On the surface of it, EU’s new battery directive seems to be solely focused on addressing ESG challenges and enabling the circular economy for batteries. But in the long run, this new regulation is expected to solve the lack of enough battery manufacturing capacity and address the critical raw materials shortage in the EU – that makes it dependent on other countries, especially China1. This it will do by enabling the collection, repurpose, recycling and reuse targets for battery materials which will create a secondary market for EV batteries and battery materials.

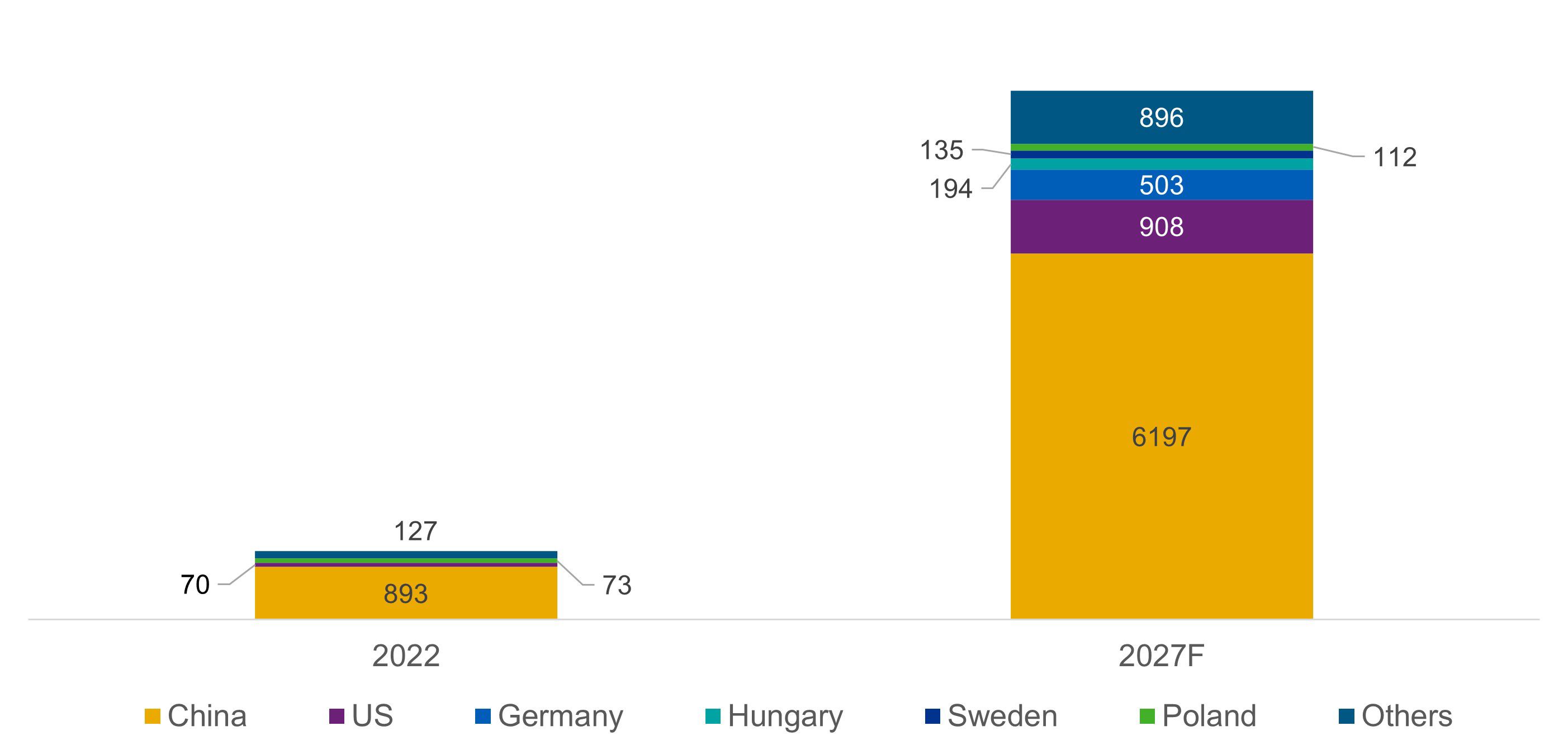

China currently owns 77% of Li-ion battery cell manufacturing capacity in the world, also controlling cathode, anode, and refined battery materials production to a great extent. By 2027, as more battery capacity comes online in the US and Germany, this percentage is expected to go down to 69%.2 Still, the future EV battery raw material value chain will remain dominated by China as it will continue to control the 3 most critical metals (from mining to refining) going into an EV battery: Lithium, Cobalt and Nickel.

