The recent insolvency case of Peek & Cloppenburg (P&C) has once again shown how important the topic of e-commerce is for companies with a long tradition in the consumer goods sector. According to industry expert Tina Müller (ex-CEO of Douglas), the "lack or very late digitization of P&C"1 was one of the main reasons for its failure, along with other factors.

We have already heard a lot about the "new customers" and their habits. They are seen as less brand loyal, with a preference for financing and using rather than buying. And they expect the brand to have a strong presence online and on mobile, and they predominantly use new payment methods. With that said, customer expectations for service and technology are high nowadays. This further forces companies to develop digital sales channels and invest in digital business models. In this context, seamless integration of the online and offline worlds is absolutely essential.

Treasury departments are expected to actively contribute to solutions for digital payments

Even treasury departments are not immune to the effects of this change. This is probably something that some treasurers have noticed as internal colleagues or the external network suddenly approach them with questions about digital payments. In many cases, this is because no dedicated e-commerce team has yet been established within the company.

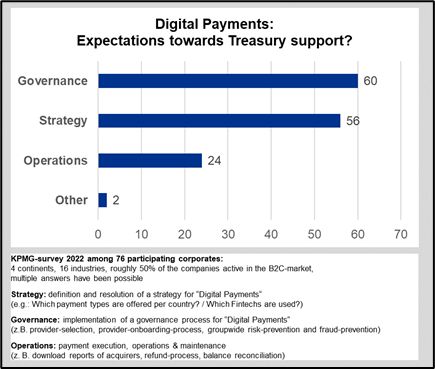

Here, what is expected of a treasury department follows on from what stakeholders are used to in conventional payment transactions. However, when it comes to the actual processing of business transactions with customers and day-to-day business, the treasury department is seen as being less responsible, as a survey conducted among KPMG clients shows (see chart). Instead, there is a clear expectation with regard to the definition of the payment strategy, in particular with regard to:

- Defining the payment types to be used per country

- Selecting the appropriate infrastructure

- Dividing the responsibility between the head office and national companies

A large proportion of respondents also see the treasury department as having clear responsibility for implementing corporate governance, for instance in regard to:

- Defining specifications for the selection and onboarding process of new service providers

- Defining specifications for controls, security, processes

- Establishing guidelines, for example within the framework of a treasury guideline

Graphic 1: KPMG survey on digital payments

Source: KPMG AG

Treasury departments are torn between providing competent support in-house for new digital payments developments on the one hand, and the limited services offered by banks on the other. In many cases, established banks can only provide limited assistance in solving problems related to digital payments.

Failure to act on the issue, however, or dismissing it out of hand could result not only in becoming less relevant, but also in running the risk of being forced to hand over other areas of responsibility. One conceivable scenario, for example, would be for companies to merge all payment transactions (B2B and B2C) into a single "payment operations team". To spearhead such centralization itself, or to at least safeguard its interests, Treasury must build up its expertise in good time and make a visible contribution.

Designing and implementing a payment strategy is still a challenge even today

Anyone who embarks on the topic of digital payments on their own quickly finds themselves overwhelmed by an unmanageable number of providers in a highly dynamic market:

- What range of services do the various providers offer and what is behind terms such as "local acquirer," "payment service provider," "cross-border e-commerce provider," "payment gateway" and "payment orchestration platform"?

- In which regions and countries can providers truly provide payment services as opposed to their marketing promises?

- How successful is vendor integration across different channels, such as mobile apps, web stores, marketplaces, or physical points of sale (POS)?

- Does the provider support additional services to be offered to the company's customers, such as microcredits, Buy Now Pay Later (BNPL) or mobile payments?

- What solutions and features does the respective provider offer in terms of fraud prevention, security and compliance?

It is also important to note that digital payment providers are currently in a strong position, operating in a vendor market. In fact, according to digital payments expert Thomas Tittelbach (Managing Partner of payment consultancy aye4fin), even popular corporate players in Germany often do not hear back when they contact service providers – especially in emerging markets. And even if an invitation to tender and negotiations do take place, this may not necessarily be successful, depending on the company's own payment volumes. This is why it requires excellent contacts and knowledge of the market to reach the goal.

Solid preparation is paramount for implementation success

Some companies cannot or do not want to solve these complex issues on their own (for example, due to a lack of resources). The best thing to do in this case is to call in an experienced partner who can guide you through the maze of providers and who has experience in selecting and implementing a suitable solution.

Before rushing into selecting a provider, however, you should be clear about your requirements and translate them into a "payment strategy". Depending on your e-commerce business's level of maturity and the size of your company, the range of target solutions ("target payment infrastructure") can be broad. The solution can range from a "single supplier strategy" and regional setups with several providers to setting up an internal "corporate fintech" with its own banking license and maximum independence from external service providers (an approach taken, for example, by Otto and Rewe).

Another factor to consider is how to embed the new solution in the corporate organization with appropriate responsibilities in the local companies and at headquarters (target operating model).

Graphic 2: Definition and implementation of a payment strategy

Source: KPMG AG

Leveraging your own strengths

If we look at the competencies of a traditional treasury department, we quickly see the great potential for success in addressing the topic of digital payments with confidence:

For one thing, the principles from classic B2B payments can to a certain extent be extrapolated to digital payments, because here, too, currency risks exist, accounts and liquidity must be managed, account statements must be posted, and reports must be generated. Ultimately, it is the smooth operation of the payment infrastructure that is crucial for success in the end-customer payment process. A lower number of cancelled payments increases the "conversion rate", i.e. the number of customers who make it from the landing page to a successful purchase, which directly contributes to the success of the business and net sales.

Further other valuable aspects include experience in relationship management with banks – from the negotiation of provider contracts and transaction costs to the details of cooperation with service providers. In this respect, the principles from transaction banking are directly transferable.

Treasury also scores with its expertise on security and compliance. Protecting personal data is extremely important in both traditional payment transactions (e.g., salary payments) and B2C payment transactions (e.g., credit card information). In both processes, authorizations should be clearly assigned and managed (whether for payment approval or in back-end systems). The topic of fraud prevention is also one that treasurers quickly encounter again in the context of digital payments (customer fraud and merchant fraud).

Ultimately, avoiding financial damage to the company is tantamount in both processes - such as fines for breaching sanctions lists (B2B) or high impending penalties for breaches of the PCI DSS standard (B2C). Therefore, CFOs will be grateful for Treasury's help in applying stringent governance to local payment service providers and e-commerce accounts.

Graphic 3: Intersection of B2B and B2C payment traffic

Source: KPMG AG

Conclusion

From these examples and common themes, it is clear that the Treasury department can take a confident approach to the topic of digital payments. It offers the opportunity to present itself as a competent business partner within the company. A suitable consultant can take over the role of the bank as a sparring partner, answer questions about the payment strategy, accompany the selection process of an optimal provider (in line with the internationalization strategy) and help with the implementation of the solution.

Source: KPMG Corporate Treasury News, Edition 132, May 2023

Authors:

Nils Bothe, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Sascha Uhlmann, Senior Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

____________________________________________________________________________________________________________________

1 Tina Müller (Former Group CEO and Member of the Supervisory Board at Douglas) in a post on LinkedIn from March 2023

Nils A. Bothe

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft