Hong Kong (SAR) - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Hong Kong (SAR).

Taxation of cross-border mergers and acquisitions for Hong Kong (SAR).

Introduction

The Hong Kong Special Administrative Region (HKSAR) government has traditionally adopted a minimal intervention approach to the economy. Consistent with this approach, Hong Kong has a relatively simple tax system, minimal competition law framework, a relatively unregulated business environment and practically no restrictions on foreign ownership. There are no exchange controls and limited restrictions on the repatriation of profits.

Under the Basic Law, Hong Kong maintains its own tax system, which is separate from that of the one used in Mainland China.

The HKSAR tax system is administered by the Inland Revenue Department (IRD) under Chapter 112 of the Inland Revenue Ordinance (IRO). Hong Kong operates a territorial basis of taxation. Broadly speaking, non-capital profits sourced in Hong Kong should be subject to Hong Kong profits tax. Under the territorial basis of taxation, foreign-sourced income is outside the scope of Hong Kong profits tax.

As Hong Kong’s tax system is territorially based, tax is not levied based on a company’s residence. However, the concept of residency does have some importance in the application of some other provisions — such as transfer pricing, offshore fund exemptions, and double tax treaties. The common law concept of residency applies in the absence of specific provisions to the contrary.

Tax losses can be carried forward indefinitely but cannot be carried back to prior years. There are no group relief provisions for losses or transfers of assets under Hong Kong tax legislation. Each company within a corporate group is taxed as a separate entity.

Hong Kong does not impose profits tax on the sale of capital assets. However, on the sale of depreciable assets, there is potentially a recapture of capital allowances.

Recent developments

The major tax changes in Hong Kong since the last edition of this report are as follows:

- Hong Kong has now concluded 45 tax treaties, including double taxation agreements with Serbia (which entered into force in 2020) and Georgia (subject to ratification in Hong Kong as of the date of this publication).

- Introduction of a ship leasing concession, enacted in June 2020 to further develop ship financing and leasing businesses in Hong Kong. The concession provides various tax exemptions for qualifying ship lessors and qualifying ship management leasing activities provided to associated corporations (0 percent profits tax rate), as well as a reduced tax rate (8.25 percent) for certain other ship leasing management businesses.

- Issuance of updated guidance on the taxation of the digital economy, e-commerce and digital assets. This includes further clarity on issues such as determining the locality of profits arising from e-commerce transactions. Importantly, the guidance includes commentary on the broad-based principles the IRD will apply to various forms of cryptocurrency.

- Introduction of 8.25 percent concessionary profits tax rate for general reinsurance business of direct insurers, certain classes of general insurance business of direct insurers and selected insurance brokerage business of licensed insurance broker companies, subject to meeting specific requirements.

- The Stamp Duty (Amendment) Bill 2020 was introduced into the Legislative Council to abolish the Double Ad Valorem Stamp Duty on non-residential property transactions, with effect from 26 November 2020. In respect of certain instruments dealing with non-residential property executed on and after the Effective Date, the Inland Revenue Department will revert the applicable ad valorem stamp duty rates from the rates under Part 2 of Scale 1 to the rates under Scale 2.

There are also a number of legislative proposals in the pipeline, the most notable of which include:

- Amendments relating to the taxation of company amalgamations, including special tax treatments for qualifying court-free amalgamations. It is also expected that the legislation will introduce loss integrity rules which will subject the carry forward of tax losses upon amalgamation to a strict anti-avoidance tests.

- A proposal for a new framework for the taxation of carried interest arrangements which will provide a tax concession for carry interest arising out of certain transactions. The concession is linked to the Unified Funds Exemption regime and will form part of the Hong Kong government’s efforts towards maintaining Hong Kong’s role as Asia’s leading asset management and private equity hub.

- The Hong Kong 2021/2022 Budget included an announcement to raise the stamp duty rate on stock transfers from 0.2 percent to 0.26 percent.

Asset purchase or share purchase

In Hong Kong, it is more common for an acquisition to take the form of a purchase of shares of a company as opposed to a purchase of its business and assets.

Persons (which include corporations, partnerships, trustees, whether incorporated or unincorporated, or a body of persons) are only subject to profits tax on their profits arising in or derived from Hong Kong from a trade, profession or business carried on in Hong Kong, except for any profits realized from sales of capital assets, which are exempt from profits tax. Sellers frequently are able to dispose of investments in shares free of profits tax.

By contrast, sales of certain assets may trigger a recapture of capital allowances claimed and possibly higher transfer duties (depending on the assets involved). These factors are likely to make asset acquisitions less attractive for the seller. However, the benefits of asset purchases should not be ignored, in particular, the potential to obtain deductions for the financing costs incurred on funds borrowed to finance the acquisition of business assets.

Some of the tax considerations relevant to each type of acquisition structure are discussed later in this report. The advantages and disadvantages are summarized at the end of the report.

Purchase of assets

For tax purposes, it is generally advisable for the purchase agreement to specify a commercially justifiable allocation of the purchase price among the assets, because all or part of the purchase price payable by a buyer may be eligible for tax relief in the form of capital allowances or deductions (either outright or over time), depending on the types of assets involved.

Tax-depreciation allowances arising from capital expenditures incurred in the acquisition of plant and machinery are generally computed with reference to the amount actually paid by the purchaser to the seller. However, the Commissioner of Inland Revenue (CIR) may apply discretion where an asset that qualifies for initial or annual allowances is sold and the buyer is a person over whom the seller has control or vice versa, or both the seller and the buyer are persons over whom some other person has control. In this case, if the CIR considers that the selling price is not representative of the asset’s true market value at the time of sale, the CIR is authorized to determine the true market value of the asset sold. The value determined is used to compute the balancing allowance or balancing charge for the seller and the capital expenditure of the buyer on which initial and annual allowances may be claimed.

For commercial and industrial buildings and structures, the tax allowances are based on the ‘residue of expenditure’ immediately after the sale. The residue of expenditure is the amount of capital expenditure incurred in the construction of the building or structure, reduced by any initial, annual or balancing allowances that have already been granted or any notional amounts written off and increased by any balancing charges made when the building or structure was previously used as an industrial or commercial building or structure.

Goodwill

The portion of the purchase price representing the cost of acquiring goodwill is not deductible for profits tax purposes. Where certain conditions are met, the Inland Revenue Ordinance (IRO) provides for the following specific deductions for payments giving rise to intangible assets:

- Sums expended for registering a trademark, design or patent used in the trade, profession or business that produces chargeable profits payments for and expenditure incurred on R&D. These include in particular: payments to an approved research institute for R&D that may be specific to the requirements of the trade, profession or business or merely within that class of trade, profession or business; and expenditure on R&D, including capital expenditure, other than expenditure on the acquisition of land including capital expenditure, other than expenditure on the acquisition of land or buildings or alterations, additions or extensions to buildings.

- Expenditures incurred on the purchase of patent rights or rights to any knowhow for use in Hong Kong (except where purchased from an associate).

- Write-off of expenditure incurred on the purchase of copyrights, registered designs or registered trademarks over 5 years.

The Hong Kong government introduced a super tax deduction for R&D expenditures that allows a 300 percent tax deduction for the first HKD2 million of qualifying R&D expenditure and a 200 percent tax deduction for remaining expenditure.

Depreciation

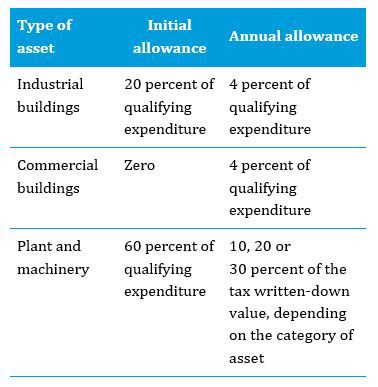

The IRO grants initial and annual depreciation allowances on capital expenditures incurred in acquiring or constructing industrial buildings, commercial buildings, and plant and machinery used in the production of assessable profits. The rates applicable for the 2019/20 year of assessment are as follows:

In addition, the IRO provides the following tax concessions:

- write-off of certain expenditures incurred on the refurbishment or renovation of a building or structure in equal instalments over 5 years,

- write-off of certain expenditures incurred on the construction of an environmental protection installation in equal instalments over 5 years and a 100 percent write-off of environmental protection machinery,

- subject to certain provisions, 100 percent write-off of computer software, computer systems and computer hardware that are not an integral part of any machinery or plant, and certain other qualifying machinery or plant used specifically and directly in the manufacturing process.

Balancing charges or allowances may be triggered on specified occasions related to the cessation of use by the claimant having the relevant interest in a building or structure (e.g. when the building or structure has been demolished, destroyed or ceases to be used by the claimant). For qualifying plant and machinery, the sales proceeds (limited to cost) are deducted from the reducing value of the relevant pool. A balancing charge arises when, at the end of the basis period for a year of assessment, the reducing value of the pool is negative. Any excess of the sales proceeds above the original cost of the plant and machinery is not subject to profits tax. Such excess should be regarded as a profit arising from the sale of a capital asset.

Tax attributes

Tax losses are not transferred on an asset acquisition. The benefit of any tax losses incurred by the seller company remains with the seller (subject to an increase or reduction by the amount of any balancing charges or allowances on the sale of any depreciable assets).

Hong Kong does not have a franking or imputation regime.

Value Added Tax

There is currently no goods and services tax (GST) or value added tax (VAT) in Hong Kong.

Transfer taxes

Stamp duty is imposed on certain instruments dealing with the sale or transfer of immovable property situated in Hong Kong. ‘Immovable property’ is defined as land, any estate, right, interest or easement in or over any land, and things attached to land (e.g. buildings) or permanently fastened to anything attached to land.

As of 5 November 2016, the ad valorem stamp duty rates for the transfer of residential property were increased to a flat rate of 15 percent irrespective of the amount or value of consideration of the residential property concerned, unless specifically exempt or otherwise provided. For the transfer of non-residential property, the ad valorem stamp duty rates range from 1.5 percent on consideration of up to HKD2 million to up to 8.5 percent on consideration of more than HKD21.7 million for instruments of non-residential property executed between 23 February 2013 and 26 November 2020. Transfers of non-residential property after 26 November 2020 are subject to ad valorem stamp duty at Scale 2 rates ranging from HKD100 (for property consideration of up to HKD2 million) to 4.25 percent (for property consideration exceeding HKD20 million).

A lease of immovable property in Hong Kong is chargeable to ad valorem stamp duty on a progressive scale ranging from 0.25 percent of average annual rent, where the term of the lease is uncertain, to 1 percent of average annual rent where the lease term exceeds 3 years.

A special stamp duty (SSD) is effective for residential properties acquired on or after 20 November 2010 and resold within 24 months. SSD applies in addition to the ad valorem rates of stamp duty already imposed. SSD is imposed on the full value of sales proceeds at penal rates of 5, 10 or 15 percent, depending on when the property is bought and sold.

As of 27 October 2012, the rates of SSD were increased for residential properties acquired on or after 27 October 2012 and range from 10 to 20 percent, depending on the holding period, which has been extended to 36 months.

A buyer’s stamp duty (BSD) on residential properties took effect from 27 October 2012. Any residential property acquired by any person (including an incorporated company), except that of a Hong Kong permanent resident, is subject to BSD. BSD is charged at a flat rate of 15 percent on all residential properties, on top of the existing stamp duty and SSD, if applicable.

The Stamp Duty Ordinance (SDO) provides that a sale or transfer of immovable property from one associated corporate body to another is exempt from stamp duty. Two companies are associated where:

- one is the beneficial owner of not less than 90 percent of the issued share capital of the other, or

- a third company owns not less than 90 percent of the issued share capital of each company.

In addition to the 90 percent association test, a number of other conditions need to be satisfied to qualify for stamp duty exemption. There is a clawback rule in cases where the 90 percent association test ceases to be satisfied within 2 years of the date of the transfer.

Purchase of shares

Tax indemnities and warranties

It is not currently possible to obtain a clearance from the Inland Revenue Department (IRD) giving assurance that a potential target company has no arrears of tax or advising whether the company is involved in a tax dispute. As a result, it is common for tax indemnities or warranties to be included in sale and purchase agreements. The extent of the tax indemnities or warranties is subject to negotiation between the seller and the purchaser, and it is customary for prospective purchasers to undertake a tax due diligence review to ascertain the tax position of the target company and to identify potential tax exposures.

Tax losses

Generally, tax losses incurred by a Hong Kong taxpayer may be carried forward indefinitely for set-off against the assessable profits earned in subsequent years of assessment. Losses may not be carried back.

There is no group relief in Hong Kong. Each company is treated as a separate person for tax purposes. Any unused tax losses incurred by the seller company cannot be transferred to the purchasing company on the sale of the business or the assets of the seller company. A sale of shares in the Hong Kong company usually does not affect the availability of the tax losses to be carried forward by that company, unless the change in the company’s shareholders is effected for the sole or dominant purpose of using the Hong Kong company’s tax losses.

In the context of court-free amalgamations, the IRD’s current position is that pre-amalgamation tax losses sustained in an amalgamating company would be available to offset the profits derived from the ‘same trade or business’ that the amalgamating company previously carried on and is continued by the amalgamated (surviving) company after amalgamation. Further, tax losses brought forward in the amalgamated company can be offset against profits derived from the trade or business succeeded from the amalgamating company, provided the amalgamated company has fulfilled certain conditions, including the financial resources test, trade continuation test and post-entry test.

Crystallization of tax charges

Changes in the shareholding of a Hong Kong company do not trigger any tax charges. The impact of changes in shareholding on tax losses is discussed in the preceding section.

Transfer taxes

Hong Kong stamp duty is chargeable on instruments effecting the sale or transfer of Hong Kong stock. Hong Kong stock is defined to include shares in Hong Kong-incorporated companies as well as shares in overseas-incorporated Hong Kong-listed companies whose transfer of shares has to be registered in Hong Kong. No stamp duty is payable on allotments of shares, and capital duty was abolished as of 2013.

The current prevailing stamp duty rate is an aggregate amount equal to 0.2 percent (0.1 percent payable each on the buy note and the sell note) on the higher of the actual consideration stated in the relevant instrument or the value of the stock as at the transfer date, plus a fixed duty of HKD5 for stamping the instrument of transfer. For unlisted Hong Kong stock, the value is generally determined by reference to the latest accounts of the company whose shares are being transferred. The net assets and liabilities of the company per the latest accounts are used as the starting point, with possible adjustments to reflect the assets’ market value as at the date of transfer.

A specific stamp duty anti-avoidance provision may apply where shares in a target company change hands and an arrangement is made between the parties so that the purchaser is required to refinance, guarantee or otherwise assume liability for the target company’s debt. For example, where A sells shares in the target company to B and, as an integral part of the transaction, A assigns to B the shareholder’s loan due by the target, the money paid by B as consideration for the assignment of the loan is deemed to be part of the consideration for the sale and purchase of the shares.

As with immovable property, the SDO provides that a transfer of shares from one associated corporate body to another is exempt from stamp duty. As noted earlier in the report, two companies are associated where one is the beneficial owner of not less than 90 percent of the issued share capital of the other, or a third company owns not less than 90 percent of the issued share capital of each company. In addition to the 90 percent association test, a number of other conditions need to be satisfied to qualify for this exemption. A clawback rule applies where the 90 percent association test ceases to be satisfied within 2 years from the date of the transfer.

Hong Kong’s 2021/2022 Budget included an increase in the Stamp Duty rate on stock transfers from an aggregate of 0.2 percent to 0.26 percent.

Pre-sale dividend

In certain circumstances, a pre-sale dividend may be considered to reduce the value of the company for Hong Kong stamp duty purposes.

Tax clearances

A person may apply to the CIR for an advance ruling on how any provision of the IRO applies to them or the arrangement specified in the application. An application fee is payable, and limitations apply.

It is not currently possible to obtain a clearance from the IRD giving assurance that a potential target company has no arrears of tax or advising as to whether the company is involved in a tax dispute.

Choice of acquisition vehicle

As Hong Kong operates a territorial system of taxation, the profits tax rules apply equally to Hong Kong incorporated companies carrying on a trade or business in Hong Kong and overseas incorporated companies carrying on a trade or business in Hong Kong through a branch. The main types of investment vehicles used to carry on business in Hong Kong are a Hong Kong incorporated company, a branch of a foreign company, a partnership and an unincorporated joint venture. The local registration and administration requirements vary, depending on the form of legal presence used.

The tax rates that apply to a person’s assessable profits to determine their profits tax liability for the 2019/20 year of assessment are as follows:

- for corporations: 16.5 percent,

- for unincorporated businesses: 15 percent.

The Hong Kong government introduced a two‑tiered profits tax regime, which applies to both corporations and unincorporated businesses. Under this regime, the tax rate for the first HKD2 million of profits is reduced to half of the standard profits tax rate (i.e. 8.25 percent for corporations and 7.5 percent for unincorporated businesses). The remaining profits will be taxed at the standard tax rates.

Under an anti-avoidance measure, a ‘group of connected entities’ can only nominate one entity within the group to enjoy the reduced tax rate for a given year of assessment. The two-tier system had effect from the year of assessment 2018/19 (i.e. periods starting on or after 1 April 2018).

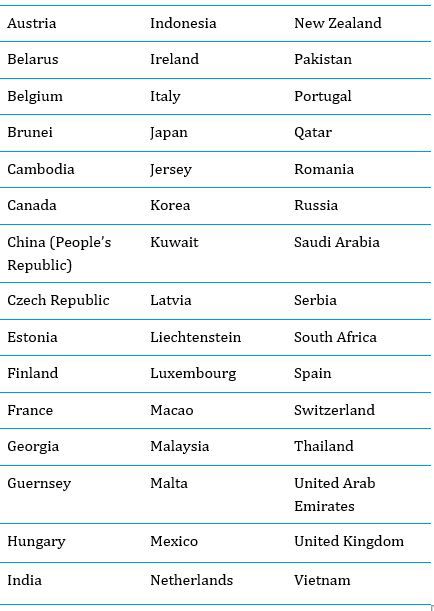

Hong Kong has concluded comprehensive tax treaties with the following countries/jurisdictions:

Negotiations to conclude tax treaties with a number of Hong Kong’s trading and investment partners are underway. Hong Kong also has non-comprehensive treaties with various countries relating to income derived from the international operation of ships and/or aircraft. Details and dates of tax treaty negotiations are published on the IRD’s website.

Foreign parent company

From a Hong Kong tax perspective, a foreign parent company may choose to make direct inbound investments into Hong Kong since dividends paid by a Hong Kong company to a non‑resident shareholder are not subject to withholding tax (WHT) in Hong Kong.

Non-resident intermediate holding company

From a Hong Kong tax perspective, it may not be necessary to set up a foreign intermediate holding company for inbound investments into Hong Kong since dividends paid by a Hong Kong company to a non-resident shareholder are not subject to WHT in Hong Kong.

Local branch

A foreign purchaser may decide to acquire business assets through a Hong Kong branch. For example, it is common for companies incorporated in the British Virgin Islands to be used to carry on business in Hong Kong. Alternatively, it may be possible for non-Hong Kong-sourced income earned through the Hong Kong branch to benefit from protection under a tax treaty concluded between the jurisdiction in which the head office is located and the jurisdiction where the relevant income is sourced.

Hong Kong does not impose additional taxes on branch profits remitted to an overseas head office. Generally, Hong Kong’s profits tax rules apply to foreign persons carrying on business in Hong Kong through a branch in the same way that they apply to Hong Kong-incorporated entities. There are special rules for ascertaining the assessable profits of a branch and those of certain types of businesses, including ship owners carrying on business in Hong Kong and non-resident aircraft owners.

Joint venture

Partners in a general partnership are jointly and severally liable for the debts and obligations incurred by them or on their behalf. A partnership is treated as a chargeable person for profits tax and property tax purposes, so tax is chargeable at the partnership level. Although a partnership is assessed as a separate legal entity for profits tax purposes, the amount of its liability to profits tax is determined by aggregating the tax liabilities of each partner with respect to their share of the assessable profits or losses of the partnership. Therefore, the amount of tax payable on the partnership profits is affected by the tax profiles of the individual partners, that is, whether the partners have losses and whether the partners are corporate entities (such that the profits tax rate of 16.5 percent applies for the 2019/20 year of assessment) or individuals (such that the standard salaries tax rate of 15 percent applies for the 2019/20 year of assessment).

By contrast, a joint venturer is not responsible in law for acts of its co-venturers. A joint venture is not a legal person and is not deemed to be a chargeable person for the purposes of the IRO. In practice, a profits tax return is often issued by the IRD under the name of the joint venture.

Provided that the IRD accepts that the joint venture should not be regarded as a partnership, it is usually sufficient for the profits tax return to be completed and filed on a nil basis. The relevant income and expenses of the joint venture is reported in the joint venturers’ own profits tax returns.

Choice of acquisition funding

Debt

Hong Kong does not impose capital taxes on the issue of debt. There are no transaction taxes or other similar charges on the payment or receipt of interest. Some forms of debt may fall within the definition of Hong Kong stock for stamp duty purposes.

Deductibility of interest

Generally, for borrowers other than financial institutions, loan interest and related expenditures (e.g. legal fees, procurement fees, stamp duties) are deductible only to the extent that the money is borrowed for the purpose of producing assessable profits of the borrower and one of the following tests is satisfied:

- The money is borrowed from a person other than a financial institution or an overseas financial institution, and the interest payable is chargeable to profits tax for the recipient.

- The money is borrowed from a financial institution or an overseas financial institution, and the repayment of principal or interest is not secured or guaranteed in whole or in part, and, whether directly or indirectly, by any instrument executed against a deposit made by any person where interest on that deposit or loan is not chargeable to profits tax.

The money is borrowed to finance: capital expenditures incurred in the provision of machinery or plant that qualifies for depreciation allowances for profits tax purposes. - The purchase of trading stock used by the borrower in the production of profits chargeable to profits tax, provided the lender is not an associate of the borrower.

The funds are raised by way of listed debentures or certain other marketable instruments.

For the first and third tests, the IRO contains provisions to counter sub-participation and back‑to-back loan arrangements by which, the IRD asserts, Hong Kong taxpayers were previously able to circumvent the conditions in and thwart the legislative intent of these provisions:

- Tax symmetry test: This test precludes a borrower from deducting interest on a loan secured by either a deposit or a loan made by the Hong Kong borrower (or an associate) where the interest on the loan or deposit is not subject to profits tax. Where the loan is partly secured by tax-free deposits or loans, the interest deduction is apportioned on the most reasonable and appropriate basis, given the circumstances of the case.

- Interest flow-back test: Under this test, interest is not deductible where an arrangement between the borrower and the lender stipulates that the interest is ultimately paid back to the borrower or a person connected with the borrower. A ‘connected person’ is defined as an associated corporation or a person who controls the borrower, is controlled by the borrower, or is under the same control as the borrower. However, a partial deduction for the interest is permitted when the interest only partially flows back to the borrower and only in proportion to the number of days during the year in which the flow-back arrangement is effective. The test does not apply where the interest is payable to an ‘excepted person’, which is defined to include a person who is subject to profits tax in Hong Kong on the interest, a financial institution (domestic or overseas), a retirement fund or collective investment fund in which the borrower or an associate has an interest, and a government-owned corporation.

In addition to these specific conditions for interest and related borrowing costs, funding costs and related expenses must be properly charged to the profit and loss account in the basis period for the year of assessment and not otherwise be of a capital nature in order to qualify for deduction.

Following the Court of Final Appeal’s decision in Zeta Estates Ltd v Commissioner of Inland Revenue (2007) 2 HKlRD 102, it is now possible for acquirers to achieve debt pushdown by borrowing to replace equity funding with debt funding (e.g. by paying a dividend), where the equity is employed as capital or working capital in a business carried on for the purpose of earning assessable profits.

Withholding tax on debt and methods to reduce or eliminate it

Hong Kong does not currently impose WHT on interest paid by persons carrying on a trade, profession or business in Hong Kong.

Checklist for debt funding

- There are no limits on the level of debt funding because Hong Kong has no thin capitalization rules. However, the restrictive circumstances in which tax relief is granted for interest and related financing costs may influence the amount and source of any debt funding introduced to make an acquisition.

- Interest and financing costs incurred on money borrowed to finance the acquisition of shares are not deductible for profits tax purposes.

- Hong Kong has a relatively low profits tax rate, so it is possible that a tax deduction may be available at higher rates in other jurisdictions.

- Hong Kong does not currently impose WHT on interest paid by persons carrying on a trade, profession or business in Hong Kong.

Equity

Capital duty on the increase in the authorized share capital of a company formed and registered under the Hong Kong Companies Ordinance was abolished as of 1 June 2012.

Hybrids

Hong Kong outbound investors generally do not use hybrid financing because it is relatively easy for non-financial lenders to ensure that any interest income is offshore-sourced.

Hong Kong companies need to satisfy the conditions explained in this report’s earlier section on deductibility of interest to be eligible to claim a deduction for amounts payable on hybrid instruments.

There are currently no specific provisions under the IRO that distinguish between equity and debt interests for profits tax purposes. However, the IRD has issued a practice note to address the changes in the accounting presentation of debt and equity instruments as required under Hong Kong Accounting Standards (HKAS) 32 and 39. These accounting standards, issued by the Hong Kong Institute of Certified Public Accountants in May 2004, are virtually identical to International Accounting Standards (IAS) 32 and 39, issued by the International Accounting Standards Board. These accounting standards deal with the presentation, recognition and measurement of financial instruments.

The IRD takes the view that the legal form, rather than the accounting treatment, should determine the nature of the financial instrument for profits tax purposes. Therefore, if the characterization of the financial instrument as liability or equity for accounting purposes is not consistent with the legal nature of the instrument, it is necessary to take into account other factors, such as:

- the character of the return (e.g., whether fixed rate or profit participation),

- the nature of the holder’s interest in the issuer company (e.g., voting rights and rights on winding up),

- the existence of a debtor and creditor relationship,

- the characterization of the instrument by general law.

For example, coupons on mandatory redeemable preference shares are treated as dividends for profits tax purposes and not as deemed interest, even where the coupons are re-characterized as interest in the profit and loss account for accounting purposes.

Compound financial instruments must be split into their liability and equity components for purposes of HKAS 32. The IRD adheres to the legal form of the compound instrument and treats it for profits tax purposes as a whole. For example, a convertible bond that is required to be split into its equity and debt components in accordance with HKAS 32 is treated as debt for profits tax purposes. The corresponding interest payments are allowed as deductions provided the general and specific conditions for interest deductibility set out in the IRO are met — see ‘Debt’ section.

HKAS 39 was replaced by the new accounting standard HKFRS 9 as of 1 January 2018. The IRD has not yet commented on the tax treatment of financial instruments following the implementation of HKFRS 9.

To provide greater certainty, it is possible to obtain an advance ruling from the IRD on the interpretation of statutory provisions in certain circumstances. A ruling may be granted on how any provision of the IRO applies to the applicant or to the arrangement described in the application. A ruling is given only for a seriously contemplated transaction and not for hypothetical transactions or those where the profits tax is due and payable. An advance ruling is not granted once the due date for filing of the relevant year’s profits tax return has passed.

Discounted securities

There are currently no specific provisions under the IRO that deal with the tax treatment of discounted securities for profits tax purposes. The IRD takes the view that the legal form, rather than the accounting treatment, should determine the nature of the financial instrument for profits tax purposes — see ‘Hybrids’ section. Where the characterization of the discount security for accounting purposes is not consistent with the legal nature of the instrument, it is necessary to take into account other factors, such as the factors noted in the preceding section for characterizing hybrid financial instruments.

Where the legal characterization of the discount on the security is interest, then such amount is deductible, provided the IRO’s general and specific conditions for interest deductibility are met — see ‘Deductibility of interest’ section. Where the legal characterization of the discount is not interest, then its deductibility is determined in accordance with Hong Kong’s general deductibility rules.

Deferred settlement

Payments made pursuant to earn-out clauses that result in additional payments or refunds of the purchase price have the same character for tax purposes for the vendor as the initial purchase price. Likewise, payments related to indemnities or warranties that result in an adjustment to the purchase price should have the same character for tax purposes for the vendor as the initial purchase price.

Where interest is payable under the settlement arrangement, such interest is taxable where the recipient carries on business in Hong Kong and where such interest has a source in Hong Kong. The deductibility of the interest to the payer is governed by the principles discussed earlier — see ‘Deductibility of interest’ section.

Other considerations

Concerns of the seller

Considerations of the seller can include:

- possible recapture of capital allowances,

- stamp duty implications of a transaction,

- scope of tax warranties and indemnities in the sale and purchase agreement.

Company law

The Hong Kong Companies Ordinance prescribes how Hong Kong companies may be formed, operated and terminated.

The Companies Ordinance, which was passed by the Hong Kong Legislative Council in July 2012 and took effect on 3 March 2014, aims to modernize the law, ensure better regulation, enhance corporate governance and facilitate business.

Under the Companies Ordinance, five types of companies can be formed (compared with eight under the previous ordinance). Unlimited companies without share capital are abolished, companies limited by guarantee, whether private or non-private, are amalgamated and become companies by guarantee, and non-private companies become ‘public companies.’ The concept of par value of shares is abolished, and a general court-free procedure based on a solvency test is introduced as an alternative to reduction of capital.

Further, the Companies Ordinance makes available a court‑free regime for two types of amalgamations of wholly owned companies within the same group:

- vertical amalgamation of a holding company and its wholly owned subsidiaries

- horizontal amalgamation of wholly owned subsidiaries of a company.

The Companies Ordinance makes no mention of the tax implications of a court-free amalgamation. Pending the decision to amend provisions in the IRO to specifically address the tax treatment of court-free amalgamations, on 16 December 2016, the IRD published guidance on its website clarifying its approach when making assessments on the profits tax consequences of a court-free amalgamation, for example, in relation to the availability of unutilized tax losses of the amalgamating companies — see ‘Tax losses’ section.

All Hong Kong companies, other than certain dormant companies, must compile accounts annually and have them audited by a registered Hong Kong auditor. However, Hong Kong private companies do not have an obligation to file financial statements with the Hong Kong Companies registry or otherwise make them publicly available.

The Companies Ordinance only permits the payment of dividends from distributable profits. A company’s profits available for distribution are its accumulated realized profits (not previously used by distribution or capitalization), less its accumulated realized losses (not previously written off in a reduction or reorganization of capital). The assessment of available profit and declaration of dividends is determined separately for each legal entity, not on the consolidated position. This entity-by-entity assessment requires planning to avoid dividend traps — the inability to stream profits to the ultimate shareholder — because of insufficient profits within a chain of companies. Appropriate pre-acquisition structuring should help to minimize this risk.

A Hong Kong company may undergo a court-free share capital reduction if approved by a special resolution supported by a solvency statement based on a uniform solvency test.

Group relief/consolidation

There is no concept of grouping for tax purposes in Hong Kong. All companies are assessed separately, irrespective of whether they are group, associated or related companies.

Transfer pricing

Hong Kong enacted transfer pricing legislation in July 2018. The legislation implements the arm’s length principle as the fundamental transfer pricing rule in Hong Kong. This empowers the IRD to adjust profits or losses where a transaction between two related parties departs from the transaction that would have been entered into between independent persons, in cases in which this has created a tax advantage.

Domestic related-party transactions are exempted from the new rules if the transaction is domestic in nature, does not give rise to an actual tax difference, and is not utilized for tax avoidance purposes.

The transfer pricing legislation also introduced mandatory transfer pricing reporting and anti Base Erosion and Profits Shifting measures in Hong Kong. In line with many OECD jurisdictions, the transfer pricing legislation broadly:

- codifies transfer pricing principles and required practices, provides a clear legal basis for transfer pricing, and increases clarity and certainty for taxpayers,

- introduces transfer pricing rules that align the taxation of profits with economic activities and value creation,

- introduces requirements to prepare and maintain contemporaneous transfer pricing documentation along with reporting requirements including three-tier transfer pricing documentation (i.e. master file, local file and, where relevant, country-by-country reporting),

- introduces specific penalties for non-compliance.

Hong Kong constituent entities of a group would be required to prepare master and local files for accounting periods beginning on or after 1 April 2018. Reportable groups are required to file country-by-country reports for accounting periods beginning on or after 1 January 2018.

Dual residency

Based on the tax treaties that Hong Kong has concluded to date, a company is generally a resident of Hong Kong if it is incorporated in Hong Kong or normally managed or controlled in Hong Kong. Cases of dual residency are resolved either by reference to the company’s place of effective management or by mutual agreement.

Foreign investments of a local target company

As explained in this report’s section on local holding companies, Hong Kong companies are not subject to profits tax on dividends received from overseas companies. Similarly, any profit derived from selling shares in the overseas company is not subject to profits tax where the shares in the overseas company are capital assets of the Hong Kong seller, or where the profit is derived from outside Hong Kong. It is relatively easy for non-financial institutions to make loans of money in a way that ensures any interest income is offshore-sourced.

Hong Kong has no controlled foreign company rules.

Comparison of asset and share purchases

Advantages of asset purchases

- Purchase price (or a part of it) may be eligible for outright deduction or capital allowances, depending on the type of asset involved.

- May be possible to step-up the tax basis on depreciable assets.

- Provided certain formalities are complied with, no previous liabilities of the company are inherited.

- No acquisition of a tax liability on retained earnings.

- Possible to acquire only part of a business.

- Greater flexibility in funding options, which can be important because interest incurred to fund the acquisition of shares (which may generate tax-exempt dividends and/or capital gains/losses) is non-deductible, whereas interest incurred to fund the acquisition of business assets is generally deductible (subject to conditions).

- Profitable operations might be acquired by loss companies in the acquirer’s group, thereby effectively gaining the ability to accelerate the use of the losses.

Disadvantages of asset purchases

- Possible recapture of capital allowances claimed.

- Possible need to renegotiate supply, employment and technology agreements.

- Higher capital outlay is usually involved (unless debts of the business are also assumed).

- May be unattractive to the seller, thereby increasing the price.

- Possibly higher transfer duties (depending on the nature of the assets involved).

- Accounting profits may be affected by the creation of purchased goodwill.

- Benefit of any tax losses incurred by the target company remains with the seller (subject to increase or reduction by the amount of any balancing allowances or charges on the sale of any depreciable assets).

Advantages of share purchases

- Lower capital outlay (purchase net assets only).

- Likely to be more attractive to the seller, thus reducing the price.

- May benefit from tax losses of the target company (indirectly).

- May gain the benefit of existing supply or technology contracts.

- Lower transfer duties payable on net assets acquired.

- Preserves historical tax attributes, such as tax basis and losses.

Disadvantages of share purchases

- May acquire unrealized tax liability for depreciation recapture on difference between market and tax book value of assets.

- Liable for any claims or previous liabilities of the entity.

- No depreciation allowances for the purchase price.

- Less flexibility in funding options (i.e. harder to push down acquisition debt to obtain interest deduction without refinancing qualifying, pre-existing intercompany loans).

KPMG Hong Kong

Darren Bowdern

KPMG

8th Floor, Prince’s Building 10

Chater Road Central

Hong Kong

T: +852 2826 7166

E: darren.bowdern@kpmg.com

John Timpany

KPMG

8th Floor, Prince’s Building 10

Chater Road Central

Hong Kong

T: +852 2143 8790

E: john.timpany@kpmg.com

This country document does not include COVID-19 tax developments. To stay up-to-date on COVID-19-related tax legislation, refer to the below KPMG link:

Click here — COVID-19 tax measures and government reliefs

This country document is updated as on

1 January 2021.