Luxembourg - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Luxembourg.

Taxation of cross-border mergers and acquisitions for Luxembourg.

Introduction

Luxembourg benefits from an extensive legal framework for cross-border mergers and acquisitions (M&A) involving Luxembourg entities.

Luxembourg companies may be involved in domestic and cross-border mergers and demergers in various ways. Luxembourg has implemented several European Union merger directives (EU Directives), as further detailed below, which allows tax-neutral company reorganizations.

This report provides a general overview of tax and other issues relating to cross-border M&A in Luxembourg and clarifies the frameworks within which the different transactions may take place. In particular, the following aspects are analyzed:

- opportunities available to the buyer when purchasing shares or assets

- choice of acquisition vehicles available to the buyer

- questions relating to funding of the acquisition.

Corporate law framework

Luxembourg corporate law has always been a strong supporter of the Luxembourg global pro-business approach. To the extent possible, corporate law rules are designed with a view to fulfilling entrepreneurs’ goals and expectations. As a global financial center, Luxembourg is eager to facilitate cross-border transactions. Cross-border mergers are a strategic key topic for groups of companies, in particular for internal restructuring or acquiring new businesses. Thus, Luxembourg has seen the need for a set of rules that contribute to such importance.

The law of 10 August 1915 on commercial companies, as amended (the Company Law), provides the current framework and facilitates mergers involving Luxembourg companies, either domestic or cross-border.

The Company Law was ahead of most other European jurisdictions, which did not foresee the benefits of a cross-border merger mechanism. In a nutshell, Luxembourg commercial companies were entitled to take part in cross-border mergers, either as absorbing or absorbed entities, to the extent that the legislation of the other jurisdiction did not prohibit such merger.

Moreover, until the law of 10 June 2009 on cross-border mergers applicable to commercial companies (the 2009 Law), which transposed several EU directives, notably the Directive 2005/56/EC on cross-border mergers of commercial companies (the 2005 Directive), into the Company Law, the latter did not provide a comprehensive legal framework. Due to its usual proactive and business-friendly approach, the Luxembourg legislator took the opportunity to exceed the minimum requirements set forth in the 2005 Directive.

Any Luxembourg company can be merged into a foreign company where:

- the foreign company or economic interest group is formed in accordance with the law of a foreign state

- the law governing the foreign entity allows cross-border mergers as a matter of principle

- the foreign entity complies with the national provisions and formalities of the foreign state.

Cross-border merger legal framework

The Company Law sets out a framework for both domestic and cross-border mergers, enabling restructuring and cooperation across borders in Europe and internationally. The Luxembourg cross-border legal framework is an example of the continuing modernization of the Company Law. This framework is designed to make Luxembourg more competitive and enable domestic companies to benefit further from the EU single market and from the flexibility of the Luxembourg corporate law system.

Scope

The scope of the Company Law regarding cross-border mergers derives initially from the 2005 Directive that is no longer in force. The 2005 Directive has been replaced by the Directive 2017/1132/EU, which has implemented further provisions regarding corporate law and more particularly the rules applicable to mergers (the 2017 Directive). The 2017 Directive provides measures aimed at providing equivalent safeguards required by the EU countries for the protection of the interests of shareholders and third parties in relation to cross-border mergers (as for instance applicable conditions procedure and documents required for a cross-border merger, date of effect and consequences of a cross-border merger, etc.).

The Company Law allows for cross-border mergers between all types of Luxembourg companies vested with legal personality and EU companies, as well as non-EU companies, insofar as the law of the non-EU country does not prohibit such mergers.

The 2005 Directive did not cover the cross-border mergers of undertakings for collective investment in transferable securities (UCITS). However, those mergers have been permitted by the Luxembourg law dated 17 December 2010 on UCITS.

Procedural steps for cross-border mergers

The legal regime for cross-border mergers is, to a great extent, the same as the regime applying to domestic mergers. This is an improvement, given that the EU directives set more stringent conditions for cross-border mergers.

The Company Law provides for items to be included in the written ‘common draft terms’ of cross-border mergers that involve public limited liability company (société anonyme — S.A.), private limited liability company (société à responsabilité limitée — S.à r.l.) and/or partnership limited by shares (société en commandite par actions — S.C.A.).

The management of the merging companies must establish these common draft terms. They include the same basic principles required in the common draft terms for mergers of Luxembourg companies and additional information for cross-border mergers and mergers resulting in the creation of a European company (EC).

According to the Company Law, the common draft terms of mergers must be published in the Luxembourg electronic gazette (Recueil —électronique des sociétés et associations — RESA) at least 1 month before the general meeting of shareholders of the merging companies, which is convened to approve of the merger. Unless an exemption applies, the governing body of the merging companies must draw up a report explaining the economic and legal aspects of the merger and its impact on shareholders, employees and creditors. In the same vein, a report from an independent expert on the terms of the merger must also be prepared save for exemption.

These two above-mentioned reports must be made available at least 1 month before the general meeting of shareholders of the merging companies.

The expert and management’s reports have to be addressed to the general meetings of the merging companies, to explain the merger and its legal and economic ground.

Validity and effect of the mergers

In Luxembourg, the notary is the national authority in charge of verifying the legality of the merger and, in particular that the merger has been executed in accordance with the terms and conditions laid down in the common draft terms adopted by each merging companies.

The notary may be required to issue a certificate attesting the legality of the merger.

The merger by acquisition of a foreign law governed company shall take effect and shall be effective against third parties from the date of the publication of the minutes of the general meeting of the shareholders of the absorbing company. The absorbing company may carry out the publication formalities in respect of the absorbed company.

However, in case of a merger by acquisition of a Luxembourg law governed company, the latter shall be deregistered in Luxembourg as of the notification of the effectiveness of the merger by the foreign business register of the absorbing company.

Once merged, the absorbed company ceases to exist and all its rights and obligations are ipso jure transferred to the absorbing company.

Asset purchase or share purchase

Purchase of assets

Luxembourg tax law differs in its treatment of transfers of ‘private’ and ‘business’ assets.

For business assets (held by a company), a capital gain on disposal must be included in the business profit of the seller.

Capital gains realized on assets other than real estate or a substantial participation held as private property (i.e. not held by a company) are exempt unless they qualify as speculative gains under article 99bis of the Income Tax Law, that is, unless the gain is realized within 6 months of the acquisition of the asset or the disposal precedes the asset’s acquisition.

Liabilities associated with the transferred asset remain with the seller and are not transferred with the asset.

Purchase price

When a Luxembourg entity directly acquires a business, the acquisition price of the assets normally represents the basis for their depreciation for Luxembourg tax purposes.

The (depreciated) acquisition cost determines gains or losses arising on a subsequent disposal. However, where a business is acquired from a related party at a price deemed not to be at arm’s length, a tax adjustment may be made.

Goodwill

Under Luxembourg tax law, each asset transferred should be allocated its own distinct value, which forms the base cost for depreciation purposes. Where the total value exceeds the sum of the values attributed to each asset, the excess is deemed to constitute goodwill. In principle, goodwill is depreciable under Luxembourg tax law, and the normal practice is to write off goodwill over 10 years. However, Luxembourg companies may write off goodwill over a longer period, provided it does not exceed the useful economic life of the asset.

Financial fixed assets, such as participations, are not generally depreciable, even where there is a goodwill element in the purchase price. A deductible write-down in value is permitted following a prolonged reduction in the value of the participation.

Depreciation

Fixed assets are, in principle, subject to an annual depreciation that should be deductible from the taxable income of the Luxembourg company. Generally, the straight-line method is used to compute the amount of depreciation. The declining-balance method may be used in certain cases but not for buildings and intangible assets.

As of 1 January 2017, taxpayers can opt to defer the deduction of annual depreciation of a tangible asset. The unused amount can be carried forward and must be deducted by the end of the asset’s useful lifetime. The taxpayer may change from the declining-balance to the straight-line method but not vice versa.

With the approval of the tax administration, depreciation on the basis of asset use may be applied to assets whose annual use fluctuates widely. Extraordinary depreciation may also be permitted if there is excessive wear and tear or other steep reductions in value of the assets. Buildings used for business purposes may be depreciated over their useful lives, but land may not be depreciated.

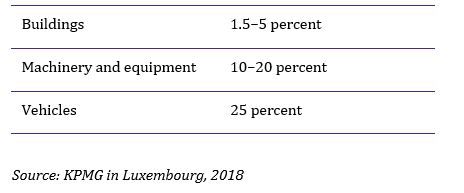

Apart from a few assets covered by administrative circulars, there are no specified rates of depreciation. The depreciation period should reflect the useful life of the asset. Rates commonly used in practice are as follows.

Reference is generally made to German rules for depreciation periods.

Tax attributes

Losses that arise on the disposal of assets may offset other taxable income of the Luxembourg company. Losses incurred before 1 January 2017 that exceed taxable income may be carried forward indefinitely against future profits of the Luxembourg entity. However, any tax losses available for indefinite carry forward of the Luxembourg company selling the assets may not be transferred to the buyer of the assets.

Losses incurred as of 1 January 2017 that exceed taxable income may be carried forward for up to 17 years.

Value-added tax (VAT)

The normal VAT rate is 17 percent. When assets are transferred individually, the transferred items within the scope of VAT are subject to the normal VAT rules for goods and services.

However, a merger or division is in principle not subject to VAT because the transfer of all assets forming all or part of a business is not deemed to constitute a supply of goods for VAT purposes, under the condition that there is a continuity between the transferee and the transferor.

Stamp duty and stamp duty land tax

No stamp duty is generally payable on the transfer of assets. The transfer of immovable property is subject to registration duty of 6 percent of the value of the real estate, plus an additional transfer duty of 1 percent.

For certain real estate in Luxembourg City, there is a supplementary municipal duty of 3 percent corresponding to 50 percent of the 6 percent registration duty.

A registration duty of 0.24 percent on the nominal amount of loans applies to loan agreements that are mandatorily or not registered.

As of 1 January 2017, only specific claims remain subject to a mandatory registration, triggering a proportional registration duty. Therefore, the contribution or transfer of an ordinary loan agreement is generally no longer subject to a mandatory registration and the related registration duty of 0.24% due on the nominal amount of the loan. A registration may however become mandatory if the loan agreement is intended to be ‘used’ or annexed to an act.

Purchase of shares

Generally, the purchase of a target company’s shares should not affect the book values of its assets. The assets of the target company cannot be revalued to reflect fair market values.

The buyer should record the participation acquired in its balance sheet at the acquisition price, plus costs directly connected with the acquisition.

Tax indemnities and warranties

Since the buyer is taking over all the liabilities, including contingent liabilities, the buyer requires more extensive indemnities and warranties than in the case of an acquisition of assets. Due diligence of the target company’s tax position is advisable, particularly when the amounts involved are significant.

In principle, indemnity payments received by a Luxembourg company pursuant to a warranty clause are taxable for the company. In principle, a Luxembourg company making such an indemnity payment may deduct it for tax purposes.

Tax losses

Generally, tax losses may only be deducted by the company that originally incurred them. Therefore, where a Luxembourg company is absorbed by an existing or a newly incorporated company, its tax loss carry forward may not be transferred. However, it may be possible to disclose latent capital gains of the absorbed company to be offset by unused tax losses. Accordingly, the absorbing company may acquire assets on a stepped-up basis on which depreciations may be computed.

As long as a Luxembourg company continues to exist following these types of restructuring, its tax losses may be carried forward in certain conditions. Conversely, where two or more Luxembourg companies are merged to create a new company, the tax loss carry forward of each disappearing entity is lost.

Crystallization of tax charges

While there are no specific rules under Luxembourg tax law, it is generally advisable that a buyer performs a due diligence to assess the tax position and related risks of the target company.

Pre-sale dividend

The treatment of pre-sale dividends (distributions by the subsidiary of retained earnings before disposal) may benefit from the Luxembourg participation exemption regime. When the subsidiary company distributes dividends to its parent company, any write-down in value of the participation held by the parent company in the subsidiary is not deductible to the extent of the amount of dividends distributed.

Stamp duty

No stamp duty is payable on the transfer of shares in capital companies. Registration duty may be levied on the transfer of all or most of the shares in certain vehicles that hold only real estate. In some cases, the tax authorities may apply a look-through approach and consider that the real estate, rather than the company, has been transferred and levy duty accordingly. Specific rules apply in the case of a transfer of partnership interests with underlying real estate.

Tax clearances

A taxpayer may request advance tax clearance from the tax authorities with respect to the application of Luxembourg tax law to the taxpayer’s specific facts and circumstances.

The advance tax clearance procedure was formalized in Luxembourg domestic law as of 1 January 2015. A ruling commission gives a binding opinion at the request of the taxpayer. An administrative fee for a ruling, ranging from EUR3,000 to EUR10,000, must be paid upfront.

The advance tax agreement is valid for a 5-year period and is binding for the tax authorities, unless the description of the situation or transactions was incomplete or inaccurate, the situation or transactions realized subsequently differ from the ones described in the request, or the decision is not or no longer in line with national, European or international law.

The Luxembourg Budget Law for 2020 amended the above advance tax clearance procedure by limiting the validity of advance tax agreements issued by the Luxembourg tax authorities before 1 January 2015 to the tax year 2019. A renewal procedure has been made available for transactions that have not produced all their effects at the date of expiry of the advance tax agreement.

Choice of acquisition vehicle

Several potential acquisition vehicles are available to a foreign buyer.

A fixed capital duty of EUR75 is due on certain transactions, including, among others, the incorporation of a Luxembourg company.

Local holding company purchasers may choose to set up a holding company to acquire the shares of a target company.

Two legal forms of limited liability company are widely used in Luxembourg.

- Public limited company (société anonyme): a joint stock company with freely transferable shares. A one-person public limited company (société anonyme unipersonnelle) is available under the same conditions, except that the board of directors may be represented by one director and the general shareholders meeting may be attended by the sole shareholder.

- Limited liability company (société à responsabilité limitée): a private limited company with restrictions on the transfer of shares. Also available is a one-person limited liability company (société à responsabilité limitée unipersonnelle), which may have only one shareholder.

These companies are generally fully taxable corporations that may benefit from the Luxembourg participation exemption regime.

Luxembourg tax legislation also provides for the private family asset holding company (Société de gestion de patrimoine familial — SPF), an investment vehicle for individuals. This type of company is specially designed to meet the business needs of family-owned holding companies managing financial assets. The exclusive objectives of an SPF are acquiring, holding, managing and disposing of financial assets, to the exclusion of any commercial activity.

Luxembourg domestic law provides for other types of entities, including:

- partnership limited by shares

- societas Europaea

- partnership

- limited partnership

- special limited partnership

- joint venture

- cooperative society

- civil company

- economic interest grouping.

Foreign parent company

The foreign buyer may finance the Luxembourg company with interest-bearing debts. In principle, interest payments by a Luxembourg company are not subject to Luxembourg withholding tax (WHT).

Dividend payments by a Luxembourg company generally are subject to 15 percent Luxembourg dividend WHT, but an exemption is provided under domestic tax law if certain conditions are met (Luxembourg participation exemption regime). The WHT can also be reduced by application of tax treaties.

No WHT tax is levied on liquidation or partial liquidation proceeds.

Non-resident intermediate holding company

Dividend payments by a Luxembourg company to a foreign entity are generally subject to a 15 percent WHT, which may be reduced by application of a tax treaty, or exempt under the Luxembourg participation exemption regime.

This relief may be challenged by the Luxembourg tax authorities if the transaction is considered as abusive.

A general anti-abuse rule (GAAR) was introduced into Luxembourg domestic tax law in order to comply with the January 2015 amendment to the Parent-Subsidiary Directive. Dividends falling within the scope of the directive, which are paid by a Luxembourg fully taxable company to a collective entity listed and covered by the directive or to an EU permanent establishment (PE) of a collective entity listed and covered by the directive, will not benefit from a WHT exemption if the transaction is characterized as an abuse of law within the directive’s meaning.

Luxembourg tax authorities may also ignore or recharacterize a transaction that is considered abusive according to the GAAR of amended paragraph 6 StAnpG implementing the GAAR of the EU Anti-Tax Avoidance Directive (ATAD 1). The GAAR targets transactions that, having been put in place for the main purpose or one of the main purposes of obtaining a tax advantage that defeats the object or purpose of the applicable tax law, are not genuine (i.e. are not put in place for valid commercial reasons that reflect economic reality) having regard to all relevant facts and circumstances. Transactions considered as abusive will be ignored by the Luxembourg tax authorities, and taxes will be computed based on the ‘genuine route’ with regard to all relevant facts and circumstances.

Finally, in the context of tax treaties, Luxembourg has ratified the Multilateral Instrument (MLI) and has decided to include in its covered tax agreements the principal purpose test as an anti-treaty abuse provision. Those provisions apply as from 1 February 2020 for withholding taxes and as from 1 January 2021 for all other taxes. Future tax treaties negotiated by Luxembourg may include similar anti-treaty abuse provisions.

Local branch

As an alternative to the direct acquisition of the target’s trade and assets, a foreign buyer may structure the acquisition through a Luxembourg PE. The income attributable to the PE is subject to Luxembourg taxation, but dividends and capital gains realized by the PE on disposal of a shareholding in a Luxembourg company may, under certain conditions, benefit from the Luxembourg participation exemption regime. The repatriation of profits to the foreign head office does not trigger additional taxes on branch profits.

Joint venture

Whenever a joint venture takes a form in which the company is legally and fiscally recognized as an entity distinct from the participants, it is taxed as a corporation (see earlier in this report).

In other cases, the income is taxable for the individual venturers under the rules for partnerships (see earlier in this report), which is the case for European economic interest groupings (Groupement européen d’intérêt économique).

The profits are allocated on the basis of the joint venture agreement.

Choice of acquisition funding

To fund an acquisition, the acquiring company may issue debt, equity or a combination of both. Below we discuss the tax aspects that should be considered when deciding the funding structure.

Deductibility of interest

Interest expenses incurred to fund the acquisition of assets generally are deductible as long as the arm’s length principle is satisfied.

Luxembourg tax law does not stipulate a specific debt-to-equity ratio. According to the Luxembourg administrative practice, the interest-bearing debt-to-equity ratio should comply with the arm’s length principle. Where the appropriate ratio is not met, a portion of the interest paid could be regarded, for Luxembourg tax purposes, as a hidden profit distribution. In principle, a hidden profit distribution is not tax-deductible and is subject to 15 percent WHT, subject to relief under the domestic WHT exemption rules or a tax treaty.

Expenses directly related to a participation that qualifies for the Luxembourg participation exemption regime (e.g. interest expenses) are only deductible to the extent that they exceed exempt income arising from the relevant participation in a given year. However, the exempt amount of a capital gain realized on a qualifying participation is reduced by the amount of any expenses related to the participation, including decreases in the acquisition cost, that have previously reduced the company’s Luxembourg taxable income.

Deductibility of interest expenses may also be limited under the anti-hybrid mismatch rules (see below).

In addition, Luxembourg transposed the interest limitation rules of the ATAD 1 with effect as from 1 January 2019. The rules introduce a new framework to limit interest deduction for entities subject to corporate income tax and aiming at restricting the deduction of an entity’s exceeding borrowing costs (broadly the part of deductible interest expense exceeding interest income) to the higher of 30 percent of its tax EBITDA (earnings before interest, taxes, depreciation and amortization) or EUR3 million. Specific exemptions apply to financial undertakings (such as, for example, alternative investment funds, UCITS, management companies of alternative investment funds and UCITS, banks, insurance companies, some securitization vehicles, etc.), to exceeding borrowing costs arising from loans contracted before 17 June 2016, etc. Those rules should apply after other tax provisions that could (fully or partially) deny the deduction of interest expenses such as the clawback rules of the Luxembourg participation exemption regime or anti-hybrid rules.

Finally, Luxembourg has passed a law disallowing (under certain conditions) the tax deductibility of interest (and royalties) due to associated enterprises located in a country listed on the EU list of non-cooperative jurisdictions, often referred to as the ‘EU Blacklist’, unless the taxpayer is able to prove that the transaction giving rise to the interest (or royalties) was done for valid commercial reasons, reflecting the economic reality. Those new rules apply as from 1 March 2021.

Furthermore, Luxembourg transposed in 2020 the amended Directive on administrative cooperation in the field of taxation (DAC 6) introducing an obligation on European intermediaries (and potentially on taxpayers) to disclose certain reportable cross-border arrangements to their local tax authorities. In particular, structures involving cross-border deductible payments between associated enterprises could fall within the scope of the hallmark C1 according to the Luxembourg law.

Withholding tax on interest payments

Luxembourg domestic tax law does not levy WHT on arm’s length interest payments, except for interest on profit-participating bonds and similar securities. In principle, interest payments on such financing instruments are subject to Luxembourg WHT of 15 percent where:

- the loan is structured in the form of a bond or similar security

- in addition to the fixed interest, supplementary interest varying according to the amount of distributed profits is paid, unless the supplement is stipulated to vary inversely with the fixed interest.

Further, where the recipient of the interest payments is a Luxembourg-resident individual, a 20 percent WHT may be due (i.e. Relibi Law: Final withholding tax on qualifying interest paid by resident paying agents to resident individuals in Luxembourg, including interest on bank deposits, government bonds and profit-sharing bonds. Scope of the final withholding tax extended to interest, as long as it falls in the Relibi Law, paid or credited by foreign paying agents located inside the EU (or another covered state situated outside the EU but inside the European Economic Area area)).

Checklist for debt funding

- In principle, interest payments are not subject to Luxembourg WHT.

- The debt-to-equity ratio must comply with the arm’s length principle.

Corporate tax and net worth tax

The cumulative corporate tax (municipal business tax — MBT) plus corporate income tax (CIT) for companies established in Luxembourg City is 24.94 percent as from 2019.

Corporate taxpayers are also subject to net worth tax (NWT) on their taxable net assets at the following rates unless a specific tax exemption may apply under domestic law or by virtue of double tax treaties:

- 0.5 percent for taxable base up to EUR500 million

- 0.05 percent for the part of the taxable base exceeding EUR500 million.

Since 1 January 2016, the minimum CIT (due by Luxembourg resident corporate taxpayers) has been abolished and replaced by a minimum NWT.

Overall, the rules determining this minimum NWT are the same as those that were in force for determining minimum CIT, with some exceptions. A minimum NWT of EUR4,815 per year is levied on corporate entities where:

- the statutory seat or place of central administration of the company is in Luxembourg

- the financial assets (i.e. participations, transferable securities, receivables from related companies with which the company has a participating link, bank deposits and cash) exceed 90 percent of their total gross assets and EUR350,000.

All other Luxembourg corporate entities having their statutory seat or central administration in Luxembourg are subject to a progressive minimum NWT based on the total balance sheet assets for the relevant tax year. The minimum NWT ranges from EUR535 for a balance sheet total up to EUR350,000, to EUR32,100 for a balance sheet total exceeding EUR30 million.

Securitization vehicles incorporated as corporations, SICARs (Société d’investissement en capital à risque), SEPCAVs (Société d’épargne-pension à capital variable) and ASSEPs (Association d’épargne-pension) are subject to the minimum NWT. Luxembourg PEs of non-resident entities remain excluded from the minimum taxation.

Share-for-share-exchange

A share-for-share-exchange is the contribution of shares by the shareholders of the target company to the acquiring company against allocation of shares in the acquiring company to the shareholders of the target company, or the ‘exchange’ of shares in the target company against shares in the acquiring company in the context of a merger/division at the level of the shareholder of the target.

In principle, a share-for-share-exchange constitutes a taxable sale followed by an acquisition by the disposing shareholder. However, Luxembourg tax law provides for tax-neutral restructuring in the following circumstances.

Article 22bis of the Luxembourg income tax law provides a limited list of share exchanges that may be tax-neutral at the level of the Luxembourg shareholder (i.e. rollover of capital gains):

- transformation of the legal form of corporation to another legal form of corporation

- merger/demerger of resident companies or EU-resident companies (entities that are covered by Article 3 of the EU Directive 434/90) or capital companies

- exchange of shares (in an EU- or European Economic Area-resident company or a fully taxable capital company subject to income tax at a rate comparable to the Luxembourg CIT (a minimum income tax of 8.5 percent (as from 2019) generally satisfies this requirement as long as the taxable basis is determined according to rules and criteria similar to those used in Luxembourg), where the acquiring company (being an EU- or EEA-resident company or a fully taxable capital company subject to income tax at a rate comparable to the Luxembourg CIT) obtains the majority of the voting rights in the acquired company or increases the majority of voting rights already held.

Where this provision does not apply:

- Luxembourg participation exemption regime may apply for qualifying investments held by resident taxable companies and qualifying branches of non-resident companies (article 166 LIR - RGD 21.12.2001) — an extensive exemption that covers capital gains triggered by a share-for-share-exchange

- rollover relief may also apply where sales proceeds are invested in a qualifying asset or participation under certain conditions (article 54 LIR).

Where none of these relieving provisions can be applied, the share-for-share-exchange is, in principle, fully taxable. However, where the shareholders are resident individuals, the gain is taxed only if (i) the participation realized represented more than 10 percent of the shares of the target company, and (ii) the disposal of the participation occurs after more than 6 months following the acquisition. Such a gain may be taxable at half the normal rate.

Non-Luxembourg resident shareholders are taxed only where a participation representing more than 10 percent of the shares of the target company is sold within 6 months following the acquisition of the shares, or where the foreign shareholder, having been a resident of Luxembourg for more than 15 years, disposed of the participation within 5 years since becoming non-resident. Most of Luxembourg’s tax treaties provide for capital gains to be taxed in the state of residence of the entity or individual realizing the gain.

Finally, capital losses realized upon disposal of a shareholding are tax deductible in Luxembourg.

Transfer of assets at book value

Article 170, paragraph 2 LIR provides for the possibility of transferring assets without their realization and thus taxation of underlying capital gains, in the context of a merger. This provision does not give a definitive tax exemption of the capital gains attached to the transferred assets but merely allows a deferral until their subsequent realization.

The following conditions must be fulfilled.

- The absorbed and absorbing company must be resident in Luxembourg (within the meaning of article 159 LIR) and fully subject to Luxembourg corporate income tax.

- The shareholders of the absorbed company must receive, in consideration of the transfer of its shares, shares of the absorbing company newly issued for this purpose. Where the absorbing company has a participation in the absorbed company, the participation must be canceled. The absorbed company must be dissolved.

- The parties must take steps to ensure that the capital gains (hidden reserves) ultimately will be taxable in Luxembourg. Thus, the absorbing company must make an entry in its fiscal financial statements reflecting the book value of the assets transferred to it by the absorbed company.

The transfer at book value is also possible in the case of a division based on article 170, paragraph 3 LIR, under specific conditions (among others, provided that the assets transferred and the assets maintained by the divided entity include at least one independent branch of activity).

This tax-neutral treatment also applies in the case of an intra-EU cross-border merger or division of a Luxembourg collective entity under specific conditions (including among others the maintenance of a PE in Luxembourg).

Where the transfer is not made at book value, to the extent the value attributed to the assets exceeds their book value, this would create taxable income in the absorbed/divided company (potentially offset by available tax losses), unless a specific tax exemption may apply under domestic law or by virtue of double tax treaties.

The higher reported amount of the assets transferred in the balance sheet of the recipient company would result in a higher depreciation of the acquisition costs of the transferred assets.

Transfer of a business by the target company

Contribution of the entire business of the target company or only an independent branch of activity can be made to an acquiring company in exchange for shares in the acquiring company (a share capital company). In this case, the target company remains in existence and, depending on the size of the companies involved, the company acquiring the business may become a subsidiary of the target company, whose sole remaining activity is the holding of shares in the acquiring company.

Article 59 LIR applies where the target company transfers either all assets and liabilities or a branch of activity (the target company remaining in existence). Under this article, in principle, hidden reserves cannot be transferred to the acquiring company because the assets involved are revalued to market value, thus exposing any increase in value over book value to taxation at normal rates at the level of the target company. Thus, the minimum value at which the acquiring company may value the assets transferred is book value.

However, where the target and acquiring companies are fully taxable companies that are resident in Luxembourg or for the acquiring company in another EU or EEA member state, articles 59(3) and 59 bis (1) LIR provide that the assets may be transferred to the acquiring company at book value, market value or an intermediate value at the election of the target company, thus deferring taxation. The maximum value at which the acquiring company may value the assets transferred is market value.

If the receiving company is resident in another EU member state and in order to benefit from a tax-neutral treatment:

- the Luxembourg tax resident company must transfer the business or branch of activity to a Luxembourg PE of a company resident in another EU member state

- the Luxembourg tax resident company must transfer a PE located in another EU member state to a company tax resident in another EU member state.

Anti-abuse rules

An anti-hybrid rule and a general anti-abuse rule (GAAR) were introduced into Luxembourg domestic tax law in order to comply with the amendments of July 2014 and January 2015 to the Parent-Subsidiary Directive, respectively. As of 1 January 2016, profit distributions within the scope of the Parent-Subsidiary Directive are no longer tax-exempt in Luxembourg where the subsidiary is a collective entity listed and covered by the Parent- Subsidiary Directive, if:

- the distributions are deductible by the payer located in another EU member state (anti-hybrid rule), or

- the transaction is characterized as abusive within the meaning of the directive (general anti-abuse rule).

A transaction may be considered as abusive if it is an arrangement, or a series of arrangements, that is not ‘genuine’ (i.e. that has not been put in place for valid commercial reasons reflecting economic reality) and has been put in place for the main purpose or one of the main purposes of obtaining a tax advantage that defeats the object or purpose of the Parent-Subsidiary Directive).

In addition, the GAAR implementing the ATAD 1 as described above also targets all non-genuine transactions (to the extent that they are not put in place for valid commercial reasons that reflect economic reality) performed in a domestic or a cross-border situation and put in place for the main purpose or one of the main purposes of obtaining a tax advantage that defeats the object or purpose of the applicable tax law.

Luxembourg has also transposed the anti-hybrid rules of the ATAD 2, which entered into force as of 1 January 2020 (and for tax year 2022 regarding reverse hybrids rules) and extend the scope of the anti-hybrid rules of the ATAD 1 (which entered into force in 2019). Those anti-hybrid rules tackle hybrid mismatches occurring between EU member states or with third countries as a result of discrepancies in the tax treatment of certain instruments or entities, by denying the deduction in the case of double deduction or if the payment is not included at the payee level.

Finally, in the context of tax treaties, Luxembourg has ratified the MLI and has decided to include in its covered tax agreements the principal purpose test as an anti-treaty abuse provision. These provisions apply as from 1 February 2020 for withholding taxes and as from 1 January 2021 for all other taxes. Future tax treaties negotiated by Luxembourg may also include similar anti-treaty abuse provisions.

Deferred settlement

Where acquisitions involve elements of deferred consideration (i.e. the amount of the consideration depends on the business’s post-acquisition performance), in principle, such future consideration should be regarded as part of the sale price.

Where the sale price relates to shares disposed of, the deferred settlement may be eligible for the Luxembourg participation exemption regime as an element of a capital gain on shares.

Other considerations

Concerns of the seller

A sale of shares of a Luxembourg company may be tax-exempt, either under the Luxembourg participation exemption regime where the seller is either a Luxembourg corporation or a Luxembourg PE of either: (i) a collective entity that is covered by the Parent-Subsidiary Directive; (ii) a corporation resident in a country with which Luxembourg has signed a tax treaty; or (iii) a corporation or a co-operative company that is resident in an EEA country other than a MS of the EU.

Luxembourg usually loses the right to tax capital gains under tax treaties, and non-resident sellers that do not benefit from treaty protection when disposing of shares in a Luxembourg company are not taxable in Luxembourg after a 6-month holding period has elapsed.

The sale of shares does not trigger registration or stamp duty (except in some cases where sellers hold Luxembourg real estate).

In an acquisition for cash of all the assets of a Luxembourg company, the seller is subject to Luxembourg corporation tax on any capital gains. Under certain conditions, the seller may defer taxation, for example, by reinvesting the sale proceeds in fixed assets.

Group relief/consolidation

Fiscal consolidation is allowed for corporate and municipal business tax purposes but not for NWT purposes. Domestic provisions allow eligible companies to set up a vertical or (as of 1 January 2015) horizontal tax consolidation group (subject to conditions). The consolidated companies are bound for a 5-year period.

Vertical consolidation

A fully taxable resident company or a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax, of which at least 95 percent of the capital is directly or indirectly held by another fully taxable resident company, or by a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax, may apply for tax consolidation with this Luxembourg company or PE.

To comply with EU law, the scope of eligible subsidiaries was expanded as of the 2015 tax year to include a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax.

Vertical tax consolidation means that the taxable income (whether negative or positive) of the integrated subsidiary is added to the taxable income of the integrating parent so that the integrating parent is taxed on the aggregate taxable income.

Horizontal consolidation

In order to comply with EU law, new measures were introduced with effect from tax year 2015 that provide for the possibility to apply for a so-called ‘horizontal’ tax-consolidated group, whereby eligible sister companies can form a tax- consolidated group without their parent company.

The setting-up of a horizontal tax-consolidated group is subject to the following conditions.

- The non-integrating parent company must be either a fully taxable resident company, or a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax, or an EEA-resident company fully subject to a tax comparable to the Luxembourg corporate income tax, or an EEA PE of a non-resident company, both fully subject to a tax comparable to the Luxembourg corporate income tax.

- The integrated subsidiaries must be either a fully taxable resident company or a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax.

- The integrating subsidiary must be either a fully taxable resident company or a Luxembourg PE of a non-resident company fully subject to a tax comparable to the Luxembourg corporate income tax.

- The integrated subsidiaries and the integrating subsidiary must be held for at least 95 percent (directly or indirectly) by the same non-integrating parent company.

- The integrating subsidiary must have in the group structure a holding relationship with the non-integrating parent company that is at least as close as one of the other integrated subsidiaries.

- The request to be filed needs to designate this parent company.

- Horizontal tax consolidation means that the taxable income (whether negative or positive) of the integrated subsidiaries is added to the taxable income of the integrating subsidiary so that the integrating subsidiary is taxed on the aggregate taxable income.

Tax consolidation is also available for participations held indirectly through a non-resident fully taxable capital company, to the extent that all the other conditions are fulfilled.

In exceptional cases, the 95 percent interest requirement may be reduced to 75 percent.

The condition with respect to the holding percentage must be met at the beginning of the financial year for which the consolidation is requested.

Tax losses generated before the fiscal consolidation can be used:

- at the level of the integrating company during the fiscal unity to the extent that both the company that generated those losses and the fiscal unity realize a positive result during the given year, and

- at the level of the company that generated the tax losses once the fiscal unity is finished.

Tax losses generated during the fiscal consolidation can be used at the level of the integrating company during the fiscal unity and also once the fiscal unity is finished.

The 2021 budget law has introduced the option for an existing vertical fiscal consolidation, to enter into a new horizontal fiscal consolidation without the dissolution of the existing consolidation, provided certain conditions are met. These provisions ensure the compliance of the tax consolidation regime with the EU freedom of establishment principles, as lined out in CJEU case (14 May 2020, C-749/18).

The members of a tax consolidation are also subject to interest limitation rules either on a consolidated basis (basic rule) or on a stand-alone basis (upon request).

The General Tax Law was modified with effect as of 1 January 2015 to facilitate the recovery of tax claims within the tax- consolidated group and ensure that each group member can be held liable for the taxes due by the parent company or the integrating subsidiary of the tax-consolidated group (in case of default of the latter).

SICARs and securitization vehicles (SVs) are excluded from the tax-consolidation regime.

Transfer pricing

The arm’s length principle is used for evaluating the conditions agreed to between related parties (article 56 LIR) and applies to all related-party transactions. Thus, both cross-border and domestic transactions must be in line with the arm’s length principle.

In addition, taxpayers must be able to justify the financial information (including transactions with related entities) in their tax returns. Taxpayers should be able to provide the Luxembourg tax administration with transfer pricing documentation sustaining the arm’s length character of their intragroup transactions. The transfer pricing report can either be submitted directly with the tax return or on request of the tax authorities.

The Luxembourg transfer pricing rules provide that if one or several transactions cannot be observed between independent parties and no commercial rationale for such transactions could be identified, then such (part of) transactions may be disregarded for transfer pricing purposes.

Where transactions between a parent company and a subsidiary take place, a non-taxable capital contribution or non-deductible profit distribution may be assumed if those transactions are not considered to be at arm’s length. In principle, such distribution is also subject to dividend WHT.

For intragroup financing companies, the Circular LIR 56/1–56bis/1 generally refers to the Organisation for Economic Co-operation and Development (OECD) guidelines and provides for the application of the arm’s length principle for Luxembourg entities that principally conduct intragroup financing transactions. The circular also outlines minimum equity requirements and defines, among others, an arm’s length remuneration for intragroup financing activities and the appropriate level of substance for such activities.

The new OECD guidelines on financial transactions published on 11 February 2020 recognize that a borrowing entity’s balance of debt-to-equity funding impacts the amount of interest paid by the borrower and may affect profits. Article 9 – covering associated enterprises and the arm’s length principle — is relevant, “not only in determining whether the rate of interest provided for in a loan contract is an arm’s length, but also whether a prima facie loan can be regarded as a loan or should be regarded as some other kind of payment, in particular a contribution to equity capital,” stated the Commentary to Article 9 of the OECD Model Tax Convention. Applying the principle of accurate delineation of actual transactions results in multiple examples of debt being recharacterized as equity. As a result, the new guidelines outline that the debt-to-equity balance should be analyzed on a case-by-case basis.

Dual residency

Resident companies are defined for tax purposes as companies that have their legal seat or central administration in Luxembourg. Corporate income tax is levied on worldwide income and capital gains of resident companies. In the case of dual residency, tiebreaker clauses in tax treaties generally determine the tax residence of a company.

Further to the transposition of ATAD 2 with effect as from 2020, Luxembourg implemented anti-hybrid rules according to which a deduction will be denied to the extent dual residency results in double deduction, unless Luxembourg has concluded a double tax treaty with the other jurisdiction(s) by virtue of which the taxpayer is considered as Luxembourg resident.

Foreign investments of a local target company

Luxembourg transposed the Controlled Foreign Company (CFC) rules of ATAD 1, which entered into force as of 1 January 2019. The rule aims to attribute and tax undistributed profits from a low-taxed foreign subsidiary or permanent establishment (i.e. the CFC) at the level of its Luxembourg parent entity/head office. The taxable income (income from non-genuine arrangements that have been put in place for the essential purpose of obtaining a tax advantage) is limited to amounts generated through assets and risks linked to significant people functions carried out by the Luxembourg controlling company and is subject to CIT in Luxembourg (i.e. 17 percent in 2021), but not to MBT.

The rule targets EU and non-EU CFCs if there is a ‘direct or indirect’ participation (together with associated enterprises) of more than 50 percent in voting rights, capital or profit entitlement and if the actual corporate tax due by the CFC is lower than 50 percent of the CIT (excluding MBT) which would be due in Luxembourg.

Comparison of asset and share purchases

Advantages of asset purchases

- Buyer may depreciate the purchase price of assets acquired.

- Possible to acquire only part of the business.

- Losses within the acquiring group may be absorbed by a profitable business acquired from the target company.

- Buyer generally is not liable for claims on or previous liabilities of the target company.

Disadvantages of asset purchases

- The business is effectively being carried on by another entity, which may require renegotiation of trading and employment contracts, etc.

- Pre-acquisition losses incurred by the target company are not transferred with the business. They remain with the target company or are lost

- Generally, there is a need to renegotiate supply, employment and technology agreements.

- Registration duties are due on transfers of real estate.

Advantages of share purchases

- Contractual continuity because the target company may remain active, with only the shareholders changing.

- Pre-acquisition tax losses incurred by the target company may be retained, despite the change of shareholder, if certain conditions are met.

- The acquiring group companies may use losses incurred by the target company following an acquisition under fiscal integration provisions (excluding losses incurred prior to the fiscal consolidation).

- Losses incurred by acquiring group companies within fiscal integration may be offset against profits of the target company.

Disadvantages of share purchases

- Participation cannot be amortized.

- There is liability for claims on or previous liabilities of the target company.

- Where the Luxembourg participation exemption regime applies, direct funding costs related to the acquisition of the subsidiary may not be entirely deductible.

KPMG in Luxembourg

Christophe Diricks

KPMG Luxembourg, Société coopérative 39, Avenue John F. Kennedy

L-1855 Luxembourg

T: +352 22 51 51 5111

E: christophe.diricks@kpmg.lu

This country document does not include COVID-19 tax measures and government reliefs announced by Luxembourg government. Please refer below to the KPMG link for referring jurisdictional tax measures and government reliefs in response to COVID-19.

Click here — COVID-19 tax measures and government reliefs

This country document is updated as of 29 January 2021.