Romania – Significant Changes Proposed to Tax and Social Security Legislation

Romania – Significant Changes Proposed to Legislation

This report covers a proposal by Romania’s government to transfer responsibility for social security contributions from the employer to the employee, while also planning to usher in a decrease in income tax and social security rates.

A recent Ordinance (hereinafter “the Ordinance” or “GEO 79/2017”)1, published by Romania’s Finance Ministry, proposes the transfer of responsibility for social security contributions from the employer to the employee, while also planning a decrease in income tax and social security rates. It is expected that the new provisions will apply to income earned from January 2018.

WHY THIS MATTERS

The shift of employer social security contributions to be borne instead by the employee will significantly increase the tax burden for employees who, therefore, may experience a decrease in their net income, despite the planned reduction in the tax and social security rates, which we explain below.

Numerous discussions have taken place on whether employers can be forced to increase employees’ gross salary so as to provide the same net salary for their employees. In this respect, on Friday, 16 November, the Government Emergency Ordinance no. 82/2017 (hereafter “GEO 82/2017”)2 was published, which established the obligation for employers to initiate collective bargaining for the implementation of the changes occurring to the Fiscal Code.

Highlights of What Has Been Changed by Ordinance 79/2017

Income Tax

According to the current version of this Ordinance, the personal income flat tax rate will be decreased from 16 percent to 10 percent, except for gambling income, income from the transfer of real estate, and dividend income.

Social Security Contributions

Currently, the social security system includes six social security contributions amounting to a total of 39.25 percent (employer and employee social security contributions).3

According to the Ordinance, the number of social security contributions will be reduced to two, i.e., the pension contribution (25 percent, payable exclusively by the employee) and the health contribution (10 percent, payable exclusively by the employee).

However, according to the draft Ordinance, employers will have to pay the work insurance contribution by applying 2.25 percent to employment income and “assimilated” employment income. The contribution is intended to finance the social security benefits as follows: unemployment indemnities (20 percent), medical leave indemnities (40 percent), indemnities granted to employees as a result of a work accident or professional disease (5 percent), and to supply the Guarantee fund for employment debts (15 percent). The 20-percent difference represents income of the state budget which is directed into a separate account.

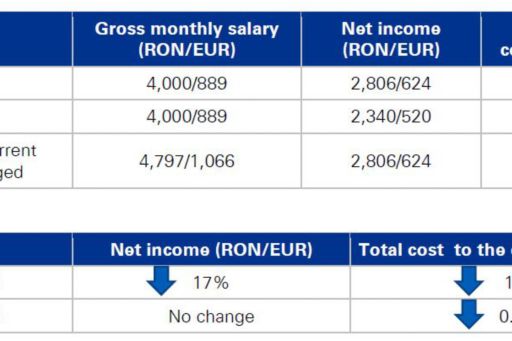

For a better understanding of the impact the proposed change may have on employers and employees, the table below summarizes the net income and the total cost for a company in terms of a gross monthly salary of RON 4,000 (approximately EUR 889) under three scenarios:

- The current tax provisions.

- The proposed tax provisions, with no compensation to the employee for the reduction in net salary.

- The proposed tax provisions, but with an increase in the employee’s gross salary so as not to affect the current net salary.

Any change in the gross salary will have to be documented through an addendum to the employment contract and notified to the relevant authorities within the relevant deadlines.

* The calculations and comments above apply for a ‟normal” employment situation. For the purpose of this exercise, a normal situation is defined by the following:

- the employee is not part of any of the categories of individuals specifically exempt from tax under the law;

- the employee has a gross salary higher than RON 3,000 per month currently (RON 3,600 per month from 2018) and thus is not entitled to personal deductions;

- work is carried out under normal conditions (not special work conditions or other conditions, as defined by specific legislation) with no collective bargaining agreements or other binding regulations apply.

KPMG NOTE

The Ordinance is currently being debated in Parliament and will subsequently be approved by law, but changes may take place prior to it being approved.

FOOTNOTES

1 Ordonanța de urgență nr. 79/2017 pentru modificarea și completarea Legii nr. 227/2015 privind Codul fiscal.

2 Ordonanța de urgență nr. 82/2017 pentru modificarea și completarea unor acte normative.

3 To learn more about Romania’s social security system, see the KPMG publication Taxation of International Executives: Romania

The information contained in this newsletter was submitted by the KPMG International member firm in Romania.

©2024 KPMG România S.R.L., o societate cu răspundere limitată de drept român, membră a organizației globale KPMG, compusă din societăți membre independente afiliate KPMG International Limited, societate privată engleză cu raspundere limitată la garanții. Toate drepturile rezervate.

Pentru mai multe detalii despre structura globală a KPMG, accesați https://kpmg.com/governance

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.