ECB, EBA and SRB priorities and action plans for 2018

ECB, EBA and SRB 2018 priorities

The ECB, EBA and the SRB announce their work programs and priorities for 2018.

The European Central Bank (ECB), the European Banking Authority (EBA) and the Single Resolution Board (SRB) make up the institutional framework of the European Banking Union. Now that they have each announced their work programs and priorities for 2018, it is worth reflecting on the key strategic areas and how these will affect banks in the New Year.

Published on Monday 18 December, the ECB identified four strategic areas in the SSM supervisory priorities 2018:

- Business model and profitability. The ECB plans to focus on sensitivity analyses of banks' IRRBB;

- Credit risk, NPL's and concentration. The ECB will further examine banks' NPL strategies and timelines for provisioning and write-off. Exposure concentrations will be covered by investigating real estate exposures and the analysis of collateral management and valuation practices;

- Risk management. On the Targeted Review of Internal Models (TRIM), the ECB plans to consult with banks on their `Guide to Internal Models' for ICAAP and ILAAP, and launch a public consultation on a revised guidance. The ECB will also follow-up the monitoring of banks' IFRS9 implementation and assess banks' preparedness on other regulatory changes (e.g. MREL\NSFR);

- Multiple risks. The ECB plans to continue holding open dialogue with banks on their Brexit preparations and to conduct an additional stress test for the remaining significant institutions (SIs) not participating in the EU-wide stress test.

On Tuesday 5 October, the EBA published the 2018 Work Programme outlining six main priorities:

- Play a central role in the regulation and policy framework. In 2018, the EBA plans to further contribute to the development of CRR/CRD and BRRD, and to review the consequences of the BCBS's revision of the trading book;

- Strengthen its role as EU data hub for collection, dissemination and analysis of data on EU banks. The EBA will focus on enhancing its role as a data hub for banks in the EU through the expansion of its data infrastructure and analytical capabilities, and also to improve banks' disclosures;

- Promote efficient and coordinated crisis management of credit institutions, investment firms and financial market infrastructure in the EU. The EBA aims to focus on the resolution of financial firms as well as AML/CFT;

- Promote the convergence of supervisory practices to a high standard and a consistent implementation of rules across the EU. The EBA aims to foster proportionality in relation to policy developments while monitoring the consistent application of the Single Rulebook;

- Identify and analyse trends, potential risks and vulnerabilities, and support efforts to resolve NPLs, by contributing to the European Council´s plan to tackle NPLs in Europe and monitoring the impact of the UK leaving the EU in 2018;

- Protect consumers, monitor financial innovation and contribute to efficient, secure and easy retail payments in the EU by focusing on evaluating and contributing to the Fintech regulatory perimeter.

On Monday 4 December, the SRB announced its multi-annual planning and work programme in 2018 with five main priorities:

- Strengthening resolvability for SRB entities and less significant institutions (LSIs). Oversight function for LSIs, resolution colleges for non-EU G-SIBs and on national handbooks;

- Fostering a robust resolution framework. Complete resolution plans for major banking groups, MREL and benchmarking;

- Preparing and carrying out effective crisis management. Improving SRB's crisis management capacity (e.g. by optimizing internal workflows) and enhancing the monitoring of banks that require increased scrutiny;

- Operationalizing the Single Resolution Fund (SRF) with a focus on investment strategy and the operationalization of SRF's role;

- Establishing a lean and efficient organization with enhanced IT-systems.

On top of this, the SRB will provide input in the European Deposit Insurance Scheme (EDIS), the third pillar of the Banking Union.

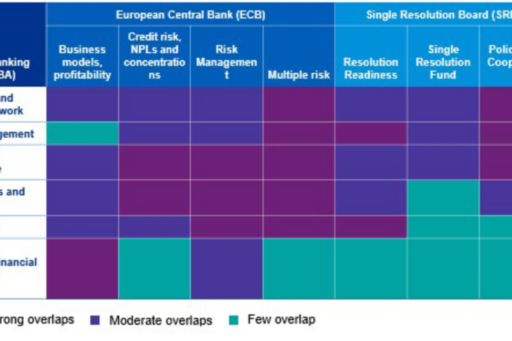

While the work programmes of the Banking Union's major authorities differ by nature, some of them overlap. These overlapping topics are important for European banks aiming to efficiently implement and address regulatory requirements in 2018 (see figure 1). Analysing the work programmes in more depth will also help banks prepare for discussions with Joint Supervisory Teams (JSTs), Internal Resolution Teams (IRTs) and other key stakeholders.

Figure 1: Key priority overlaps between the ECB, EBA and SRB. Source: ECB, EBA, SRB, KPMG.

Day-to-day supervision of EU banks

Regarding day-to-day supervision, the EBA has also published its report on the convergence of supervisory practices which refers to heightened supervisory attention based on:

- EBA's risk analysis work and findings from its bi-annual risk assessments;

- Monitoring of new regulatory developments;

- Findings from the monitoring of supervisory colleges in the course of the previous year.

Competent authorities supervising cross-border banking groups are requested to pay particular attention to these topics in 2018 and organize relevant discussions within the supervisory colleges' framework. Therefore we also expect these priority topics to be addressed by these competent authorities in the SREP 2019.

Figure 2: Report on the convergence of supervisory practices. Source: EBA.

For further details on this topic, please contact David Nicolaus (DNicolaus@kpmg.com) or Nicolas Baudoyer (nbaudoyer1@kpmg.com) from KPMG's ECB Office.