As early as 1994, Bill Gates said: "Banking is necessary, banks are not". This motto regained importance after the 2007/08 financial crisis, when the banking sector's deficiencies became apparent and start-ups began to exploit these weaknesses to their advantage by using new technologies (Financial Services + Technology = FinTech).

And since then, several new business models and companies have emerged that are hugely popular with private users in particular and have become an integral part of everyday life, such as Wise, Robinhood and N26.

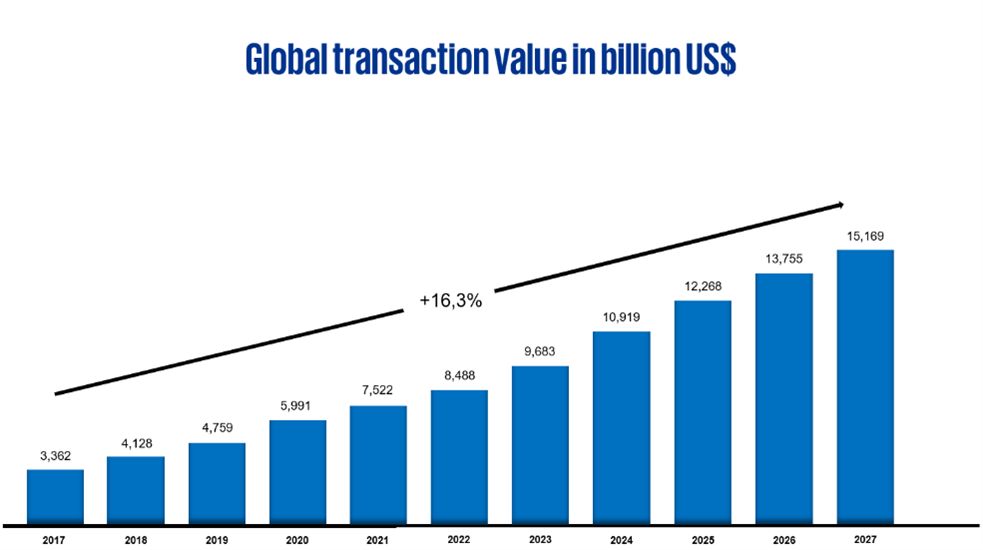

By 2027, the market for digital consumer payments alone is expected to grow by 16.3% p.a.:

Graph: Market Data Analysis and Forecast

Source: statista Report FinTech

While these and other developments present treasury departments with challenges, they also open up opportunities to deliver a sustainable contribution to the overall success of the company through innovation and cost efficiency.

The following section identifies FinTech, start-up and novel approaches along the treasury task spectrum and analyzes the potential added value.

Cash and liquidity management

At the same time, the disruptive potential of new solutions is changing various aspects of cash and liquidity management. This is where efficiency, transparency and control can be improved.

Real-time insights into liquidity: These tools can provide corporate treasuries with real-time insights into their liquidity positions. By analyzing cash flows, investment and repayment plans in real time, these tools give a comprehensive overview of a company's liquidity.

Cash and liquidity forecasting: Predictive analytics and machine learning can be utilized to more accurately forecast cash and liquidity needs. This forecasting can help treasurers to reduce necessary liquidity buffers and, consequently, liquidity costs.

Funding: The solutions' focus is on more efficient and flexible financing options. For example, these include platforms for syndicated loans, blockchain promissory bills or bonds and pay-per-use models. There are also new providers of innovative supply chain finance solutions entering the market in the area of working capital management.

Investments: Leveraging cutting-edge platforms, robo-advisors and automated trading systems, companies are finding it easier to explore and manage investment opportunities for excess liquidity across asset classes, taking into account individual risk preferences. Delivering data-driven insights, advanced analytics and cost-effective investment options helps treasurers optimize financial outcomes.

The following are examples of this: HighRadius (AI-based order-to-cash and treasury management provider), Tesorio (cash flow forecasting and management) and GTreasury (comprehensive treasury management system provider), Taulia (supply chain finance), Othoz (AI-based investment strategies), Treasuryspring (financing and investment provider) and VC Trade (private placement platform for debt offerings), Finledger (blockchain platform for settlement of promissory bills)

Payment operations

The digitalization of payment transactions will have profound consequences for treasury departments.

Changes in the B2C environment: There has been a massive change in consumer behavior in recent years, particularly in digital commerce (online shopping and direct payment), mobile point-of-sale payments (payment by smartphone via wallets or other mechanisms) and digital remittance (especially cross-border payments, often peer-to-peer).

On top of this, an entire ecosystem of additional services is being created around payment processing, such as an expanded range of services for connecting to online stores (payment gateways) or by implementing buy-now-pay-later offers. For the B2C sector, this creates additional flexibility, which can potentially result in greater customer willingness to buy and therefore higher sales.

Additionally, new digital currencies are gaining relevance. For instance, Tesla now accepts Bitcoin payments and El Salvador has introduced Bitcoin as a national currency. Although the success and the knock-on effect failed to materialize, some central banks are looking into the implementation of central bank digital currency (CBDC). This could potentially lead to faster and cheaper cross-border payments, greater transparency and security, and a promotion of the digital economy.

Changes in the B2B segment: The Payment Service Directive II & III, which requires banks to open up their infrastructure and allow third-party services by providing data via Application Programming Interfaces (APIs) (Open Banking), opens up the market to competition and encourages innovation.

