Colombia - Taxation of cross-border mergers and acquisitions

Taxation of cross-border mergers and acquisitions for Colombia.

Taxation of cross-border mergers and acquisitions for Colombia.

Introduction

Cross-border merger and acquisition (M&A) activity in Colombia has been increasing in recent years, as the government has been reforming the tax system to enhance tax benefits for foreign investors.

This report analyzes the main tax issues that potential foreign investors should consider when deciding to invest in Colombia.

Recent developments

As of January 2013 (by virtue of the tax reform enacted in December 2012), the national government implemented a tax reform that brought important structural changes to the tax system and regulating cross-border transactions.

The tax reform incorporated anti-abuse, thin capitalization, permanent establishment (PE) and place of effective management rules, some of which have been developed in the more recent tax reforms (enacted in 2016, 2018 and 2019). Comparability criteria for transfer pricing regulations were established, a list of tax havens was issued and refined, the tax effects of M&As were specifically regulated, and control mechanisms for international transactions were enacted.

On April 2020, Colombia completed its domestic procedures for ratification of the Organisation for Economic Co-operation and Development (OECD) Convention and deposited its instrument of accession to it.

As mentioned, in December 2016, 2018 and 2019 the national government enacted other tax reform bills. Changes include:

- modifying the rates of income tax and withholding tax (WHT) and establishing and eliminating a surcharge

- modifying the regulation on income tax and WHT on dividends abroad

- repealing the income tax for fairness (CREE by its Spanish acronym)

- establishing new transfer pricing reports (i.e. local file, master file and country-by-country (CbyC) reports)

- regulating controlled foreign corporations (CFC)

- regulating Colombian Holding Companies (CHC)

- establishing new rules for non-cooperative jurisdictions, low or zero-tax jurisdictions and preferential tax regimes, and modifying the applicable income tax and exemptions

- incorporating a definition of the ‘beneficial owner’ in the tax law

- establishing new regulation on indirect transfers.

The corporate income tax rate was lowered to 31 percent for fiscal year (FY) 2021 (30 percent for FY 2022 onwards). The income tax rate for non-resident individuals is 35 percent.

Colombia also implemented International Financial Reporting Standards (IFRS). Income tax is generally determined based on IFRS, with some exemptions.

Colombia has, and continues developing, a network of tax treaties that generally follow the principles of the OECD. Treaties with Chile, Mexico, Canada, Spain, Switzerland, Portugal, The Czech Republic, Korea, the UK and India have been signed and are currently in effect. Treaties with France, Japan, Italy and the UAE have been signed and are in the internal approval process. Colombia has also signed, but not yet deposited, the ratification document to conclude the multilateral instrument (MLI). However, Colombia has notified its positions about the MLI and made reservations on a provisional basis. The MLI will align Colombia’s current treaty network with the OECD’s standards for addressing base erosion and profit shifting (BEPS) once the MLI is brought into effect and the Colombian legislative and constitutional approval procedures are complete.

The special free trade zone regime continues, granting users classified as ‘industrial users of goods and services’ a reduced income tax rate of 20 percent.

A deduction is available for investments in science and technology of 100 percent of the invested value as well as a discount of 25 percent of the same value, subject to pre-qualification by the national government.

Asset purchase or share purchase

A foreign investor may acquire a Colombian company by purchasing either its shares or its business assets. Generally, acquisitions are carried out by purchasing shares in a Colombian entity because this creates no direct tax liability for the foreign investor. Dividends to foreign entities from profits taxed at the level of the distributing entity (PTI dividends) are subject to a 10 percent withholding tax on the gross payment or accrual of the dividend, which differs from the 37.9 percent income tax withholding on dividends from profits not taxed at the level of the distributing entity (non-PTI dividends).

Whether shares or business assets are sold, their subsequent sale produces a taxable capital gain taxed at a rate of 31 percent for 2021 and 30 percent for 2022 onwards, or at 10 percent, depending on their holding period.

Purchase of assets

In a purchase of business assets, real estate tax (land/property tax) liabilities remain attached to the acquired assets, so the purchaser could be liable for such tax.

Profits from the use of the acquired assets are subject to income tax. Since PE rules apply, owning assets in Colombia under certain circumstances could come with an obligation to register with the tax authorities and keep tax accounts.

Profits derived from the sale of assets could produce a taxable capital gain. The sale of inventories could be subject to value-added tax (VAT) and other taxes.

Purchase price on assets

The purchase price is the price agreed to by the parties, provided it does not diverge by more than 15 percent from the fair market price of goods of the same kind at the date of the sale. The sale price of real estate cannot be lower than its fiscal cost, the valuation recorded in the land registry office, or the price recorded in the previous year’s real estate tax return.

Transactions carried out between Colombian taxpayers and foreign-related parties are subject to transfer pricing rules.

Purchase price of shares

For shares of entities that are not listed on a stock exchange, unless there is evidence justifying a different value, the selling price of the shares cannot be lower than their intrinsic value (entity’s accounting net equity/outstanding shares) plus 30 percent.

In addition to transfer pricing liabilities, if the buyer is an affiliate, the sale price is determined using commonly accepted financial valuation methods, particularly those that allow identifying fair market value (FMV) through the present value of future income. In no case would the book value (known as ‘intrinsic value’ in Colombia) of the shares be considered as a valid valuation method.

Goodwill

With the tax reform of 2016, goodwill paid on the acquisition of assets or commercial establishments is generally not amortizable. Some exceptions may apply.

On share acquisitions, no intangible assets are created. Goodwill is understood to be the difference between the acquisition price and the book value of the shares. Valuations of the business and the intangible assets may be required.

Depreciation

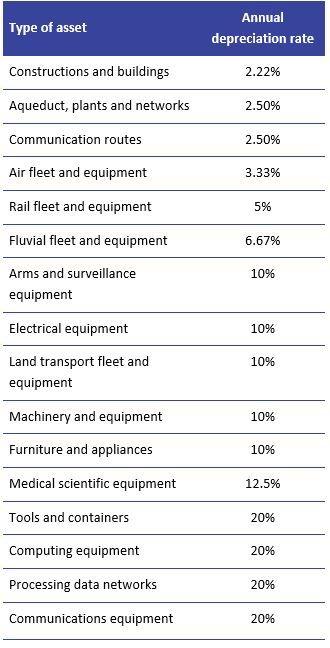

The tax authorities recognize and accept depreciation of a company’s fixed assets used during the tax year. Useful life terms are established by law and are mandatory; however, it is necessary to review the expense depreciation in the accounting and tax for fiscal purposes. The national government should issue a regulatory decree with rates of depreciation but given that it has not done so, the indicative rates of depreciation are as follows.

Taxpayers can use the depreciation methods established in the accounting rules with some limitations.

Value-added tax

VAT is levied at the rate of 19 percent on the sale of tangible movable goods located in Colombia at the time of the sale, services rendered within the Colombian territory and from abroad, and importations of tangible movable goods. Sales of fixed assets and/or shares are excluded from VAT.

Real estate tax

Real estate tax (land tax) is a municipal (local) tax levied on real estate in the municipality at rates ranging from 0.10 to 0.33 percent of the real estate’s value.

A registry tax is levied on the registration of the documents transferring the ownership of real estate with the property registration office. In this case, the tax is 1 percent of the price of the real estate included in the registered public deed.

Purchase of shares

Investing in a Colombian company by purchasing its shares does not lead to a direct tax liability for the investor. Dividends from profits taxed at the level of the distributing entity (PTI dividends) are subject to a 10 percent income tax withholding on the gross payment or accrual of the dividend, which differs from the 37.9 percent income tax withholding on dividends from profits not taxed at the level of the distributing entity (non-PTI dividends).

These rules apply unless the dividends are paid to a resident of a country that has an enforceable tax treaty with Colombia. In such cases, the tax rates are as stipulated in the treaty.

Where the tax profit available to be distributed without WHT (i.e. profits that have been taxed at the distributing company’s level) exceeds the amount of accounting profits for the year, the excess can be carried back for 2 years and carried forward for 5 years.

By contrast, the sale of a Colombian company’s shares to residents or non-residents generates a tax liability in Colombia for the seller. The taxable income is the positive difference between the sale price and the tax cost of the shares. The sale price must be determined and the tax cost corresponds to the acquisition cost, plus tax adjustments.

Tax indemnities and warranties

In a share acquisition, the purchaser takes over the target company, including all related liabilities, so the purchaser usually requires more warranties and indemnities than in the case of a business assets acquisition. Where significant sums are at stake, it is common for the purchaser to carry out a due diligence exercise, including a review of the target’s tax issues.

Tax losses

General tax losses are treated as follows.

- For mergers, losses can be used where the merging companies share the same economic activity before the merger.

- For mergers, losses originating in each merging company can be used only to offset the taxable income of the merged company at the same percentage as the absorbed company’s net equity represents to the absorbing company’s equity.

- Losses accrued as of FY2017 can be offset against the net income in the 12 FYs following the taxable year in which loss arose.

Transfer taxes

The national stamp tax rate is 0 percent. Local jurisdictions (municipalities) are entitled to levy their own stamp duties.

Choice of acquisition vehicle

Several acquisition vehicles are available to a foreign investor purchasing a Colombian company, and the tax effects for each vehicle differ.

Local holding company

Acquisitions can be structured through Colombian holding companies.

Foreign parent company

The possibility of a foreign parent company being used as an acquisition vehicle to push debt down to the Colombian target should be subject to a viability analysis under the new anti-abuse rules. In any case, Colombia’s thin capitalization rules require a 2:1 debt-to-equity ratio with regard to debt with associated parties. Interest paid in excess of the ratio is not tax-deductible.

The transactions also must comply with transfer pricing regulations. Where the transaction is not within the applicable ranges, the interest is recategorized as dividends.

Non-resident intermediate holding company

Where the foreign country taxes capital gains and dividends received overseas, an intermediate holding company resident in another country could be used to defer such taxes. The intermediate holding company can be incorporated in a country with an enforceable tax treaty with Colombia, although the treaty’s limitation on benefits (LOB) and/or anti-abuse clauses of the relevant treaty would have to be analyzed. Also, the impact of the MLI should be analyzed once it is in effect.

Local branch

The foreign investor could purchase the business assets of a Colombian company through a branch incorporated in Colombia. However, branches are Colombian taxpayers and subject to income tax, VAT, financial transactions tax, customs duties and all local (municipal) taxes, such as industry and commerce tax and municipal stamp duties. Branches are liable for all formal obligations related to these taxes and required to file periodic tax returns.

Where branches or PEs transfer their profits abroad, the transfer is considered to be a dividend that could be subject to WHT, as discussed earlier. However, the recent position of the taxing authority on this matter should be analyzed in the case of countries with tax treaties.

Branches are subject to income tax at rates of 31 percent for 2021, and 30 percent for 2022 onwards, on their national (Colombian) income and their national net worth. Colombian regulations do not allow branches to acquire shares of Colombian companies.

Joint venture

Certain activities can be carried out through joint ventures. However, since joint ventures are not considered legal entities separate from their members, each member is liable for tax on profits earned from the activities performed directly by the joint venture. Special tax regulations applies to joint ventures.

Colombian Holding Companies (CHC) regime

The CHC regime applies for Colombian companies that meet the following set of standards.

- National companies are eligible for the CHC regime if they have as one of their main activities the holding of securities, investment or shares or participations in Colombian or foreign companies, or the administration of said investments.

- Having a direct or indirect participation in at least 10 percent of the capital of one or more national or foreign entities for a minimum period of 12 months.

- Having the human and material resources for the full realization of the business purpose. It is considered the aforementioned is fulfilled when the company has at least three employees, its address in Colombia, and can demonstrate that the strategic decision-making with respect to investments and assets of the CHC is carried out in Colombia, for which the simple formality of the annual shareholders’ meeting will not be sufficient.

- Informing the Tax Authority about the choice to be subject to this regime.

According to the regime, in general:

- Dividends or participations distributed by non-resident entities in Colombia to a CHC will be exempt from income tax and declared as income exempt from capital regime.

- Dividends distributed in turn by CHC to Colombian tax residents would be taxable. However, the distribution of dividends coming from foreign investments by CHC to non-tax residents would be considered as foreign source income (i.e. non-taxable income). The regime does not apply if the shareholder of the CHC is located in a tax haven.

- Special treatment on dividends distributed by resident entities in Colombia to a CHC applies.

- Income from the sale of the participation in the CHC is exempted from the income tax on the portion that corresponds to profits from activities that are not carried out in Colombia. For foreign shareholders of the CHC, income from the sale of the participation in the CHC is not taxed in Colombia as it is deemed to be foreign-sourced income on the portion that corresponds to profits from activities that are not carried out in Colombia.

Choice of acquisition funding

A foreign investor can use a Colombian acquisition vehicle and finance it with capital contributions, debt or a combination of both.

Debt

The main advantage of debt is the potential tax deduction of instalments, interest and related expenses, such as guarantee fees, bank fees, financial costs and exchange rate differences. Colombia’s thin capitalization rules could limit the deductibility of interest.

Foreign loans to Colombian companies are subject to income tax withholdings. Interest from loans granted for 1 year or more are subject to a 15 percent withholding; otherwise, they are subject to a 20 percent withholding. Where the lender is a related party, the transaction is subject to several transfer pricing rules.

Deductibility of interest

Interest payments are deductible, provided the loan was used in income-producing activities and WHT was applied to the payments. Interest payments should be deducted in the same fiscal year in which they are accrued. Financial costs and expenses related to the debt are also deductible, provided they are related to the income-producing activity.

Under the thin capitalization rules, interest paid on debts with foreign and Colombian-associated parties is only deductible where the debt average total amount does not exceed two times the taxpayer’s previous year’s net equity (i.e. 2:1 ratio).

The thin capitalization rules apply to debts with local or foreign-associated entities. Transactions with foreign-related parties should be reviewed to determine the impact of the transfer pricing rules. Thin capitalization rules do not apply to certain infrastructure projects.

Loans between affiliates must meet several comparability conditions.

Withholding tax on debt and methods to reduce or eliminate it

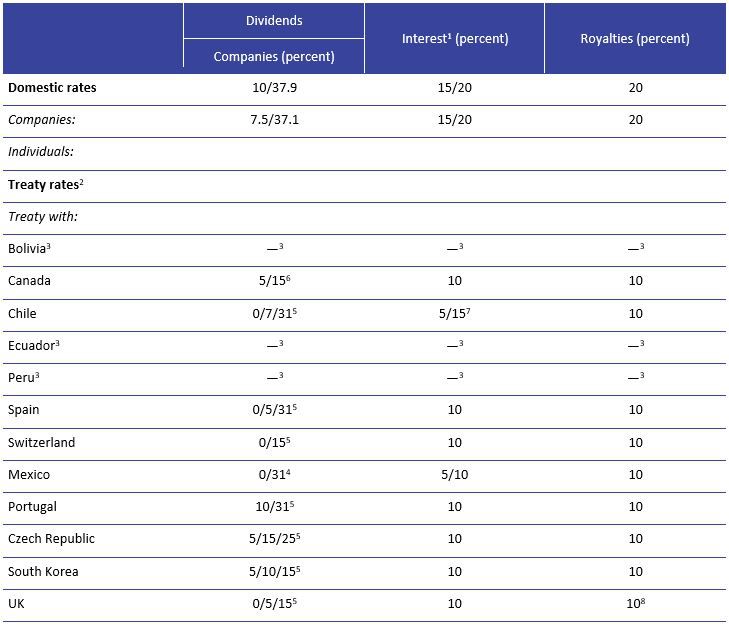

Interest from loans granted for 1 year or more is subject to a 15 percent withholding; otherwise, it is subject to a 20 percent withholding. Reduced rates apply to interest on foreign loans with entities located in countries with enforceable tax treaties (0, 5, 10 and 15 percent). See the table of WHT rates under Colombia’s tax treaties at the end of this report.

Checklist for debt funding

- The thin capitalization rules.

- For indebtedness with a foreign lender, inform the Colombian Central Bank before disbursement of the loan.

- Where the lender is a related party, transfer pricing rules apply.

- Interest payments, financial costs and expenses are deductible, subject to certain requirements.

Equity

Foreign investors can fund the Colombian vehicle through direct contributions to the capital of the vehicle. Profits transferred from the vehicle to the investor are subject to WHT at the same rates applicable to dividends. Where such profits are paid to a resident of a country with an enforceable tax treaty, the WHT rate may be reduced or eliminated.

Discounted securities

The investment could be channeled through the acquisition of certain discounted securities, such as the ‘BOCEAS’, the Spanish acronym for bonds that convert into shares at a certain price or at a discount once the bonds reach maturity or a pre-determined time has elapsed.

Other considerations

Concerns of the seller

A sale of shares or business assets to residents or non-residents generates a tax liability in Colombia for the seller. The taxable income is the excess of sale price over the tax cost of the shares or business assets.

For non-listed shares in a sale between associated parties, the sales price agreed upon is determined based on acceptable technical studies. For non-listed shares, in a sale between non-associated parties, unless the contrary is proven, the sales price is the intrinsic value increased by 30 percent, without prejudice that the Tax Authority established a different price by applying a commonly accepted financial valuation method.

The tax cost of shares is the acquisition cost plus tax adjustments. The tax cost of business assets is the historical cost less the relevant depreciation.

A Colombian taxpayer should include in the income tax return as a capital gain the profits derived from the sale of shares or business assets owned for 2 years or more, and the sale is not made within the business activity of the seller, which is taxed at 10 percent.

Where the shares are owned for less than 2 years, capital gains should be included in the return as ordinary income, which is taxed at a rate of 31 percent for 2021, and 30 percent for 2022 onwards.

Foreign investors must file an income tax return within the following month next to the sale of the shares. Transfer pricing requirements may apply.

A transfer of shares that results from a merger or a spin-off transaction between foreign companies could trigger a taxable event where the value of the assets located in Colombia represents more than 20 percent of the total assets owned by the group to which the entities involved in the merger or spin-off belong.

Finally, keep in mind that under domestic anti-abuse rules, and according to the specific facts and circumstances, the taxpayer could be required to prove that the merger or spin-off has a business purpose (rather than only the purpose of obtaining any tax benefits).

Indirect transfers

For 2019 (Act 1943 of 2018 applicable to 2019) and for 2020 and onwards (Act 2010 of 2019), ruled by Decree 1103 of 2020 (special for indirect sales), provide that the indirect sale or exchange of shares or rights in companies or assets located in Colombia, through the transfer, under any title, of shares, interests or rights of foreign entities, should be subject to corporate income tax in Colombia, as if the underlying Colombian asset had been sold directly (subject to the exceptions outlined below).

For these purposes, the indirect transfer is understood as the total or partial transfer of a right to participate in an asset, whether such transfer is made between associated or non-associated parties.

When the underlying asset of a foreign corporation is a Colombian holding company, it will be understood that the underlying asset being transferred is the stock or the rights associated to such stock.

It would be necessary to analyze if a double taxation agreement (DTA) could cover the indirect transfer of Colombian assets in those cases where either the transferor or the holder of the underlying asset is in a DTA country.

Exceptions

There are two exceptions in relation to the sale of assets and shares based on the value of the Colombian assets in comparison to the assets of the alienated entity and on the listing of the alienated shares in a stock exchange.

Mergers and spin-offs between foreign entities that involve an indirect transfer in Colombia would not be taxed under the new indirect taxation regulation provided the requirements of an international tax-free merger are met.

There are special rules to determine the cost and the price of the underlying asset sold.

The indirect seller is the one that shall fulfil the tax compliance obligations in Colombia; otherwise, the underlying Colombian company will be jointly and severally liable for income taxes, interest for late payment and penalties.

The rate will apply on the positive difference between the sale price and the fiscal cost of the shares at the following rates:

- long-term gain (shares held for 2 years or more and provided the equity is not alienated in the regular course of business of the seller): 10 percent.

- Short-term gain (shares held for less than 2 years): 31 percent for 2021 and 30 percent for 2022 and onwards.

Company law and accounting

Transfer pricing rules apply to transactions with foreign-related parties and with free trade zones.

The commercial code governs how companies may be incorporated, operated, reorganized and dissolved. The principal types of companies are described below.

Corporation (Sociedad Anónima — SA)

A corporation must have a minimum of five shareholders. Each shareholder is liable up to the amount of its capital contribution as represented by negotiable shares. The corporation’s capital is divided into authorized share capital, subscribed share capital and paid-up share capital. At the time of the company’s incorporation, at least 50 percent of its authorized share capital must be subscribed and at least 33 percent of its subscribed share capital must be paid-up. The balance must be paid during the year following the incorporation of the company.

Some characteristics of these corporations are as follows.

- Where a corporation needs to be capitalized, it may issue shares or bonds that are convertible into shares.

- Shares may be sold at any time without restriction, unless the bylaws provide for a special procedure or a preemptive right in favor of existing shareholders or the company. Where a corporation’s shares are registered on the stock market, they may be freely negotiated.

- The shareholders can meet to deliberate and reach decisions in a place other than the corporation’s main offices, and even abroad, if the total of the corporation’s shares is represented at the meeting.

- The corporation is dissolved when 95 percent or more of the contributed shares belong to one shareholder.

Limited liability company (Ltda)

A limited liability company may be organized with a minimum of two partners and a maximum of 25. The partners are liable up to the amount of their capital contributions, except for tax and labor liabilities, in which case partners can be severally and jointly liable along with the company in accordance with particular provisions. The capital of the company must be fully paid at the time of the incorporation and is divided into capital quotas of equal amounts, which may be assigned in accordance with the provisions in the company’s by-laws and Colombian law.

The limited liability company’s highest direction and administration body is the board of partners, in which the partners have as many votes as they own capital quotas in the company.

The capital quotas of limited liability companies may be assigned to other partners or third parties, after approval by the board of partners. Every capital quota assignment implies an amendment of the articles of incorporation that must be legalized by a public deed and registered with the Chamber of Commerce of the company’s registered place of domicile.

A statutory auditor is mandatory if stipulated by the articles of incorporation or when the assets are higher than 5,000 minimum legal wages (1,336,000 US Dollars (US$) approximately) or the revenues are higher than 3,000 minimum legal wages (about US$802,500).

Limited partnership (Sociedad en Comandita Simple y en Comandita por Acciones)

A limited partnership involves one or more managing partners who commit themselves to a joint and unlimited liability for the entity’s transactions (partners with unlimited liability) and one or more non-managing partner(s) whose liabilities are limited to their respective capital contributions (limited liability partners).

The partnership equity consists of the capital partner’s contributions and those of the managing partners or partners with unlimited liability.

Limited partnership entities can be subdivided into simple limited partnerships and shares partnerships. A simple limited partnership’s equity is divided into partnership quotas, while a shares partnership’s equity is divided into shares. Therefore, limited partnerships involve elements of both capital-based entities and person-based entities.

On incorporation and for statutory modifications, limited partnerships follow the general requirements for a public deed and notary expenses.

Partnership (Sociedad Colectiva)

Partnerships are the least commonly used corporate type in Colombia, given their inflexibility regarding incorporation and modifications, and the comprehensive responsibility of its partners for the obligations entered into by the partnership. The equity is divided into ‘parts of interest’ that confer one vote to each partner regardless of the partner’s contributions to the partnership’s capital.

The partnership is fully represented by all its partners, who are also in charge of its management in every way.

Simplified joint-stock corporation (Sociedad por Acciones Simplificada — SAS)

The SAS can be incorporated in Colombia with a single shareholder. In each case, the incorporation of a SAS gives rise to a new legal entity completely independent of its shareholders or shareholder.

The liability of the shareholders of the SAS is limited to the amount of the subscribed capital; the shareholders of an SAS are never jointly and severally liable for tax or labor liabilities.[1] Being the most flexible and ‘customizable’ corporate type in Colombia, it is possible to create different kinds of shares for the SAS, such as shares with fixed dividends that grant the right to receive a fixed dividend, notwithstanding the percentage of participation of the shareholder.

A financial or statutory auditor is mandatory if stipulated by the articles of incorporation or when the assets are higher than 5,000 minimum legal wages (about US$1,336,000) or the revenues are higher than 3,000 minimum legal wages (about US$802,500).

The structure of the SAS is simple for the following reasons.

- It does not need a board of directors, unless otherwise required by its articles of incorporation (bylaws).

- All management and representative activities can be carried out by the legal representative appointed in the shareholders’ meeting (which could be constituted by single or multiple shareholders).

- The shareholders’ meeting can directly result in implementing decisions (e.g. approving financial statements, dividend distributions, corporate accounts). The shareholders assembly may also assign these activities to a board of directors or legal representative.

- The SAS may be incorporated by means of a private document, making it simpler and more cost-efficient to create than entities requiring a public deed and notary expenses.

In addition, the SAS may choose to have as its corporate purpose ‘any lawful activity’[2] and may have an undetermined duration.

At the time of incorporation, the subscribed capital may be of any amount desired by the shareholders and no proportion of other capital is taken into account.[3] The subscribed capital may be paid in proportions and on deadlines agreed to in the articles of incorporation not exceeding 2 years.

Merger

Under Colombian law, a merger of companies is a complex legal transaction in which one or several companies are dissolved but not liquidated and absorbed by another company or combined to create a new company. The merger is achieved by means of an equity transfer representing all the assets and liabilities of the absorbed companies into another absorbing company, which may be newly formed or pre-existing.

In this situation, the absorbing or new company acquires the rights and obligations of the dissolved companies as they were at the time of the execution of the merger agreement.

Tax effect of company merger

The tax reform of 2012 established two kinds of mergers: acquisitive mergers and reorganizational mergers.

Acquisitive mergers take place where the merging entities are not related parties, while reorganizational mergers take place where the merging entities are related. In both cases, the merger is tax-neutral, provided certain requirements are met.

For both types of mergers, the shareholders of the merging entities must meet several requirements related to the percentage of participation. For example, for acquisitive mergers, at least 75 percent of the shareholders of the merging entities must have a participation in the resulting entity equivalent in substance to the participation previously owned in the merging entities (although in proportion to the resulting entity).

Tax regulations stipulate that the absorbing or new company is responsible for paying the taxes, advances, withholdings, penalties, interests and other tax obligations existing in the merged or absorbed companies.

Demerger or spin-off of companies

In accordance with applicable commercial regulations (law 222, dated 20 December 1995), a spin-off can be carried out in two ways:

- A company, without being dissolved, transfers in a block one or several portions of its net worth or patrimony to one or more existing companies or uses such portion(s) to set up one or more new companies.

- A company is dissolved but not liquidated and splits its net worth or patrimony into two or more portions that are either transferred to several existing companies or used to create new companies.

Transfer pricing

Transfer pricing rules apply to taxpayers engaged in transactions with foreign-related parties. All transactions with foreign-related parties must be reported in the relevant return and supporting documentation must be prepared and kept available at any time for the tax authorities.

The OECD’s transfer pricing principles are followed as guidelines for transfer pricing purposes in Colombia.

The tax reform of 2012 introduced new comparability criteria for transactions with related parties, subjected new transactions to the transfer pricing rules and established new methods for determining profit margins for transactions with related parties. The tax reform of 2016 established new reports for transfer pricing documentation (local file, master file and CbyC report) that follow the BEPS action plan.

Foreign investments of a local target company

Colombian entities can invest in foreign companies, but they must register such investments with the Central Bank.

Taxes paid abroad can be credited against the Colombian liability (Colombian taxpayers pay their income tax on worldwide profits with some limits).

Comparison of asset and share purchases

Advantages of asset purchases

- The price paid to acquire a fixed asset, adjusted for inflation up to 31 December 2006, can be used as the basis for depreciation or tax amortization.

- When used goods are acquired, the assets can be depreciated over the remainder of their useful life, after deducting the depreciation period used by the seller.

- An asset purchaser does not take on any risk or contingency relating to the commercial or tax obligations of the selling company, unless the asset acquired carries a mortgage or pledge, or in the case of real estate where the real estate tax (land tax) liability is transferred.

- It is possible to acquire only part of a business.

Disadvantages of asset purchases

- A permanent establishment could arise. The facts and circumstances should be analyzed to identify any potential risk.

- There may be a need to renegotiate supply, employment and technology agreements and to renew licenses.

- Sale generally requires access to greater cash resources.

- Benefit of losses incurred by the target company remains with the seller.

- Depending on the type of agreement, a public deed to formalize the deal could be required to be executed and registered, generating a notary fee (approximately 0.3 percent) plus a registration tax of 1 percent of the total price stated in the document, plus registration fees at an incremental rate depending on the amount included in the Public Deed.

Advantages of share purchases

- Sale generally requires less capital outlay.

- Purchaser may benefit from existing supply and technology agreements.

- A share sale does not require registration duties, but the transaction must be reported to the Central Bank regarding transfer of some participations. A public deed must be granted in certain cases and notary fees should be paid (e.g. participations in the limited liability companies).

- Target keeps its losses and tax attributes, which can be offset in the future against taxable income.

- The anti-abuse rule penalizing taxpayer behaviors aimed at evading taxes might be applicable. Based on the ‘substance-over-form’ principle, the rule states that, for tax purposes, transactions that do not have a real business purpose other than obtaining a tax benefit are not accepted.

- Transactions with parties in jurisdictions on the government’s tax haven list may be restricted in terms of income tax deductibility and attract higher WHT.

Disadvantages of share purchases

- Purchaser acquires liability for the commercial obligations of the company up to an amount equal to their capital contribution (limitation applicable to SAS and SA).

- The partners of limited liability companies (Ltda) are severally and jointly liable for tax debts.

- Partners are also jointly liable for some labor liabilities of the partnership.

- There is an eventual taxation on the indirect transfer of the Colombian entity (an alternative for an exit).

Colombia — Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Colombia’s tax treaties. This table is based on information available up to 1 January 2021.

Source: Colombia’s double taxation conventions, 2021

Notes:

- Many treaties provide for an exemption for certain types of interest (e.g. interest paid to government institutions or state-owned institutions (including governmental financial institutions)). Such exemptions are not considered in this column.

- Treaties may stipulate anti-abuse provisions (Limitation of Benefits or Principle Purpose Test) that should be considered. In addition, the MLI might modify these treaties.

- Based on Decision 578 of the Andean Community, Colombia would have the right to tax dividends and interests paid by Colombian residents.

- The domestic rate applies. There is no reduction under the treaty as the source state has the exclusive right to tax.

- In some tax treaties, the rates would depend on the shareholder’s participation in the distributing entity and could vary due to the application of the domestic law. It is necessary to analyze the applicable rates to the specific case.

- 15 percent in general; reduced to 5 percent for interest derived by banks or insurance companies.

- 10 percent in general; reduced to 5 percent for interest derived by banks or insurance companies.

- The UK DTT excludes the technical services, technical assistance services and consulting services from the Article of royalties. This could imply that payments for those concepts are considered as business profits and could also impact other treaties in which the ‘Most Favored Nation’ clause has been agreed.

KPMG in Colombia

Ricardo Ruiz

KPMG Advisory, Tax & Legal Services S.A.S.

Calle 90 no.19c-74

Edificio Blue tower Bogota Colombia

T: +57 1 6188 000

E: ricardoaruiz@kpmg.com

Jessica Massy

KPMG Advisory, Tax & Legal Services S.A.S.

Calle 90 no.19c-74

Edificio Blue tower Bogota Colombia

T: +57 1 6188 000

E: jmassy@kpmg.com

This country document does not include COVID-19 tax measures and government reliefs announced by the Colombian government. Please refer below to the KPMG link for referring jurisdictional tax measures and government reliefs in response to COVID-19

Click here — COVID-19 tax measures and government reliefs

This country document is updated as of 1 January 2021.

Footnotes

1 However, the corporate veil may be pierced if the company is used for fraud against third parties.

2 However, simplified corporations cannot negotiate their shares in the stock market or be used to develop activities that are under the supervision of the Superintendence of Finances (e.g. banking and insurance activities).

3 See, for example, the proportions required in corporations.