Singapore - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Singapore.

Taxation of cross-border mergers and acquisitions for Singapore.

Introduction

The Republic of Singapore is an island state and member of the British Commonwealth.

Income is taxed in Singapore in accordance with the provisions of the Income Tax Act (Chapter 134) (ITA) and the Economic Expansion Incentives (Relief from Income Tax) Act (Chapter 86).

Generally, the Comptroller of Income Tax is vested with the powers to administer the country’s tax legislation. Certain tax incentives are administered by other statutory boards, such as the Economic Development Board (EDB) and Enterprise Singapore (resultant entity of merger of International Enterprise Singapore and Spring Singapore).

Goods and services tax (GST) and stamp duty are levied in accordance with the Goods and Services Tax Act (Chapter 117A) and the Stamp Duties Act (Chapter 312).

Recent developments

Singapore’s mergers and acquisitions (M&A) scheme was introduced in 2010 to encourage companies to grow their businesses. The M&A scheme comprises the M&A allowance and stamp duty relief, which can be claimed by an acquiring company. Originally set to lapse in 2020, the M&A scheme has been renewed to cover qualifying acquisitions made on or before 31 December 2025; the scheme remains unchanged, except for the non-renewal of stamp duty relief for instruments for acquisitions executed on or after 1 April 2020 (among other refinement).

The safe-harbor rules in Section 13Z of the ITA were introduced in 2012 to provide certainty on the tax treatment of disposal gains of ordinary shares. Subject to conditions, a divesting company (whether incorporated in Singapore or otherwise) may avail of the Section 13Z safe-harbor rules for exemption on gains from divestment of ordinary shares in an investee company. Notably, the disposal of unlisted shares in an investee company (other than a property developer) that is in the business of trading or holding Singapore immovable properties is excluded from the scope of exemption. In 2020, the Section 13Z safe-harbor rules were extended (from the original lapse date of 31 May 2022) to 31 December 2027. However, the scope of exclusion has been widened with respect to disposals taking place on or after 1 June 2022; subject to certain exceptions, the Section 13Z exemption will not apply to the disposal of unlisted shares in an investee company that is in the business of trading, holding or developing immovable properties situated both inside and outside Singapore.

Asset purchase or share purchase

An acquisition in Singapore can take the form of a purchase of assets and business, or a purchase of shares of a company. The choice is influenced by factors such as the treatment of the gains as revenue or capital (there is no capital gains tax in Singapore), the likely recapture of capital allowances by the seller (in the case of purchase of assets), the possibility of availing of the Section 13Z safe-harbor rules for exemption on share divestment gains (in the case of purchase of ordinary shares) and the amount of stamp duty payable on asset purchases versus share purchases. Some of the tax considerations relevant to each method, and the advantages and disadvantages of each method, are summarized in the later sections.

Section 13Z safe-harbor rules on share divestment gains

A divesting company (whether incorporated in Singapore or otherwise) may be exempted on gains from divestment of ordinary shares, where immediately preceding the date of divestment, the divesting company had at all times during a continuous period of at least 24 months owned at least 20 percent ordinary shares in the investee company. The exemption is subject to certain exclusions. Divesting companies whose profits are governed under Section 26 of the ITA (i.e. insurance companies) are excluded from the operation of Section 13Z; divestment of shares held through partnerships is also excluded. In addition, the disposal of ordinary shares in certain excluded investee companies are excluded from the scope of exemption:

- for disposal of shares before 1 June 2022, unlisted shares in an investee company (other than a property developer) that is in the business of trading or holding Singapore immovable properties

- for disposal of shares on or after 1 June 2022, unlisted shares in an investee company that is in the business of trading, holding or developing immovable properties situated both inside and outside Singapore (unless certain exceptions apply).

Divestment gains that are not exempted under Section 13Z would be subject to normal income tax rules (i.e. the taxability depends on whether the gains are capital or revenue in nature).

The Section 13Z exemption scheme is subject to a sunset clause and currently applies to qualifying disposals taking place on or before 31 December 2027 (unless further extended).

Purchase of assets

A purchase of assets may give rise to income tax and stamp duty implications for the seller and buyer. Depending on the tax status of the seller, the disposal gains may be regarded as trading gains subject to income tax. Where the asset is a real property, the amount of stamp duty payable on transfer may be substantial. The buyer is usually liable for the duty. The seller may also be liable to seller’s stamp duty to the extent that residential properties and industrial properties are disposed of within prescribed period (see below for detail). Where capital allowances have been claimed on the assets, they may be recaptured by and taxable to the seller, depending on the consideration.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. Hence, it is advisable to specify in the sale and purchase agreement an allocation that is commercially justifiable. For trading stocks, the transfer can be at net book value, provided the stocks also constitute trading stocks of the buyer. This is to ensure tax neutrality on the transfer. Otherwise, the open market value is substituted as the transfer value.

Goodwill

For tax purposes, the amount of goodwill written off or amortized to the income statement of the company is non- deductible on the basis that the expense is capital in nature.

Depreciation

The ITA contains provisions for granting tax depreciation (commonly referred to as capital allowances) on capital expenditure incurred on qualifying assets (i.e. plant and machinery) used in a trade, business or profession carried on by the taxpayer. Tax depreciation for qualifying assets may be claimed based on several methods/rates, as summarized below.

- Claim over prescribed working life: Broadly, an initial (tax depreciation) allowance based on 20 percent of the cost of asset is granted in the year of incurrence of capital expenditure, with annual allowances granted over the prescribed working life of the qualifying asset (i.e. 5, 6, 8, 10, 12 or 16 years). To streamline tax depreciation claim under this method, businesses may make an irrevocable election to claim the annual allowances over 6, 12 or 16 years instead; this is applicable for qualifying assets acquired during or after financial year 2022 (i.e. year of assessment 2023), or for qualifying assets where tax depreciation was previously fully deferred.

- Accelerated claim over 3 years: Alternatively, all qualifying assets can be depreciated on an accelerated basis over 3 years.

- Accelerated claim over 2 years: For qualifying assets acquired during the financial year 2020 (i.e. year of assessment 2021), businesses are given an option to depreciate their assets over 2 years.

- Accelerated claim in 1 year: Some prescribed assets, including prescribed automation equipment (e.g. robots, computers), power generators installed in factories or offices as backup units in the event of power failures, and efficient pollution control equipment, can be written off in 1 year. A 100 percent 1-year write-off is also available on qualifying fixed assets where the cost of each asset is no more than 5,000 Singapore dollars (SGD); the aggregate claim for 100 percent write-off of such minor assets is capped at SGD30,000 per year of assessment (YA).

Writing-down allowances (WDAs) are granted on qualifying capital expenditure incurred by a company in acquiring intellectual property rights (IPRs) from 1 November 2003 to the last day of the basis period for YA 2025 for use in its trade or business. The transferee must acquire the legal and economic ownership of the IPRs from the transferor to be eligible for WDAs. An application for a waiver from legal ownership can be made to the EDB. A third-party independent valuation report on the value of the IPRs acquired is required to be submitted for certain scenarios.

From YA 2017, an irrevocable election to claim WDAs over a 5-, 10- or 15-year period (on a straight-line basis) will have to be made via a declaration form on filing the income tax return for the first YA of the WDAs claim.

Land intensification allowance (LIA) was introduced in 2010 to promote the efficient use of industrial land for higher value-added activities. LIA comprises an initial (one-time) allowance of 25 percent and an annual allowance of 5 percent, and it is available on capital expenditure incurred for the construction or renovation/extension of a qualifying building or structure, subject to qualifying criteria. The LIA scheme is administered by the EDB and the Building and Construction Authority (BCA). The LIA scheme was granted an extension until 31 December 2025, having originally scheduled to lapse after 30 June 2020. Approval for the LIA incentive will be granted by EDB/BCA to businesses on qualifying buildings or structures up until 31 December 2025.

Where a company disposes of plant and machinery or IPRs, a balancing charge or balancing allowance normally arises to adjust for the difference in the residual or tax written-down value (TWDV) of the asset as compared to the consideration received for the asset. A balancing allowance is available to the company when the TWDV of the asset is greater than the consideration received. Conversely, where consideration exceeds the TWDV, a balancing charge is imposed (restricted to the capital allowances or WDAs allowed previously with respect to the asset).

Tax attributes

In the case of an asset or business transfer, the unused tax losses and capital allowances remain with the company unless the transfer is a qualifying corporate amalgamation.

GST

Generally, GST is chargeable at the prevailing standard rate on any supply of goods and services made by a GST-registered entity in the course or furtherance of its business. The standard rate is currently 7 percent but is expected to increase to 9 percent between 2022 and 2025.

The transfer of a business (or a part of the business that is capable of separate operation) as a going concern is treated as neither a supply of goods nor services for GST purposes on which GST is not chargeable. This applies only where the business (or part of that business) is a going concern at the time of the transfer, the transferee is a GST-taxable person and the assets are to be used by the transferee in an existing or new business of the same kind as that carried on by the transferor. The mere transfer of assets is not conclusive evidence that the transfer of assets is a transfer of a business as a going concern. The general rule is whether the transfer puts the transferee in possession of a going concern business, the activities of which could be carried on without interruption. Where the Inland Revenue Authority of Singapore (IRAS) is not convinced that the transfer is that of a transfer of business as a going concern, GST at standard-rate is applicable on taxable components including goodwill or intangibles.

Conversely, if the business transfer is a transfer of business as a going concern but standard-rate GST has been erroneously levied on such transfer, the IRAS has the discretion to disallow the GST incurred by the transferee and deny the claim as an input tax credit.

The reverse charge mechanism for business-to-business import of services was implemented on 1 January 2020. GST-registered or registrable businesses are subject to GST at the prevailing standard rate on in-scope imported services.

Transfer taxes

Stamp duty is payable on documents relating to the sale or transfer of immovable properties and shares in accordance with the Stamp Duties Act.

Sale and purchase of immovable property

Stamp duty payable on documents relating to the sale or transfer of immovable properties is computed based on the higher of the purchase consideration or the market value of the immovable property located in Singapore.

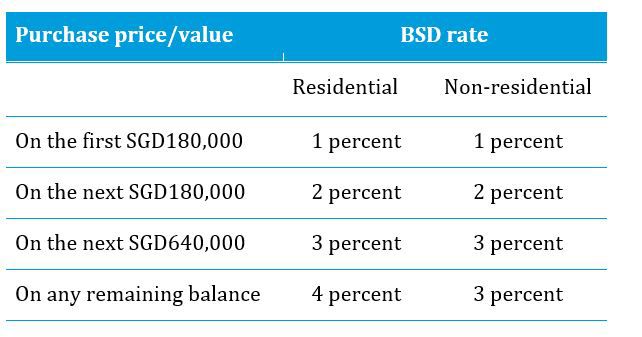

Buyer’s Stamp Duty (BSD) on acquisition of properties is payable by the buyer at the following rates.

Additional Buyer’s Stamp Duty (ABSD) may be payable by the buyer on top of BSD for acquisitions of residential property located in Singapore, depending on the profile of the buyer. In particular, foreigners buying residential property located in Singapore must pay ABSD of 20 percent and non-individuals buying residential property located in Singapore must pay ABSD of 25 percent. Non-individuals who are housing developers are subject to an additional 5 percent ABSD (i.e. 25 percent plus 5 percent), albeit that the 25 percent ABSD may be remitted subject to conditions.

Seller’s Stamp Duty (SSD) is payable by the seller and applies to the following.

- Residential properties purchased from 14 January 2011 to 10 March 2017 (both dates inclusive) and disposed of within 1, 2, 3 or 4 years of purchase are subject to stamp duty of 16 percent, 12 percent, 8 percent and 4 percent, respectively.

- Residential properties purchased on or after 11 March 2017 and disposed of within 1, 2 and 3 years of purchase are subject to stamp duty of 12 percent, 8 percent and 4 percent, respectively.

- Industrial properties purchased on or after 12 January 2013 and disposed of within 1, 2 or 3 years of purchase are subject to stamp duty of 15 percent, 10 percent and 5 percent, respectively.

Sale and purchase of shares

Stamp duty is payable on documents relating to the transfer of shares in a Singapore company. The rate of duty is 0.2 percent on the higher of the consideration or the value of the shares and is payable by the buyer.

Sale and purchase of residential property-holding entities

In addition to existing stamp duty on shares, certain acquisitions or disposals of equity interests in residential property-holding entities (PHEs) attract additional conveyance duty (ACD).

The rates of ACD for buyers are:

- 1 percent to 4 percent of the market value of the underlying residential property

- 30 percent (flat rate) of the market value of the underlying residential property.

The rate of ACD for sellers (where equity interest is disposed of within 3 years of acquisition) is 12 percent (flat rate) of the market value of the underlying residential property.

Relief from stamp duties

Several kinds of relief are provided by the Stamp Duties Act. Approval is required from the Commissioner of Stamp Duties. The key reliefs are as follows.

- Relief from stamp duty in connection with a scheme for the reconstruction or amalgamation of companies, subject to conditions.

- Relief from stamp duty on a transfer of property between associated permitted entities, subject to conditions. The permitted entities (LLP or companies) are associated where:

- one entity is the beneficial owner of not less than 75 percent of the voting share capital and more than 50 percent of the voting power of the other, or

- a third entity is the beneficial owner of not less than 75 percent of the voting share capital and more than 50 percent of the voting power of both entities.

No relief is granted on transfers involving residential PHEs where ACD is applicable.

M&A scheme

The M&A scheme was introduced in 2010 to encourage companies in Singapore to grow their business through M&A. The M&A scheme was further enhanced in 2015 and 2016. In 2020, the M&A scheme was given a 5-year renewal (from the then expiration date of 31 March 2020) to cover qualifying acquisitions made on or before 31 December 2025; as part of the renewal, the scheme remains unchanged since the 2016 enhancement, except for the following:

- stamp duty relief for qualifying share acquisitions had not been renewed, and so stamp duty relief would not be applicable to instruments effected on or after 1 April 2020; and

- for acquisitions completed on or before 31 March 2020, the qualifying condition that the ultimate holding company of the acquiring company must be incorporated and tax resident in Singapore may be waived on a case-by-case basis. This waiver is no longer available for acquisitions made on or after 1 April 2020.

Under the current M&A scheme, an M&A allowance for each YA equal to 25 percent of the value of acquisition is granted for qualifying shares acquired from 1 April 2016 to 31 December 2025, subject to a maximum cap of SGD10 million on the allowance granted per YA. This cap effectively allows for qualifying share acquisitions (made from 1 April 2016 to 31 December 2025) of up to SGD40 million in aggregate in each YA. The M&A allowance is claimed over 5 years on a straight-line basis.

For qualifying share acquisitions completed during the period from 17 February 2012 to 31 December 2025, a 200 percent tax allowance is granted in the form of double tax deduction on transactions costs (net of grants or subsidies from the government or any statutory board), subject to a cap of SGD100,000 per YA. Transaction costs are professional fees that are necessarily incurred for the qualifying share acquisition such as legal fees, accounting and tax advisors’ fees, valuation fees, etc. However, any such fees or incidental cost with respect to loan arrangements such as borrowing costs, stamp duty and any other taxes are excluded.

Key aspects of the M&A scheme are as follows:

- available to Singapore-resident companies that purchase the ordinary shares of another company directly or indirectly (for acquisitions made on or after 17 February 2012) through a wholly owned holding vehicle;

- where the acquiring company belongs to a corporate group, the ultimate holding company of the acquiring company must be incorporated and tax resident in Singapore;

- acquiring company is carrying on a trade or business in Singapore on the date of share acquisition, has at least three local employees (excluding company directors) throughout the 12-month period prior to the date of the share acquisition, and is not connected to the target company for at least 2 years prior to the date of the share acquisition;

- where the acquiring company uses a subsidiary to make the acquisition, the subsidiary must be a wholly owned subsidiary, must not carry on a trade or business in Singapore or elsewhere on the date of the share acquisition, and must not claim any deduction for capital expenditure, or claim tax benefits under the M&A scheme;

- must result in the acquiring company owning (for share acquisition during the period from 1 April 2015 to 31 December 2025):

- 20 percent of the ordinary shares of the target company if, before the date of acquisition, it owned less than 20 percent of the ordinary shares in the target company (additional conditions apply for M&A allowance claim based on the 20 percent shareholding threshold), or

- more than 50 percent of the ordinary shares of the target company if, before the date of acquisition, it owned 50 percent or less of the ordinary shares in the target company.

The M&A scheme is not available to asset acquisitions.

Tax losses

The unabsorbed trade losses (and capital allowances) generated by the target company are transferred along with the company and are available for carry forward for set-off against the company’s future years’ taxable profits, subject to the shareholders’ continuity test. The test effectively requires that not less than 50 percent of the total number of issued shares of the company were held by or on behalf of the same shareholders at relevant comparison dates.

Additionally, the company must carry on the same trade or business in order to utilize the unabsorbed capital allowances.

The shareholders’ continuity test is intended to target situations where loss-making companies are being acquired for tax reasons. Where a substantial change in ultimate shareholding takes place, local tax laws still provide the relevant company with an avenue to appeal to the Minister for Finance (or such person as he may appoint) to waive the shareholders’ continuity test. The Minister is likely to examine the appeal based on its merits. Where such a waiver is obtained, the Singapore company can continue to carry forward its unabsorbed trade losses and/or capital allowances but only for set-off against future taxable profits arising from the same trade that gave rise to the relevant losses and/or capital allowances.

Any person carrying on a trade, business, profession or vocation may carryback their current year unabsorbed capital allowances and current year unabsorbed trade losses (up to SGD100,000) for set-off against their assessable income of the YA immediately preceding the YA in which the capital allowances were granted or the trade losses were incurred. The carryback relief is subject to the shareholders’ continuity test. Current year unabsorbed capital allowances are also subject to the same business test. The carryback relief scheme has been enhanced for YA 2020; subject to the same SGD100,000 cap and applicable test(s) mentioned earlier, unabsorbed capital allowances and tax losses arising in YA 2020 may be carried back up to 3 immediate preceding YAs.

Unabsorbed M&A allowance and double tax deduction on transaction costs are not available for carryback to set off the acquiring company’s assessable income for preceding years.

Pre-sale dividend

Under certain circumstances, the seller may prefer to realize part of their investment as a pre-sale dividend because dividends paid by Singapore-resident companies are tax-exempt.

GST

Generally, the disposal of shares is a GST-exempt supply. However, where the transferee is a person who belongs outside Singapore, the supply is zero-rated for GST purposes.

While output GST is not payable in both transactions, there is implication on the claiming of input GST credits. Generally, no input GST is allowed for the making of exempt supplies arising from share disposal unless certain qualifying conditions are met. However, any input GST incurred for making zero-rated supplies including that from shares sold to persons belonging outside Singapore is claimable.

Tax indemnities and warranties and tax clearance

On taking over the target company, the buyer assumes all related liabilities, including contingent liabilities. It is not possible to obtain a clearance from the IRAS that a potential Singapore target company has no tax arrears.

Therefore, the buyer usually requires indemnities and warranties in the sale agreement. The extent of the indemnities or warranties is subject to negotiation between the seller and buyer. Where the sums involved are significant, the buyer normally initiates a due diligence exercise, including a review of the target company’s tax affairs to ascertain the tax position of the target company and identify potential tax liabilities.

Choice of acquisition vehicle

Singapore adopts a territorial system of taxation and the corporate tax regime applies equally to Singapore incorporated entities and foreign entities carrying on business in Singapore through vehicles such as a Singapore branch or permanent establishment. The main types of vehicle (described in more detail below) that may be used to acquire shares or assets in Singapore or to carry on a business in Singapore include the following:

- Singapore-incorporated company (including local holding company)

- Singapore variable capital company

- foreign parent company

- non-resident intermediate holding company

- branch of a foreign company

- foreign corporate entity that transferred its registration to Singapore under the inward re-domiciliation regime

- Singapore-registered business trust (BT)

- partnership

- limited liability partnership

- limited partnership

- other vehicles.

Local holding company

It can be tax-advantageous for foreign investors to establish a Singapore holding company to acquire shares or assets in (or outside) Singapore. The primary tax advantages that could arise are as follows.

- Group relief arising from the option to transfer current-year losses, current-year unabsorbed capital allowances and donations within qualifying group companies (i.e. Singapore-incorporated companies) may be available.

- Foreign-sourced dividends, foreign branch profits and foreign-sourced service income, which are taxable when received in Singapore by a Singapore resident company, may be exempt from Singapore tax where certain conditions are met. Alternatively, Singapore tax arising on such income may be mitigated or effectively eliminated through Singapore’s unilateral tax credit system and bilateral tax agreements, provided foreign tax has been paid on the income.

For Singapore tax purposes, the tax residency of a company is determined by its place of management and control. The management and control of a company typically vests in its board of directors (BOD), and so where the BOD meets normally determines the entity’s place of management and control. To the extent that the BOD holds its meetings in Singapore to deliberate on and make strategic decisions concerning the Singapore entity, the IRAS normally accepts that the entity is a tax resident of Singapore. However, for a foreign-owned company (50 percent or more of its shares held by foreign companies/shareholders), the IRAS is more stringent and requires the company to provide evidence to substantiate that its control and management is indeed in Singapore.

Variable capital company (VCC)

In January 2020 Singapore introduced a new form of corporate vehicle known as the VCC, which is primarily tailored for the fund management industry. A key advantage of a VCC is that, unlike a private limited company (which can only pay dividends out of retained profits), a VCC can pay dividends out of capital; there is also greater flexibility in the issuance and redemption of shares in a VCC. Fund managers will be able to set up multiple sub-funds within a single umbrella VCC, with legal ring-fencing of the assets and liabilities of each sub-fund; economy of scale and cost efficiency can be achieved as the umbrella VCC and sub-funds may share the same board and service providers.

A VCC is incorporated and governed under the Variable Capital Companies Act. It is administered by the Accounting and Corporate Regulatory Authority (ACRA). Incorporation of new VCCs can be done through submission of online application to ACRA.

Salient legal features of VCCs include:

- able to issue and redeem shares without shareholders’ approval;

- may pay dividends out of capital (not restricted to availability of retained profits);

- can be used as a single stand-alone fund or an umbrella fund with two or more sub-funds. The assets and liabilities of each sub-fund are ring-fenced and segregated from that of the other sub-funds (even though the sub-funds do not have separate legal personalities);

- allow for privacy to investors due to restriction on public access to VCC financial statements and shareholders’ registers;

- may be used for a variety of investment strategies and cater to both open-ended and closed-ended funds, thus allowing for a multi-fund structure within a single legal entity;

- must at all times be managed by a licensed/registered Singapore fund manager that is regulated by the Monetary Authority of Singapore;

- allow foreign corporate funds with comparable structure to be re-domiciled to Singapore as VCCs.

From a Singapore tax perspective, the key features and benefits of a VCC include the following.

- A VCC is treated for income tax purposes as a single entity (whether for a stand-alone VCC or an umbrella VCC) and similar to that of a private limited company, subject to certain modifications and certain corporate income tax (CIT) rules that apply at sub-fund level. An umbrella VCC is required to file one CIT return regardless of the number of sub-funds.

- Singapore fund tax incentives (i.e. the Enhanced-tier Fund Scheme and Singapore Resident Fund Scheme) are extended to VCCs. In the case of an umbrella VCC with multiple sub-funds, only one set of economic conditions is required to be met by the VCC for the purpose of the fund tax incentive.

- VCCs that are tax residents of Singapore will be eligible to access Singapore tax treaties. In the case of an umbrella VCC, the certificate of residence (COR) will be issued in the name of the VCC, with the name of the relevant sub-fund(s) being indicated in the COR.

- GST will apply at VCC level for a stand-alone VCC, or at sub-fund level for an umbrella VCC with multiple sub-funds. The current GST remission allowing claim of GST (i.e. input tax) on all expenses incurred for the purpose of investment activities is extended to VCCs, with the exception of disallowed expenses as prescribed under the GST (General) Regulations, so long as the applicable conditions are met.

- A VCC is treated as a company for stamp duty purposes. For an umbrella VCC, the sub-funds are treated as separate persons for stamp duty purposes. When an instrument for the transfer of Singapore immovable properties or Singapore shares is executed between (i) an umbrella VCC and its sub-funds, or (ii) sub-funds of the same umbrella VCC, the instrument will attract the same duties as an instrument executed between companies.

- Tax framework for inward re-domiciliation of companies into Singapore (subject to necessary modifications) has been extended to the inward re-domiciliation of foreign VCCs.

Foreign parent company

The foreign buyer can make the acquisition itself. Singapore does not normally tax the gains of a foreign company disposing of Singapore shares unless those shares are held for the purpose of a trade carried on through an operation in Singapore. Singapore does not impose withholding tax (WHT) on dividends. However, the following payments to non-residents made by a resident person or permanent establishment in Singapore are subject to WHT in Singapore:

- interest and any payment in connection with a loan or indebtedness

- management, technical assistance and service fees where services are performed in Singapore

- royalties

- rent or any payment for use of movable property

- directors’ remuneration.

Non-resident intermediate holding company

An intermediate holding company resident in another country can be interposed to take advantage of a favorable tax treaty with Singapore. However, certain Singapore tax treaties contain anti-treaty shopping provisions that would render ineffective any structure set up solely to derive tax benefits.

In line with Singapore’s commitment to implement the minimum standard on preventing treaty abuse, Singapore has joined more than 100 jurisdictions in signing the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) to swiftly update their tax treaties. Singapore has deposited its instrument of ratification for the MLI on 21 December 2018 and the MLI has entered into force for Singapore on 1 April 2019.