Figure 1: Li-ion battery cell manufacturing capacities (GWh), 2022 and 2027F

(Source: Bloomberg NEF)

To counter China’s dominance in EV battery value chain, the EU is undertaking a couple of measures. Other than EU’s new battery directive, the EU has drawn up “The Critical Raw Materials Act”, which will not only aim to secure the extraction and refining capacity of critical battery raw materials for use in the EU, but also present a roadmap for EU countries to navigate the geopolitical puzzle concerning critical raw materials that befuddles EU-based automakers and battery manufacturers.

Furthermore, for securing supplies of Lithium, the EU has secured a new sourcing agreement with Chile. Major EU countries like Germany are following in this wake to ink partnerships in South America to secure Lithium mining, supply, and circular economy. “Stockpiling” of critical raw materials through international cooperations, securing domestic production in Portugal (having significant Lithium reserves), and Sweden (having significant reserves of rare earth metals), as well as monitoring raw materials supply chain (to have a transparent view of the supply-demand balance of raw materials) are also included as important strategies to reduce dependence on China under “The Critical Raw Materials Act”3.

While “The Critical Raw Materials Act” lays out a broad strategic direction, the “European Battery Alliance (EBA)” - a collaboration of more than 800 companies and institutions – has laid out specific objectives and priorities to strengthen EU’s competitiveness in the entire battery value chain, especially in the wake of China’s dominance and US’s Inflation Reduction Act (IRA)4. As a result, companies like Automotive Cells Company (ACC) have been created between big automakers “to create a European battery champion for electric vehicles” which intends to build and operate 120 GWh of EV battery capacity by 2030 in the EU.5

The new battery directive in the EU also mandates a “Battery passport” through which the EV batteries will carry a QR code, linked to an online database where EV owners, businesses and regulators can access information on the battery’s composition. So, it’s just not about new sources of supply for the critical battery materials but also how much of that is ESG compliant. This can prove advantageous to the EU companies involved in the sourcing of raw materials and manufacturing of EV batteries – as many of them are taking strategic steps to source responsibly.

Carmakers and battery manufacturers in the EU are also exploring different EV battery chemistries which have minimal or no Nickel and Cobalt content – as the prices of these critical metals have skyrocketed in recent years and there are serious ESG issues associated with the sourcing of these metals. Forerunners in this race are the Lithium Iron-Phosphate (LFP) and solid-state batteries. Finnish Minerals Group and Freyr Battery, for instance, have recently announced to setup a LFP cathode plant in Europe – which will cut EV battery costs for automakers and domesticate production6. At the same time, Factorial, a solid-state battery start-up backed by Mercedes-Benz, Stellantis and Hyundai-Kia, is expanding into Europe to better serve European automotive OEMs and maneuver around the evolving ESG regulations7.

Given these developments, it is imperative for both EV makers and battery manufacturers in the EU need to take greater cognizance and prepare for a new strategic direction – that will not only set them off on a path more aligned with the future of automotive but also serve their regional interests creating lower dependency on China. However, the cost is huge: a BNEF estimate puts the investment requirement at $102 billion for Europe to have a fully localized battery supply chain serving the domestic battery demand by 2030.8

Connect with us

1Flash Battery, “European battery regulation: A concrete step towards a sustainable future”, accessed on 24th April 2023

2Visual Capitalist, “Visualizing China’s Dominance in Battery Manufacturing (2022-2027P)”, January 2023

3Politico, “China leaves EU playing catchup in race for raw materials”, March 2023

4EBA250, “Priority actions”, accessed on 24th April 2023

5Stellantis, “Stellantis and TotalEnergies welcome Mercedes-Benz as a new partner of Automotive Cells Company (ACC) and raise its capacity plan to at least 120 GWh by 2030”, September 2021

6FastMarkets, “Proposed Finnish LFP cathode plant expands Europe’s battery value chain”, February 2023

7Electrive.com, “Solid state battery company Factorial expands into Europe”, March 2023

8BloombergNEF, “The battle to break China’s battery-making supremacy, in five charts”, December 2022