e-Tax alert 111 - MoF announced list of treaty countries unable to effectively exchange CbC Report with Taiwan

e-Tax alert 111 -

What is different this year is that Taiwan has adopted the three-tier transfer pricing (“TP”) documentation in the local regulations. Hence, Taiwanese entity with the Group’s annual consolidated group revenue for 2016 exceeding NTD 27 billion will be required to disclose whether it will be the filing entity for Country-by-Country Report (“CBCR”) in Page B6 of the transfer pricing disclosure forms as part of the 2017 corporate income tax (“CIT”) return.

Once again, it is the busiest tax filing season of the year for companies with fiscal year ended December 31, 2017.

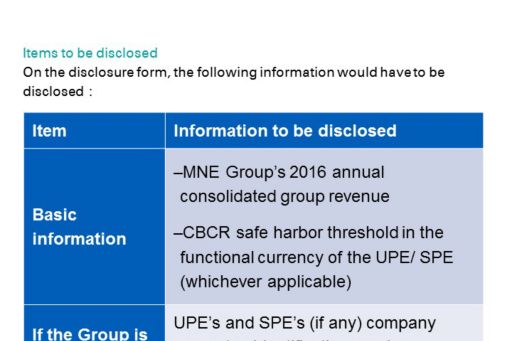

Disclosure Requirements

What is different this year is that Taiwan has adopted the three-tier transfer pricing (“TP”) documentation in the local regulations. Hence, Taiwanese entity with the Group’s annual consolidated group revenue for 2016 exceeding NTD 27 billion will be required to disclose whether it will be the filing entity for Country-by-Country Report (“CBCR”) in Page B6 of the transfer pricing disclosure forms as part of the 2017 corporate income tax (“CIT”) return.

If ultimate parent company (“UPE”) is a Taiwanese entity

According to Article 22-1 of the Assessment Rules Governing Non-Arm’s-Length Transfer Pricing for Profit-Seeking Enterprises Income Tax (“TP Assessment Rules”), where an entity in Taiwan is the UPE of a multinational enterprise (“MNE”) group, it shall prepare a CBCR of the current fiscal year in accordance with the prescribed format and submit the same to the local tax authority within one year after the end of the financial year.

If UPE is a foreign entity

Where an MNE Group whose UPE is located outside Taiwan, one of its constituent entities in Taiwan shall submit the CBCR to Taiwan tax authority if one of the following conditions apply:

- The UPE of the MNE Group is not obliged to file a CBCR in its country/ jurisdiction of tax residence.

- The UPE has filed a CBCR in its country/ jurisdiction of tax residence, but such country/ jurisdiction does not have an agreement to exchange CBCR with Taiwan by the CBCR filing deadline in Taiwan.

- The UPE has filed a CBCR in its country/ jurisdiction of tax residence and such country/ jurisdiction has an agreement to exchange CBCR with Taiwan, but Taiwan tax authority is unable to effectively obtain the CBCR in accordance with the agreement.

For foreign entities in Taiwan, if the Group’s revenue exceeds the NTD 27 billion threshold or EUR 750 million or a near equivalent amount in other currency, it is important to know if the CBCR filed by the UPE or surrogate parent entity (“SPE”) can be successfully exchanged with Taiwan tax authority.

According to Tax Ruling No. 10724507300 issued by Taiwan Ministry of Finance (“MOF”) on April 27, 2018, as of now, only New Zealand can effectively exchange CBCR with Taiwan.

In order words, a Taiwanese entity with UPE or SPE located other than New Zealand will have to indicate itself (or another MNE member in Taiwan) as the filing entity for 2017 CBCR under Page B6 of the transfer pricing disclosure forms as part of the 2017 CIT return.

Submission of CBCR

Ongoing discussion on CBCR exchange mechanism

Taiwan MOF is currently in discussion with the following treaty countries for effective CBCR exchange mechanism: Australia, Austria, Belgium, Canada, Denmark, France, Gambia, Germany, Hungary, India, Indonesia, Israel, Italy, Japan, Kiribati, Luxembourg, Macedonia, Malaysia, the Netherlands, Paraguay, Poland, Senegal, Singapore, Slovakia, South Africa, Swaziland, Sweden, Switzerland, Thailand, the U.K. and Vietnam. The list will be updated from time to time.

Filing deadline of CBCR and language

According to Article 22-1 of TP Assessment Rules, the CBCR should be filed within one year after the last day of the reporting fiscal year. Please be reminded that the prescribed language for CBCR in Taiwan is both English and Chinese.

KPMG Observation

In view that 2017 tax year is the first year Taiwan has implemented the requirement on CBCR reporting, only New Zealand can effectively exchange CBCR with Taiwan as of April 27, 2018.

Taxpayer first needs to determine how the Taiwanese entity should disclose the relevant information if it is required to submit the CBCR. If required to submit, then only one shall consider how to submit the CBCR.

As Taiwan MOF may update the list of countries to allow effective CBCR exchange mechanism irregularly, it is recommended that Taiwanese entities of foreign MNE groups seek advice from their tax consultants when completing TP disclosure forms for 2017 CIT return, and to monitor for any further developments regarding the list of treaty countries after the CIT filing.

It is expected that further details/ guidance on practical issues for filing CBCR will be released by the MOF in the near future.

Authors

Stephen Hsu, Partner

Ellen Ting, Partner

e-Tax alert

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。