As of writing, more than 40 tax treaties concluded by Singapore — including those with Australia, France, Japan, the UK and the Netherlands, have been amended by the MLI. The amended tax treaties contain, among others, the general anti-abuse rule commonly known as the Principal Purpose Test (PPT) rule.

Local branch

A branch of a foreign corporation is regarded as constituting a part of the same legal entity as its head office. As the Singapore branch normally is managed and controlled out of its foreign head office, most Singapore branches are regarded as non-residents of Singapore for tax purposes. This is on the premise that the board meetings of the foreign entity are held outside Singapore. From a Singapore income tax perspective, a branch of a foreign corporation generally is taxed no differently from a subsidiary company. There is usually no difference in the tax rates or variation in the methodology for computing the taxable profits for a branch and a subsidiary company.

As an investment vehicle, there are some inherent tax disadvantages in a Singapore branch, compared to a local company. The foreign income exemption provisions mentioned earlier are not available to a non-resident Singapore branch. Additionally, a non-resident entity cannot take advantage of the tax benefits and concessions accorded under Singapore’s tax treaties, which have been concluded with more than 87 jurisdictions for double taxation relief. The non-resident entity also does not qualify for the unilateral tax relief provisions under the ITA that would relieve qualifying foreign income from Singapore taxation.

Foreign corporate entity transferring registration to Singapore

As of 11 October 2017, a foreign corporate entity (FCE) is allowed to transfer its registration to Singapore under the inward re-domiciliation regime. Once re-domiciled, the FCE becomes a Singapore company registered under the ACRA and must comply with the Singapore Companies Act. Benefits of re-domiciliation may include the availability of financial or fiscal incentives, a more conducive tax or regulatory environment, improved access to financial and capital markets, and closer proximity to the FCE’s shareholders or operational base.

To transfer its registration to Singapore, an FCE must meet the following requirements.

1. Minimum size requirements (any two of the following criteria):

- the value of the FCE’s total assets exceeds SGD10 million

- the annual revenue of the FCE exceeds SGD10 million

- the FCE has more than 50 employees.

An FCE that is a parent is assessed based on consolidated financial statements. An FCE that is a subsidiary may rely on its parent’s consolidated financial statements to satisfy the size requirement if its parent is a Singapore-incorporated company that meets the size requirement, or its parent is an FCE that has transferred its registration to Singapore.

2. Minimum solvency criteria:

- there are no grounds on which the FCE could be found to be unable to pay its debts

- the FCE is able to pay its debts as they become due during the period of 12 months after the date of the application for transfer of registration

- the FCE is able to pay its debts in full within the period of 12 months after the date of winding up (if it intends to wind up within 12 months after applying for transfer of registration)

- the value of the FCE’s assets is not less than the value of its liabilities (including contingent liabilities).

3. Other requirements:

- the FCE must be authorized to transfer its incorporation under the law of its place of incorporation

- the FCE must comply with the requirements of the law of its place of incorporation in relation to the transfer of its incorporation

- the application for transfer of registration is not intended to defraud existing creditors of the FCE and is made in good faith

- the FCE must not be under judicial management, in liquidation or being wound up.

For tax purposes, the Singapore government has introduced a tax framework for companies re-domiciling to Singapore under the inward re-domiciliation regime. The tax framework is only applicable to FCEs where such FCEs have not carried on any trade or business in Singapore before the date of re-domiciliation. Broadly, the tax framework prescribes the tax treatment for certain expenses incurred (e.g. relief for exit taxes suffered in existing jurisdictions, deduction for bad debts and trading stock) or assets acquired (e.g. capital allowances on qualifying expenditure) by the FCEs prior to the re-domiciliation to Singapore.

Registered business trust

BTs are businesses structured in the form of trusts. A BT is created by a trust deed under which the trustee has legal ownership of the assets and manages the assets for the benefit of the beneficiaries of the BT. Unlike a company, a BT is not a separate legal entity. Unlike a private or unit trust, a BT actively runs and operates a business or trade. Under the Business Trusts Act (BTA), a BT must be run by a single responsible entity, known as the trustee-manager, which must be incorporated in Singapore.

Unlike companies, BTs are not restricted to paying dividends out of accounting profits; they can make distributions to their investors out of operating cash flow.

For income tax purposes, a BT (registered under the BTA) is treated like a company. The income of a registered BT is taxable at the trustee level, and the registered BT is treated like a company under the one-tier CIT system. The beneficiaries or unit holders of the registered BT are not taxed on their shares of the statutory income (of the trustee) to which they are beneficially entitled. The beneficiaries or unit holders are not allowed any credit for the tax paid by the trustee of the registered business trust. Group relief provisions only apply to a registered BT that is established in Singapore, has trust deeds executed in Singapore, and is governed by Singapore law.

From a GST perspective, a GST remission is granted to a registered BT that carries on certain qualifying businesses, namely infrastructure business, aircraft leasing and ship leasing (‘qualifying registered BT’), allowing them to claim input GST incurred on allowable business expenses even if they are not registered for GST, provided that the qualifying registered BT:

- is listed or to be listed on the Singapore Exchange

- has veto rights over key operational issues of its special purpose vehicles (SPVs) (e.g. changes to the equity capital structure of the SPVs) holding the underlying assets

- the underlying assets of the qualifying registered BT make taxable supplies or out-of-scope supplies that would be taxable supplies if made in Singapore.

As of 1 April 2015, and subject to meeting the qualifying conditions above, a qualifying registered BT is also allowed to claim input GST on business expenses incurred to set up financing SPVs and their allowable business operating expenses, provided all funds raised by the financing SPV is on-lent to the qualifying registered BT to finance its taxable business activities.

The GST remission expires on 31 December 2025.

Partnership

A partnership is not taxed as an entity. Tax is instead charged at the partner level on the partners’ shares of the adjusted income from the partnership. The divisible income is allocated among the partners according to their profit-sharing formula, and capital allowances (also allocated according to their profit-sharing formula) are deducted in arriving at the partners’ chargeable income. Where there is a partnership loss, each partner may offset their share of the loss against their respective income from other sources.

Limited liability partnership

A limited liability partnership (LLP) must be registered under the Limited Liability Partnerships Act. An LLP is regarded as a legal entity separate from the partners and confers limited liability on them. It has perpetual succession, so a change in partners does not affect its existence, rights or liabilities. An LLP is tax-transparent; it is not taxed at the entity level. Tax is chargeable on each partner based on the applicable income tax rate.

Where an LLP partner has unabsorbed capital allowances, industrial building allowances, qualifying donations or trade losses, the amount allowed for set-off against their income from other sources (relevant deductions) is restricted to the amount of their contributed capital.

When the contributed capital of an LLP partner is reduced and the reduction results in the partner’s past relevant deductions exceeding the reduced contributed capital, the excess is deemed to be taxable income of the partner.

The admission of a new partner or withdrawal of an existing partner owing to retirement, death or other reasons does not result in a cessation of the business of all the partners, unless there is evidence of a change in the business carried on through the LLP.

Limited partnership

Limited partnerships (LPs) in Singapore are governed by the Limited Partnership Act, which was enacted in 2008. The LP is a business structure that functions as a partnership with no separate legal personality from its partners. LPs generally comprise at least one general partner with unlimited liability and one or more limited partners that enjoy limited liability.

For Singapore tax purposes, an LP is accorded tax-transparency treatment like LLPs and general partnerships. The tax treatment for limited partners of an LP is the same as that for partners of an LLP. The general partners of an LP are treated for tax purposes the same as partners of a general partnership.

Any of the general partners of an LP may assume the role of precedent partner for the purposes of notice of chargeability and filing of tax returns.

Where an LP is dissolved, the general partner(s) of the LP must wind up its affairs, unless a court orders otherwise.

Other vehicles

An unincorporated joint venture that is not a partnership is not a legal person, so it is not taxable in its own right. Tax is instead charged to the respective joint ventures on their shares of the tax-adjusted income from the joint venture.

Trust income of a unit trust is treated as the trustees’ income and is subject to tax at the normal corporate tax rate. Unit holders declare their share of the trust income and obtain a credit on tax paid at the trust level.

Singapore has one of the world’s most effective tax regimes for real estate investment trusts (REITs). In Singapore, a REIT is established as a unit trust and is regulated by the Monetary Authority of Singapore. The REIT is managed by an asset manager and administered by a trustee, both of which are set up as companies limited by shares. Generally, REITs in Singapore are listed on the Singapore Exchange and their units are freely tradable.

A number of tax concessions may be granted to REITs. They include the following.

- Tax transparency treatment applies at the trustee level where the trustee is not assessed tax on the REIT’s taxable income that is distributed to the unit holders.

- REIT distributions to unit holders who are individuals are tax-exempt, unless they hold their units through a Singapore partnership. (This tax concession has become a permanent feature, with the removal of the sunset clause in 2019.)

- Foreign-source income may be exempt from tax in Singapore.

- The WHT rate for non-resident institutional investors is reduced to 10 percent for distributions made from 18 February 2005 to 31 December 2025.

- A GST remission is allowed for claims of input GST incurred on business expenses for acquiring and holding non-residential properties through the REIT’s multi-tiered structure until 31 December 2025, subject to qualifying conditions similar to those for qualifying registered BTs.

For those REITS that are liable to register for GST due to their direct holdings of non-residential properties in Singapore to derive taxable rental income, they will still be required to register for GST in their own rights.

The GST remission allowing qualifying registered BTs to claim input GST on business expenses incurred to set up financing SPVs and their allowable operating expenses also applies to REITs, subject to the same qualifying conditions.

Choice of acquisition funding

A transaction can be financed through shares, loan notes, cash, asset swaps or a combination of different types of consideration.

Debt

Where the consideration is in the form of cash, the acquirer may have to raise external borrowing. Incidental costs of raising loan financing, such as legal fees, rating fees and guarantee fees, are normally viewed as non-deductible capital costs. Exceptions arise where such expenditure is integral to the operations of a trade or business, thereby qualifying as deductible revenue expenditure, as in the case of banks and other financial institutions.

Broadly, ‘qualifying debt securities’ (QDSs) are defined to include Singapore government securities (e.g. Singapore treasury bills); or bonds, notes, commercial papers, certificates of deposit and Islamic debt securities arranged in accordance with the relevant regulations (subject to certain exceptions). The main tax concessions for QDSs are as follows:

- tax exemption on interest, discounts, prepayment fees, redemption premiums, and break costs from any QDS, such other income directly attributable to QDSs, and any amount payable from any Islamic debt securities that are QDSs (collectively ‘QDS income’) and that is derived by a non-resident person, subject to qualifying conditions;

- concessionary tax rate of 10 percent on QDS income derived by companies and bodies of persons, subject to qualifying conditions.

The tax exemption and concessionary tax rate will apply to QDSs issued on or before 31 December 2023.

In addition, current Singapore tax legislation provides for tax exemption on interest, discount, prepayment fee, redemption premium and break cost from any debt securities, such as other income directly attributable to debt securities, and any amount payable from any Islamic debt securities, where the income is derived from Singapore by any individual, provided such income is not derived through a partnership in Singapore or from carrying on a trade, business or profession in Singapore.

Deductibility of interest

Interest expense is tax-deductible where it is incurred on capital employed in acquiring income. Therefore, interest is deductible where it is incurred in connection with amounts borrowed and used as working capital or to fund capital expenditure used to generate income for the company. As such, interest incurred on borrowings to acquire either shares of a company or the trade and assets of a company should be tax-deductible. See, however, comments later in the report.

While there are no thin capitalization rules in Singapore, certain restrictions may limit the deductibility of interest.

The IRAS takes the view that each investment asset (including an intercompany advance) constitutes a separate source of income. Therefore, to the extent that the investment or asset has never produced income (i.e. non-income producing investments and assets), any interest expense that is incurred in funding or financing the asset is not deductible for income tax purposes.

Where it is not possible to trace the usage of interest-bearing funds, the IRAS uses an asset-based formula to attribute the interest expense to the non-income producing investment. Based on this formula, the interest attributable to the non-income producing investment is disallowed for tax purposes. Non-income producing investments include interest-free loans and equity investments that have never yielded dividend income.

WHT on debt

Interest paid to any person who is not a tax resident of Singapore is subject to Singapore WHT at the rate of 15 percent of the gross payment. The WHT applies provided that the interest is not derived by the non-resident person from any trade, business, profession or vocation carried on or exercised by the non-resident in Singapore and that the interest is not effectively connected with any permanent establishment of that non-resident person in Singapore. The rate of WHT may be reduced by a tax treaty between Singapore and the country of the recipient.

Where interest is payable on a loan for a purpose that promotes or enhances economic and technological development in Singapore, an application may be made to the Minister for Finance for the payment of the interest to be exempted from WHT.

Checklist for debt funding

- Consider whether the level of non-income producing assets limits the deduction of interest expenses.

- Consider whether WHT of 15 percent on interest may be reduced or eliminated by structuring loans from the relevant treaty country.

Islamic financing

Although Islamic finance has existed for several decades, this alternative has only recently attracted global attention.

The basic principle of Islamic banking is the prohibition or absence of interest. Given the nature and structure of Islamic financial products, they tend to attract more tax than conventional financial products. Transactions that involve financing of real estate in compliance with Islamic law would typically be exposed to stamp duties twice under Singapore tax law because there would be two transfers of legal title to the property asset.

To encourage the growth of Islamic financing, the following tax concessions have been introduced.

- Where there are double stamp duties for qualifying Islamic financing arrangements involving real estate, the taxpayer may apply for stamp duty remission, subject to prescribed conditions.

- The concessionary tax treatment under the QDS scheme is extended to Islamic debt securities. Under this treatment, any amount payable from any Islamic debt securities that are QDSs and issued from 1 January 2005 to 31 December 2023 may be tax-exempt or taxed at 10 percent, subject to certain conditions.

- Any amount payable on Islamic debt securities derived by individuals on or after 1 January 2005 is exempt from Singapore tax, provided the income is not derived through a partnership in Singapore or from carrying on a trade, business or profession in Singapore.

Equity

Incidental costs of raising equity finance, such as legal and professional fees, are normally regarded as capital in nature. As such, they are not tax-deductible unless they qualify for double tax deduction under the M&A scheme outlined in the earlier section.

The registration fee for a limited liability company is SGD300, regardless of the size or currency of the share capital. Whereas for VCC, the registration fee for incorporating a VCC is SGD8,000; the fee for registering a sub-fund (of an umbrella VCC) is SGD400 per sub-fund.

A Singapore company is no longer required to have an authorized capital.

There is no WHT on dividends paid by a Singapore company (including a VCC). Dividends paid by a Singapore-resident company (including a VCC) are tax-exempt in Singapore.

Profits arising from share swap transactions are not normally subject to income tax under restructuring arrangements.

Stamp duty is generally payable on a share swap transaction unless the conditions for intragroup exemption (discussed earlier) are satisfied.

Hybrids

A commonly used hybrid instrument is the redeemable preference share (RPS). An RPS is generally treated as a form of equity for tax purposes even though certain RPSs may be treated as debt instruments for accounting purposes. The use of an RPS allows for flexibility of redemption, which is generally regarded as a repayment of capital. The IRAS has also issued guidelines to determine the characterization of hybrid instruments and, accordingly, the tax treatment. As the characterization would be determined based on facts and circumstances and a combination of factors, an advance ruling may be sought from the IRAS to obtain certainty before issuing the hybrid instrument.

Discounted securities

For tax purposes, the issuer of discounted securities can claim deduction for the discount as a borrowing cost. However, the discount is only allowed as a deduction when it is incurred on the maturity or redemption of the debt securities.

Deferred settlement

The buyer is not allowed a deduction for deferred consideration for an acquisition because the payment is regarded as capital in nature. This treatment applies even where the deferred consideration can only be determined at a later date on the basis of the post-acquisition performance of the business.

Depending on the seller’s tax status, the seller is taxed on deferred consideration where the gains from the sale of the business or shares are regarded as trading gains.

Other considerations

Concerns of the seller

Where the seller is likely to be taxed on gains arising from the transfer, it is more tax-efficient for the seller to realize part of the value of their investment by the payment of a pre-sale dividend, which is tax-exempt.

Amalgamations

Under the Companies Act (Cap. 50), Singapore provides for an effective and efficient statutory form of merger and amalgamation process, which allows:

- two or more companies to merge and continue as one company without involving the courts, provided the companies are solvent; or

- a parent and a wholly owned subsidiary to merge or two or more wholly owned subsidiaries to merge (i.e. a short-form amalgamation).

Section 34C of the ITA governs the tax treatment for amalgamating companies in a qualifying corporate amalgamation that takes effect on or after 22 January 2009.

The section only applies to a ‘qualifying amalgamation’, which is defined as:

- any amalgamation of companies where the notice under section 215F of the Companies Act (Cap. 50) or a certificate of approval under section 14A of the Banking Act (Cap. 19) is issued on or after 22 January 2009; or

- other amalgamations of companies approved by the Minister (or such person as he may appoint).

In a qualifying amalgamation, the amalgamated company must elect in writing within 90 days from the date of the amalgamation to avail itself of the tax treatment for a qualifying amalgamation. On election, the trade and business of all the amalgamating companies is treated as carried on in Singapore by the amalgamated company from the date of amalgamation.

The following tax treatment applies to qualifying corporate amalgamations (as provided in the ITA, regulations and/or IRAS guidelines).

- An amalgamated company cannot claim tax deduction on interest and borrowing costs incurred on any borrowings made by an amalgamating company to acquire shares in another amalgamating company where the two companies concerned subsequently amalgamate.

- Where the property transferred is trading stock for both the amalgamated and amalgamating companies, the amalgamated company is deemed to have taken over the trading stock of the amalgamating company at net book value. Consequently, the cost of the stock claimable by the amalgamated company in computing its gains is the net book value of the stock taken over at the point of amalgamation.

- Alternatively, the amalgamating company can elect to take over the stock at fair value. In this case, the amalgamated company can fully deduct the fair value and the amalgamating company is taxed on the difference between fair value and net book value.

- Where the property transferred is trading stock of the amalgamating company but a capital asset to the amalgamated company, the amalgamating company is regarded as having sold the property at the open market value on the date of amalgamation.

- Where the property transferred is not a trading stock of the amalgamating company but is trading stock of the amalgamated company, the purchase consideration of the amalgamated company is taken as the market value on the date of amalgamation or actual amount paid, whichever is the lower.

- Where the amalgamating company ceases to exist on amalgamation, the amalgamated company can deduct the impairment loss or the amount of bad debts written off with respect to the trade debts taken over (from the amalgamating company). Similarly, where the amalgamating company has been allowed a deduction with respect to any debt written off or impairment loss, any such debt recovered subsequently is taxable for the amalgamated company.

- Where capital allowances have been made to properties transferred from the amalgamating company to the amalgamated company, the capital allowances continue to be made to the amalgamated company as if no transfer had taken place.

- Where the amalgamating company has unused capital allowance, donations or losses at the date of amalgamation, the amalgamated company may take over those items and use them against its assessable income, provided the amalgamating company was carrying on a trade up to the date of amalgamation and the amalgamated company continues to carry on the same trade or business as that carried on by the amalgamating company immediately before the amalgamation.

- Where any of the amalgamating companies cease to exist on amalgamation, the amalgamated company assumes all liabilities and obligations of the amalgamating companies.

Group relief/consolidation

Subject to meeting the requisite conditions, qualifying group companies may transfer current YA unabsorbed capital allowances, current year losses and unabsorbed approved donations to other group member companies. For the purpose of the group relief system, the primary test (among other requirements) is that a group must consist of a Singapore-incorporated company and its Singapore-incorporated group members. Two Singapore-incorporated companies are members of the same group where:

- at least 75 percent of the ordinary share capital in one company is beneficially held, directly or indirectly, by the other; or

- at least 75 percent of the ordinary share capital in each of the two companies is beneficially held, directly or indirectly, by a third Singapore-incorporated company (i.e. the relevant holding company).

Under the M&A scheme, the M&A allowance and double tax deduction on transaction costs are not available for transfer under the group relief system.

Transfer pricing

Legislation formalizing existing transfer pricing compliance and documentation requirements and providing for new penalties and surcharges on transfer pricing adjustments made by the IRAS was passed in October 2017. Accompanying subsidiary legislation, Income Tax (Transfer Pricing Documentation) Rules 2018 (Rules), as well as the fifth edition of the Transfer Pricing Guidelines (TPG5) were also released in February 2018.

The IRAS has adopted the arm’s length principle as the standard and expects all related-party transactions to be conducted on an arm’s length basis. The IRAS has the power to recharacterize controlled transactions to those consistent with arm’s length dealings, if it is found that unrelated parties would have entered into substantially different arrangements or would not have entered into similar arrangements. A 5 percent surcharge will be levied on any transfer pricing adjustments made by the IRAS from YA 2019 onwards. Transfer pricing documentation should be prepared and maintained on a contemporaneous basis (i.e. no later than the tax filing due date for the financial year in which the transaction was made) unless specifically exempted, and penalties for non-compliance may be applicable.

To facilitate compliance with the arm’s length principle and reduce compliance cost, the IRAS has introduced an indicative margin for related-party loans below SGD15 million obtained or provided from 1 January 2017. Where a related domestic loan is provided by a taxpayer that is not in the business of borrowing and lending, the IRAS will apply interest restriction in place of the arm’s length methodology. This is done by limiting the taxpayer’s claim for any interest expense to the interest charged on such loan. The IRAS requires all cross-border loans to be made on arm’s length terms.

For routine support services that satisfy prescribed conditions provided in the Rules and TPG5, there is a safe-harbor cost plus mark-up of 5 percent.

Dual residency

There is no advantage in establishing a dual resident company because the IRAS does not recognize such status.

Foreign investments of a local target company

As Singapore has adopted a territorial basis of taxation, tax is levied on income accruing in or derived from Singapore. Foreign-sourced income is not taxable in Singapore unless it is received or deemed to be received in Singapore under local tax legislation. Hence, dividend income from foreign investments is not taxed in Singapore unless it is remitted or deemed remitted to Singapore.

An income tax exemption is generally granted to all persons resident in Singapore on their specified foreign income — namely, dividends, branch profits and service income received in Singapore on or after 1 June 2003 — provided the following conditions are met.

- In the year the income is received in Singapore, the headline tax rate of the foreign jurisdiction from which the income is received is at least 15 percent.

- The specified foreign income has been subjected to tax in the foreign jurisdiction from which it was received.

- The IRAS is satisfied that the exemption would be beneficial to the Singapore-resident person.

Where the specified foreign income was exempted from overseas tax in the relevant foreign jurisdiction by virtue of a tax incentive awarded for substantive business operations undertaken in the foreign jurisdiction, the income is deemed to have been taxed in that foreign jurisdiction.

Additionally, exemption under specified scenarios or circumstances may also be granted upon application.

Where the above conditions are not met, the specified foreign income is taxed on remittance under normal tax rules. Where the specified foreign income is also subject to tax in the foreign jurisdiction, double taxation may be relieved through Singapore’s unilateral tax credit system and through its many bilateral tax treaties.

With effect from YA 2012, foreign tax credits can be claimed for foreign tax suffered under a foreign tax credit pooling system, which is based on the lower of the aggregate foreign taxes paid or the aggregate Singapore tax payable in the pooled foreign income.

Comparison of asset and share purchases

Advantages of asset purchases

- The purchase price of qualifying assets (or a proportion) may be depreciated for tax purposes in the form of capital allowances.

- Liabilities and business risks of the seller company are not transferred.

- Possible to acquire only certain parts of a business.

- Interest is deductible where incurred to fund the acquisition of plant, equipment and other assets that will be used in the trade or business.

Disadvantages of asset purchases

- Possible clawback of capital allowances claimed by the seller in the form of a balancing charge.

- Higher stamp duties on the transfer of immovable properties (other than cases involving equity interests in residential PHEs where ACD applies).

- Benefits of any losses or unused tax attributes remain in the target company.

Advantages of share purchases

- No balancing charges or clawbacks for the seller.

- Buyer may be able to use and benefit from tax losses, other unused tax attributes and tax incentives of the company acquired, subject to conditions.

- Lower stamp duties payable on the transfer of shares, compared with immovable property (other than cases involving equity interests in residential PHEs where ACD applies).

- Eligible for tax benefits under the M&A scheme, subject to conditions.

- Divesting company (whether incorporated in Singapore or otherwise) may avail of the safe-harbor rules under Section 13Z of the ITA for exemption on gains from divestment of ordinary shares in an investee company, subject to the relevant conditions.

Disadvantages of share purchases

- Buyer may acquire historical tax and other liabilities.

- No deduction or depreciation allowances (capital allowances) are available for the purchase cost of shares.

- Interest incurred to fund the acquisition of shares could be restricted.

KPMG in Singapore

Agnes Lo

Partner

KPMG Services Pte. Ltd.

16 Raffles Quay #22–00

Hong Leong Building

Singapore 048581

T: +65 6213 2976

E: agneslo1@kpmg.com.sg

Adam Rees

Principal Advisor, M&A Tax

KPMG Services Pte. Ltd.

16 Raffles Quay #22–00

Hong Leong Building

Singapore 048581

T: +65 6213 2961

E: adamrees@kpmg.com.sg

Bernard Yu

Director, M&A Tax

KPMG Services Pte. Ltd.

16 Raffles Quay #22–00

Hong Leong Building

Singapore 048581

T: +65 6213 3656

E: bernardtgyu@kpmg.com.sg

This country document does not include COVID-19 tax measures and government reliefs announced by the Singaporean government. Please refer below to the KPMG link for referring jurisdictional tax measures and government reliefs in response to COVID-19.

Click here — COVID-19 tax measures and government reliefs

This country document is updated as of 1 January 2021.