For Europe and Germany, the current energy supply situation is characterized by the goal of becoming carbon-neutral by 2050 and drastically reducing CO2 emissions. This necessitates considerable efforts, in particular with regard to power supply. As Germany plans to become climate-neutral as early as 2045, this will entail a substantial increase in the demand for electricity, as the manufacturing industry, buildings as well as transportation would have to be electrified. What's more, it would also require electricity for hydrogen production in order to reduce the use of fossil fuels in manufacturing.

This set of circumstances presents power-intensive industries in particular with the challenge of switching their power supply to sustainable sources and reducing CO2 emissions in the long term. But at the same time, these companies depend on a stable supply of electricity and need to hedge against ever-increasing price volatility on the energy markets. The success of these companies depends to a large extent on whether they are able to realign their electricity procurement strategy. Given their high energy consumption, they are particularly vulnerable to price fluctuations on the energy markets. Implementing a successful procurement strategy requires carefully analyzing the company's energy needs, considering energy efficiency measures and identifying suitable procurement models combined with realigning risk management for long-term renewable power purchase agreements.

PPAs as part of a re-oriented procurement strategy for electricity

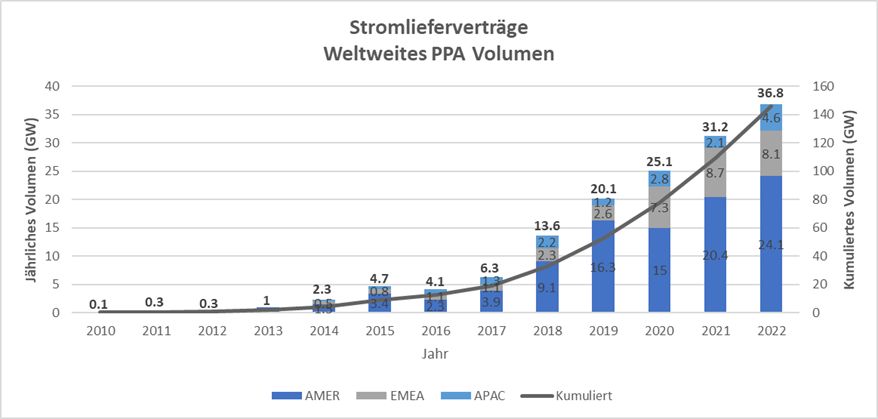

Power Purchase Agreements (PPAs) constitute one option for achieving both supply security and price stability. PPAs involve long-term contracts between an energy producer and a buyer in which the buyer agrees to purchase a certain amount of energy at a fixed price (fixed-price PPA). They provide a long-term energy supply at a predictable price, thus reducing the risk of supply bottlenecks and volatile prices on the electricity market for the company. Additionally, companies can make a substantial contribution to achieving CO2 neutrality by purchasing electricity from renewable energy sources. The following chart visualizes the global PPA volume from 2010 to 2022.

Fig. 1: PPA growth over time

Source: International Energy Agency – BloombergNEF

In recent years, PPAs have become increasingly important for energy-intensive companies, a study by the International Energy Agency's (IEA) Corporate Sourcing of Renewable Energy (CRE) found. In 2022, PPAs totaling 36.8 gigawatts (GW) of capacity were signed globally, with most contracts signed in the US, Europe and Asia. An increasing number of companies are relying on PPAs to secure reliable energy supplies, reduce energy costs and increase the share of renewable energy in their energy supply.

Realigning the procurement strategy for electricity in the power-intensive industry does, however, also entail a number of risks that need to be taken into account when negotiating and using PPAs. Among other things, one of the main risks is the energy supplier's financial standing, as it needs to remain financially stable over a long period of time to deliver the contractually agreed energy. Should the energy supplier become insolvent, the purchasing company may face significant financial consequences.

Approaches in the credit risk management of long-term procurement contracts

A key component of managing credit risk from long-term renewable power purchase agreements is revising and adapting previously used risk management methodologies, models and KRIs.

There are a number of methods that can be used to minimize credit risk associated with PPAs. As a first priority, select PPA providers from the outset that have a sound financial standing (for example, credit rating, high equity ratio, etc.) and a proven track record of success. On top of that, having a diversified set of providers and contractual terms and conditions can help minimize the risk of breach or default. An important KRI to assess credit risk is the financial stability of PPA providers. Also, contract terms and conditions should be monitored to minimize the risk of contract breaches. Evaluating the provider's operations and track record can also help assess credit risk. To this end, news tools available on the market on a daily basis can help identify early warning indicators that may point to a decline in the counterparty's creditworthiness.

It is also important to review existing models for measuring credit risk (e.g. CVaR) and adjust them if needed. The crucial factor here is the adjustment of input factors, which can change when contracts have very long terms. Beyond this, it is important to consider events that have a low probability of occurrence but may nevertheless have a significant impact on credit risk, such as changes in the regulatory framework for renewable energies or the energy market, as well as natural disasters or extreme weather events that could affect power generation. Likewise, assessing credit risk for long-term PPAs requires an increased level of significance due to the contract's longer term and the associated increased risk of impairment. In this context, the significance level refers to the probability with which credit risk is assessed for long-term PPAs. Another adjustment involves adjusting the correlations between two variables. For instance, the correlation between electricity prices and the availability and cost of fuels such as gas or coal, which can change significantly over the long term. By the same token, market price volatilities and price developments are also extremely important, as they can affect the PPA provider's profitability.

On the whole, procuring electricity through long-term renewable energy purchase agreements (PPAs) is a complex task for the energy-intensive industry. It calls for a thorough understanding of market dynamics and regulatory frameworks, as well as regular monitoring and scrutinizing of KPIs and KRIs used.

We in the Finance and Treasury Management team would be pleased to help you evaluate your current credit risk management processes, methods and models and work with you to develop tailored recommendations for action.

Source: KPMG Corporate Treasury News, Edition 132, May 2023

Authors:

Ralph Schilling, CFA, Partner, Head of Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Moritz zu Putlitz, Manager, Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Ralph Schilling

Partner, Financial Services, Head of Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft