With more than 2,603 employees, KPMG is one of the leading providers of professional services in Switzerland. We have a well-established presence in Switzerland and Liechtenstein as well as a strong global network.

Known for actionable insights that lead to new opportunities and better outcomes, we serve clients from a variety of industries in Audit, Tax & Legal and Advisory. The quality and integrity of the services we provide consistently demonstrates our commitment to excellence.

Our professionals are focused on creating long-term relationships founded on trust. We deliver tangible results by gaining a profound understanding of our clients’ needs and teaming this knowledge with our deep expertise and innovative thinking.

Our annual report

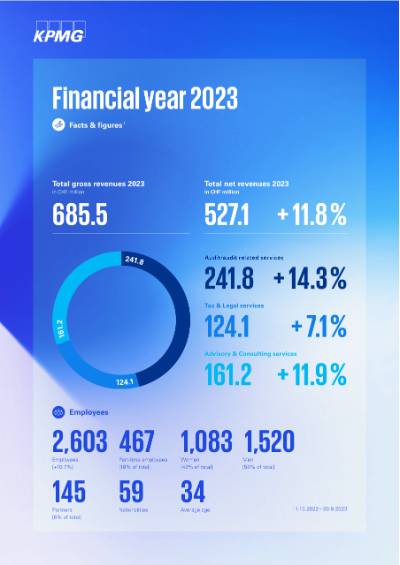

In 2023 we posted the best results in our history. With CHF 527.1 million we surpassed the very ambitious goal of CHF 500 million in net revenues, up 11.8 % compared to prior year. We also recorded record gross revenues of CHF 685.5 million. Given the challenging business environment this outstanding double-digit growth for the firm as a whole is impressive. It demonstrates our relevance in the market and is proof of our successful multidisciplinary approach, our agility and our relentless will to challenge ourselves and deliver excellence.

- Audit and audit-related services saw a net revenue contribution of CHF 241.8 million, up 14.3% compared to prior year. KPMG is now auditing 9 out of 20 companies listed in the Swiss Stock Exchange SMI. Apart from the larger Audit portfolio we have also seen a continuous high demand for non-recurring / audit-related business and growing interest from our audit customers in non-financial assurance due to ever-increasing regulation, especially in the ESG field.

- Tax & Legal services reported a net revenue of CHF 124.1, up 7.1% compared to prior year. Amongst other we continued to support our clients to prepare BEPS 2.0 implementation and saw an increased demand for our digital Multishore Tax Reporting solutions.

- Advisory services saw a strong net revenue contribution of CHF 161.2 million, up 11.9% compared to prior year. The demand for Cyber solutions continued its powerful momentum and the heightened client demand for digital and finance transformation services led to a remarkable increase in consulting activities, partly due to volatile markets and the overall mounting uncertainty caused by a slowing economy.

I would like to thank all our clients and business partners. We were able to achieve this impressive result thanks to the continued trust you placed in KPMG Switzerland and our expertise.

Stefan Pfister, CEO KPMG Switzerland

Employees & commitment

Our network

KPMG is a global network of independent member firms providing Audit, Tax and Advisory services. We operate in 146 countries and territories, collectively employing close to 227,000 people, to serve the needs of business, governments, public-sector agencies, nonprofits and – through member firms’ audit and assurance practices – the capital markets. We lead with a commitment to quality and consistency across our global network. In a world where rapid change and unprecedented disruption are the new normal, we inspire confidence and empower change in all we do.

Learn more about our network in the 2021 KPMG Global Review.

Our locations

Creating lifetime value for our people, our revamped offices are future-oriented workplaces. They help us to encourage and nurture precious multidisciplinary collaboration, broaden our network, work closely with different colleagues and collaborate more easily.

KPMG has a total of 11 locations in Switzerland and Liechtenstein. Our strong local presence means we are always close to our clients.

Our Executive Commitee

Our Board of Directors

Our history

KPMG in Switzerland

KPMG Switzerland arose from the Zürcher Treuhand-Vereinigung as a result of a series of mergers. The organization was founded in 1910. Two years later, Zürcher Treuhand-Vereinigung’s name was changed to Fides Treuhand-Vereinigung. Schweizerische Kreditanstalt (SKA) then acquired a majority stake in 1928. A number of takeovers and mergers followed, which led to further changes to the name.

The company operated as KPMG Fides Peat from 1987 onwards. Credit Suisse’s ownership ended after a management buyout in 1992 and the company became KPMG AG in 2007. 2010 marked KPMG Switzerland’s 100th anniversary.

The founding fathers

When the industrial revolution of the late eighteenth and nineteenth centuries helped transform accounting into a profession, KPMG’s founding fathers were center stage, pioneering the industry.

William Barclay Peat (the P in KPMG) set up the firm of William Barclay Peat & Co. in London in 1891. In 1897, the US firm Marwick, Mitchell & Company got its start in New York City. The company was formed by James Marwick (the M in KPMG) and Roger Mitchell. Meanwhile, in 1917, Piet Klynveld (the K in KPMG) established Klynveld Kraayenhof & Company in Amsterdam. The last of our founding fathers, Reinhard Goerdeler (the G in KPMG) comes into the story almost half a century later in 1979 as co-founder of Klynveld Main Goerdeler.