One key trend in corporate banking is real-time transfers, as they allow more precise planning of money movements and can therefore reduce liquidity costs.

Another feature is the ability to check whether customers' bank accounts actually exist. At the moment, this still requires penny testing.

Beyond this, buy-now-pay-later models are also being implemented in the B2B sector, allowing companies to set themselves apart from the competition, given that credit checks and debt collection processes are too expensive, especially for small companies.

Treasury as a corporate FinTech: Up until now, FinTechs have mainly been active in the B2C segment and growth in the corporate client business has been slow, but the new technologies and providers are set to make inroads into corporate payments. When it comes to dealing with FinTechs, Treasury must define a strategy with global standards that defines a framework for action that fits the overall corporate strategy. It will also be crucial to build up the necessary technology expertise to support the IT implementation and connection to ERP and treasury management systems to ensure a frictionless customer experience. The impact on cash and liquidity planning also needs to be analyzed, as not every service provider provides daily or even real-time settlements or actually pays out the existing credit balance in full.

The following are examples of this:

- AliPay, Venmo, Paypal, amazonPay, Shopify, Mondu, Adyen (digital commerce)

- ApplePay, Samsung pay, paytm (mobile POS payments)

- Wise, Remitly Xoom (digital remittance)

- Yodlee (fraud prevention ‒ verifying the existence of accounts)

Bank management

Even though FinTechs have set out to replace banks, the market shows that this seems unlikely, at least in the short term.

A few neobanks have become established, but other specialized FinTechs are increasingly focusing on collaboration in order to serve corporate clients and thus treasury departments more comprehensively. This means that the management of banking relationships will most likely continue to be necessary.

Improved cost tracking and reporting: Analyzing and managing costs is a crucial aspect of bank management. Fintech apps and software offer cost tracking and reporting tools that simplify this process. It provides transparency, which is the first step towards optimizing costs.

Neobanks: offer digital business bank accounts that can be opened and managed entirely online. Such accounts tend to have lower fees and lower account management charges compared to traditional banks. Many neobanks offer APIs for various financial services, including account opening. This streamlines the onboarding process. Multibank APIs for instant account opening let users access a wide range of banking services and open accounts with multiple financial institutions through a single interface.

The following are examples of this: Stripe (payment processing platform), NDepth & Fiserv (bank fee analysis), Revolut (neobank) and Brankas (multi-bank API for account opening)

Risk management

Considering the various geopolitical developments, the trend in key interest rates, fears of recession and the resulting heightened volatility on the financial markets, financial risk management is becoming ever more important.

Forecasting risk parameters: Emerging technologies use data from various sources, such as credit agencies, news and social media, to generate a forecast of various risk parameters, for example providing credit ratings for a wide range of companies. A similar approach can be applied to traditional market price risks, which are managed by the treasury department. With the help of artificial intelligence, models can be optimized to more accurately predict default probabilities and loss amounts, for example.

Real-time risk management: It also offers the option of real-time monitoring to identify potential risks at an early stage. This involves collecting and analyzing data in real time to identify trends and patterns that may indicate potential risks. If a potential risk is detected, an alert is automatically issued. This improves the efficiency and effectiveness of risk management processes.

The following are examples of this: Quantexa (data analytics and artificial intelligence (AI) solutions for financial crime detection and risk management), Credit Benchmark (credit consensus ratings and analytics), Onspring (real-time reporting and risk insights)

Reporting

The challenge often faced by treasury reporting is that data procurement and preparation is very time-consuming.

Robotics and process automation: In many cases, the data sources for reporting are highly fragmented. Particularly when it comes to data collection and preparation, RPA technology can help to compile information from various sources in different formats (e.g. database, emails, Excel files on a network drive) and then process it for consolidation purposes, resulting in greater efficiency and accuracy in reporting.

Balance confirmations: In the course of annual audits, obtaining balance confirmations often involves an increased communication effort, as partner banks have to be addressed and reminded individually. Confirmation platforms enable auditors to check assets directly at the source.

The following are examples of this: Automation Anywhere (robotic process automation), Blue Prism (robotic process automation), Kofax (document capture and business process automation), Circit (retrieval of balance confirmations)

Conclusion

FinTechs and start-ups are gaining ground also in Treasury, but it seems to be an evolutionary rather than a disruptive development.

Before starting a collaboration, you need a strategy that sets out a general action framework and defines collaboration models as well as qualitative and quantitative criteria for measuring success and risk. It also needs to fit in with the overall corporate strategy.

The next step is to identify potential candidates in the sometimes confusing market and analyze them in detail. It must be noted here that these are mostly start-ups whose continued existence is subject to greater uncertainty than is the case with established companies. Time and again, new markets are hit by waves of consolidation and not all start-ups survive, as the examples of Cringle, Nuri and Fintura show.

For traditional banking services in particular, the reliability of the providers is paramount, which banks have been able to demonstrate through their long business relationships, as well as the high level of regulation to which they are subject. In this respect, a trial-and-error approach does little to inspire confidence.

Attention must also be paid to ensuring that the offerings and technologies can be efficiently integrated into the existing treasury IT system landscape and that their use is in line with the IT strategy.

This requires an extensive business case that clearly focuses on the strategic and economic added value and transparently presents and evaluates the associated risks.

Source: KPMG Corporate Treasury News, Edition 138, November 2023

Authors:

Michael Gerhards, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Philipp Knuth, Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia