Big tech companies such as Amazon, Google, Facebook and Apple are often cited as leaders due to the success and flexibility of their business models. While they owe their rapid growth to their enormous innovative spirit, there is also a clear focus on the global scaling of digital sales channels. One key factor in this scaling are payment services in order to monetize offers efficiently. These are generally provided by so-called "corporate fintech", independent group companies that bundle expertise and solutions for payment processing.

This article outlines the benefits of corporate fintech for established companies, who it is suitable for, what can be done to implement it and what value corporate treasury can add.

Independent fintech units in corporate groups

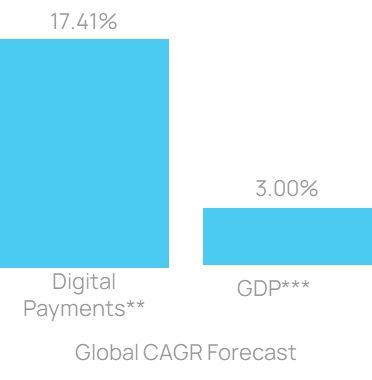

In the coming years, while the economy as a whole will have to contend with a recession, the market for digital payments is expected to grow by 20.8%1 annually. This will mean that the market will become more relevant, if not highly relevant, for all companies.

Fittingly, investor Angela Strange, who is a partner at Silicon Valley investor Andreesen Horowitz2, has posited that in future "every company can be a fintech" and generate a significant proportion of its revenue from financial services. Notably, this will be made possible by new web services, such as BaaS (Banking as a Service) offerings, which also allow companies without a banking license to offer financial services.

By the same token, a lack of expertise in the area of digital payments could become a real stumbling block for business development in the future. These days, customers tend to simply turn away if a payment process is too complicated, is interrupted or popular payment methods are not offered. There are other challenges that will need to be overcome in the future in order to be successful in competition. Among these are the automatic processing of payments on marketplaces or between systems in the background (M2M payments).

Regrettably, established banks, payment service providers or the internal payment factory often do not offer suitable solutions for the complex organizational, process-related and international requirements of companies. In light of this, companies and digital groups from various industries have bundled all activities in specialized departments or subsidiaries in recent years. Such units take care of all digital payment topics and offerings across the group.

In nearly all companies, digital payments will play a major role.

Figure 1: Development of digital payment as compared to global GDP

Source: ** Growth Forecast Global Digital Payment Growth: https://www.prnewswire.com/news-releases/digital-payment-market-size-to-grow-by-usd-85-12-bn--driven-by-rising-number-of-online-transactions--technavio-301451318.html *** Growth Forecast Global GDP: https://www.imf.org/en/Publications/WEO/Issues/2023/07/10/world-economic-outlook-update-july-2023

Corporate Fintech: Advantages and features

The biggest advantage is gained by companies that bundle digital payments in an independent subsidiary, a so-called corporate fintech. While the exact structure of the financial services offered varies from company to company, all corporate fintechs have one thing in common: They are composed of experts with both professional, technical and legal backgrounds, which means that a focused interdisciplinary team enables innovative financial services to be developed more quickly and efficiently and established across the group.

For companies with considerable sales via digital payments, it is usually worth setting up a small banking license, usually with a permit in accordance with the German Payment Service Provider Supervision Act (ZAG). For companies with considerable sales via digital payments, it is usually worth setting up a small banking license, usually with a permit in accordance with the Payment Service Provider Supervision Act (ZAG). While this license does not include the ability to grant loans, it allows companies to independently define payment processing and the associated customer processes. It also enables optimized cooperation with other banking partners. For very large companies in particular, these small banking licenses can be operated in parallel with existing house banks.

In this way, digital payment services can be offered in a more focused manner.

The ZAG license can be used to offer more customer-friendly processes, to process certain forms of payment such as invoice purchases independently or to reduce dependency on service providers. This is also an additional step towards expanding internal value creation.

Which business groups would benefit from a corporate fintech?

Corporate fintechs are particularly useful for bundling digital payment activities, implementing them in a structured and efficient manner and reducing dependencies on third parties.

Now the question is: Shouldn't every company set up its own corporate fintech? Based on our experience, internationally active companies with a strong innovative drive in particular benefit from setting up a corporate fintech. Being innovative requires structures and systems that allow new and diverse business models to be implemented quickly. It allows customer needs to be implemented flexibly and quickly.

And this is precisely where corporate fintech comes in, operating outside of existing corporate structures. By eliminating middlemen, processes become faster and more independent, product innovations can be brought to market easily and independently and can also be rolled out in other countries.

Years ago, OEMs were already pioneers in this area, offering their customers financing with the help of their own financial services and thus strengthening customer loyalty. After an initial wave in which online retailers in particular established their own corporate fintech, we are currently seeing an increasing number of initiatives by established industrial companies.

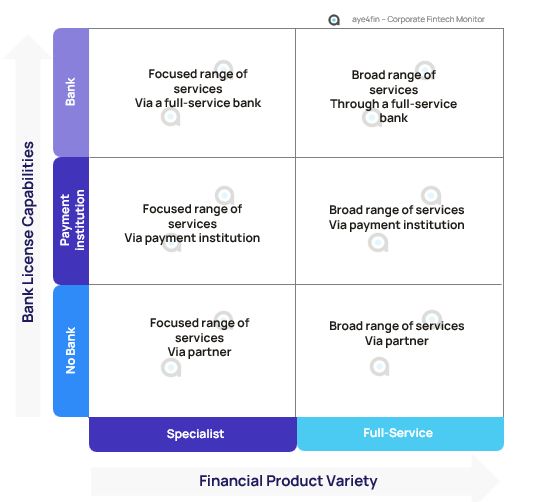

Figure 2: Corporate Fintech Monitor

Source: aye4fin

The path to a corporate fintech

Once a company decides to develop into a corporate fintech, it is crucial to establish a clear vision. The transition from a hierarchical organizational structure with financial partners to a dedicated corporate fintech with a banking license is a complex transformation process that cannot be achieved overnight.

Typically, a lot of questions arise, such as:

- Is the business case sufficient for a banking license?

- And just what expertise and resources do we need?

- How long does the development phase last?

- What needs to be done and in what order?

- Are we now competitors of our service providers?

- What certifications do we need?

Splitting the overall objective into several phases and enabling initial corporate fintech offerings quickly is quite common, and the following procedure has become established:

Step 1: Benchmarking:

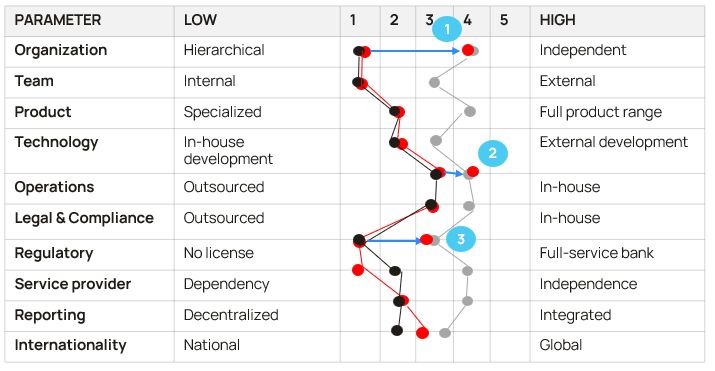

Based on a corporate fintech framework, an outside-in analysis is conducted to compare the company along relevant parameters with leading practice companies within the same industry or in other industries.

Figure 3: Example benchmark

Source: aye4fin

Step 2: Developing an understanding of corporate strategy

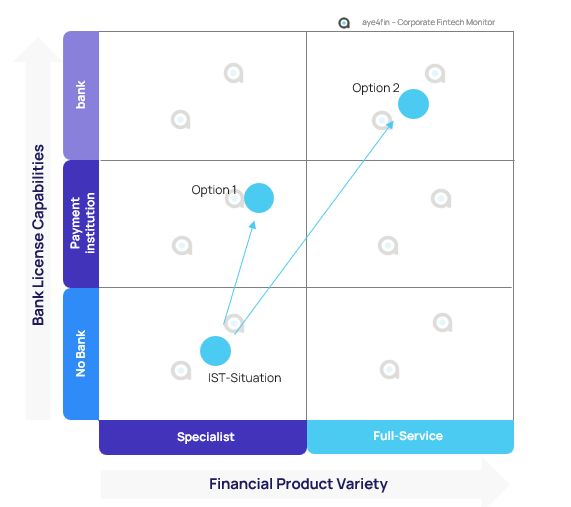

Next, the strategic target vision and digital payment strategy are discussed in order to integrate them into the Corporate Fintech Monitor. This results in one or more target positionings that differ in terms of availa-ble bank licenses and depth of financial services.

Figure 4: Example of strategy development

Source: aye4fin

Step 3: Detailing the potential solutions

With the strategic objectives available, supplemented by benchmark information and the target positioning(s), the next step is to detail available options. First conceptual designs are developed and recorded in a catalog of requirements, which represents an important basis for decision-making for the development of a prioritized solution.

Step 4: Business case

At the core of the persuasion process within the company is the business case, which also includes the planning of the resources required for operations. When calculating the business case, both revenue-increasing activities, resulting from the use of new sales channels, and cost-reducing activities, resulting from the bundling of transaction volumes, which are made possible by the establishment of a corporate fintech, must be taken into account. It is also possible to establish a regulated institution with a small team by using outsourcing and cooperation partners.

Figure 5: Target Operating Model for a corporate fintech

Source: KPMG AG

Step 5: Implementation planning and execution

When it comes to implementation, we recommend a pilot that can be implemented quickly and still promises a great return in order to improve company-wide acceptance. Then, in a structured roll-out process, further use cases follow according to their priority and complexity. Especially in international projects, there are also numerous differences depending on local regulation and the payment service provider to be integrated, which can be handled efficiently by a corporate fintech.

Step 6: Ongoing review

When establishing and designing a corporate fintech, it is important to regularly review rapidly changing framework conditions, in particular regulatory, legal and technical requirements, as they may make it necessary to adapt the target design. Over the next few years, the implementation of the European Payment Service Directive 3 (PSD3) in particular will lead to organizational and technical changes.

Summary:

By the term corporate fintech, we mean the bundling of group-wide activities for digital payments in a legally independent company within a company.

Setting up a corporate fintech is relevant for all companies that consider digital payments to be a strategic (additional) service for their company and want to position themselves accordingly.

When it comes to the practical implementation of projects in companies, the treasury department plays a central role in end-to-end planning and management. By pooling digital payments activities in an independent company, projects can be implemented more efficiently compared to decentralized setups, despite an increased need for interaction within the organization and also from region to region.

These projects can take anywhere from a few months to several years. Especially if there is a need for an own payment service provider license, the duration and effort increase significantly. In some cases, companies have to wait around 1.5 years for a license to be issued.

An early analysis of the individual approach to digital payments sharpens the path to the target image. For many companies, the development of a customized Corporate FinTech is a guarantee for remaining competitive.

Digital payment cooperation KPMG & aye4fin:

Being leading consulting firms in the field of digital payments, KPMG & aye4fin advise international companies, marketplaces and payment service providers on the development and expansion of innovative payment solutions. Both companies regularly publish information on exciting market developments.

Source: KPMG Corporate Treasury News, Edition 139, December 2023

Authors:

Michael Gerhards, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Sascha Uhlmann, Senior Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Guest author:

Thomas Tittelbach, Managing Partner, aye4fin

______________________________________________________________________________________________________________

1 Source: https://www.grandviewresearch.com/press-release/global-digital-payments-market, Accessed on 01.10.2023

2 Source: https://www.trendingtopics.eu/investorin-jedes-unternehmen-kann-auch-ein-fintech-sein/, Accessed on 01.10.2023

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia