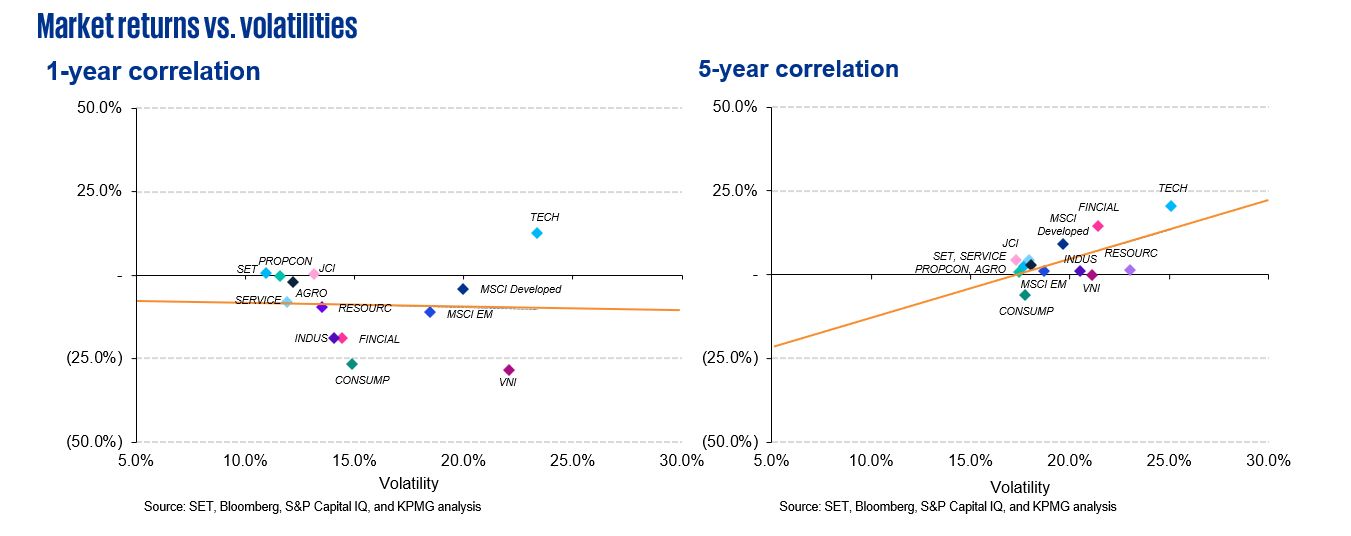

- The SET has outperformed the MSCI EM and VNI indices over the 1- and 5-year observation periods. However, the market has underperformed the similarly sized Indonesian stock market. Returns appear to have been weighed down by the price performance of constituents in the traditional economy while technology players have outperformed. The SET had lower volatility for the year ended March 2023 than other compared markets.

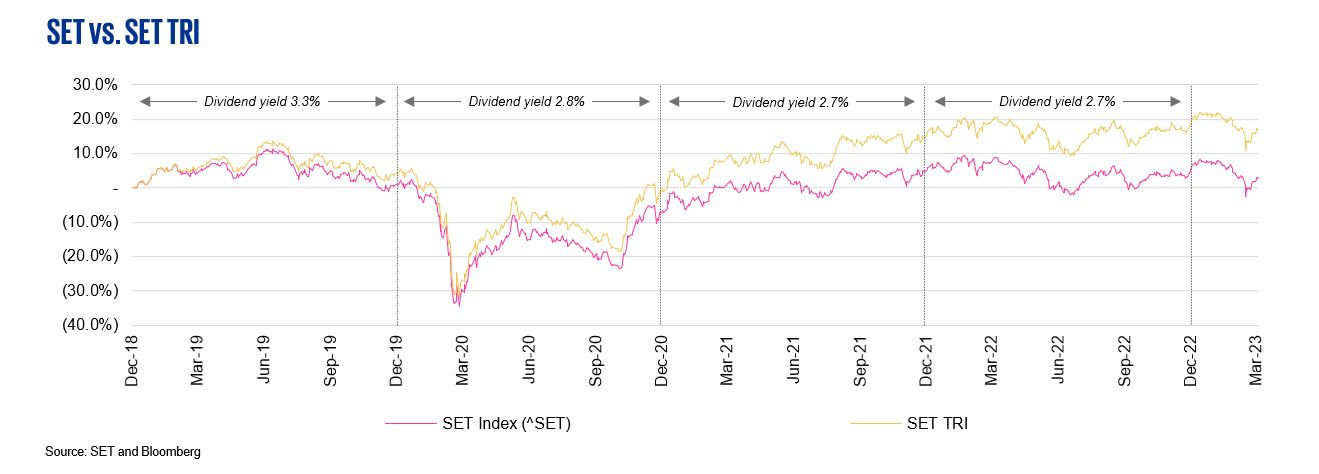

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises (1) a return arising from the change in value of the securities or “Capital gain/loss”, and (2) dividends paid, assuming they are reinvested in the securities.

- Dividend yields have shown a slight declining trend owing to the expansion of value share of non-dividend-paying sectors and recent earnings trends across the traditional economy.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The calculation of the sector valuation multiples excludes company multiples outside of the first- to third-quartile range.

- 12-month trailing multiples are derived from Q1/2022 to Q1/2023.

Regression on returns and volatilities

- Market index returns and volatilities are determined by total returns while Thai sectors' returns and volatilities are determined by price returns.

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 April 2019 – 31 March 2023.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia