ECBs Prudential Provisioning Backstop for NPLs

ECBs Prudential Provisioning Backstop for NPLs

The publication of a draft addendum to the ECB guidance on Non-Performing Loans (NPLs) has clarified the ECB’s supervisory expectations for a prudential provisioning backstop. While the addendum only covers new flows, there are concerns that this may put additional pressure on European banks.

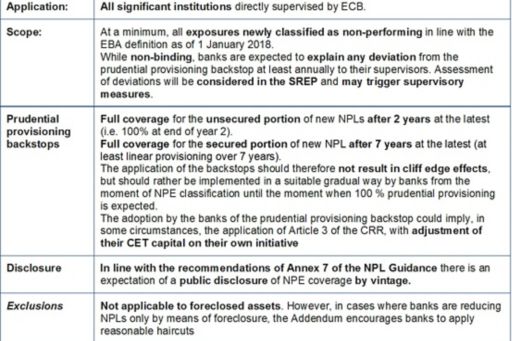

The publication of a draft addendum (“Addendum”) to the ECB guidance on Non-Performing Loans (“NPLs”) on October 4 has clarified the ECB’s supervisory expectations for a prudential provisioning backstop. The Addendum concerns only exposures newly classified as Non-Performing Exposures (“NPEs”) in line with the EBA definition as of 1 January 2018. The ECB provides expectations on both quantitative and time targets, such as full provisioning after 2 years for the unsecured portion of NPEs and 7 years (linear) for the secured portion. While non-binding, deviations from the guidance may dictate additional supervisory measures. The public consultation period runs until the 8 December, with a public hearing on 30 November 2017.

While the prudential provisioning backstop is understood to only cover new NPE flows from a regulatory capital calculation perspective, there are concerns by the industry that this may put additional pressure on European banks, raising numerous questions, inter alia, about financial statements implications and practical implementations.

KPMG member firms offer guidance to banking clients to help them understand the specific implications of these changes on their organization and business, including performing gap assessments and supporting effective implementation of changes when required for timely compliance.

Key elements of the new prudential provisioning backstop

The purpose of the Addendum is to foster a more timely prudential provisioning practice for NPLs in the EU for significant institutions, specifying quantitative supervisory expectations for minimum levels of prudential provisions for new NPEs for regulatory capital. This is in line with the action plan of the European Commission issued early in July to tackle Europe’s 1 trillion euro NPL problem. The expectations are based on the following two drivers:

- The length of time an exposure is classified as non-performing (i.e. vintage)

- The collateral held (if any).

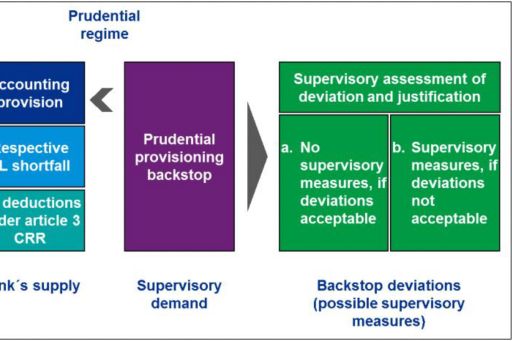

According to the ECB, the supervisory expectations should be seen as a “prudential provisioning backstop” aimed at a conservative treatment of NPEs and therefore is aimed at avoiding the excessive build-up of non-covered and aged NPEs on banks’ balance sheets in the future (see Figure 1 on the architecture of the prudential provisioning concept) (PDF 269 KB).

Figure 1: Overview of the prudential provisioning concept. Source: ECB's draft addendum to the ECB Guidance to banks on non-performing loans (4/10/2017)

Key elements of the prudential provisioning backstops include, inter alia:

Potential impacts and how KPMG can help

While the prudential provisioning backstop only applies at a minimum to new flows of NPEs classified as such as of 1 January 2018, there are concerns by the industry that, at least overtime; this will lead to additional regulatory capital buffers, secondary market activities or both.

It also raises numerous questions, such as potential implications for:

- Financial statements and IFRS´ implementation.

- Practical implementation and regulatory capital calculation.

- Reconciliation of data between the prudential and accounting requirements.

- NPL strategy and NPL management.

- The (re)definition of the bank's risk appetite framework, credit strategy and secondary markets.

As a result, in light of the increasing complexity of the business and regulatory environment, KPMG member firms can offer a wide range of technology solutions and services (accounting advisory, GAP Analysis, business adaption and transformation, deal advisory and transaction assistance) aimed at supporting financial institutions clients to effectively implement and comply on a timely basis with the ECB’s guidance on NPL and with the prudential provisioning backstop.

For further information, please contact Eric Cloutier (mailto:Eric.Cloutier@KPMG.co.uk) (Deal Advisory), Alessio Venturino (mailto:alessioventurino@kpmg.com) (Deal Advisory), Maureen Finglass (mailto:MaureenJuliaFinglass@kpmg.com) (Audit and Accounting) and David Nicolaus (mailto:dnicolaus@kpmg.com) (Risk Management).