e-Tax alert 100 eng- Taiwan announced Latest Amendments of the 3-Tiered TP Assessment Rules

e-Tax alert 100 eng- Latest Three-Tiered TP Rules

Taiwan Ministry of Finance (MOF) announced the amendments to “Regulations Governing Assessment of Profit- Seeking Enterprise Income Tax on Non-Arm's- Length Transfer Pricing” ("TP Assessment Rules"). The amended TP Assessment Rules had included the three-tiered transfer pricing documentation as suggested by OECD under Base Erosion and Profit Shifting ("BEPS") Action 13. The latest amendments will apply to fiscal years of 2017 onward. The three-tiered transfer pricing documentation is composed of a transfer pricing report which is already implemented from 2005, two new additions are Country-by-Country reporting ("CbCR") and Master File (“MF”). The compliance thresholds for preparing CbCR and MF are yet to be announced by MOF.

On November 13, 2017, Taiwan Ministry of Finance (MOF) announced the amendments to “Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing” ("TP Assessment Rules"). The amended TP Assessment Rules had included the three-tiered transfer pricing documentation as suggested by OECD under Base Erosion and Profit Shifting ("BEPS") Action 13. The latest amendments will apply to fiscal years of 2017 onward. The three-tiered transfer pricing documentation is composed of a transfer pricing report which is already implemented from 2005, two new additions are Country-by-Country reporting ("CbCR") and Master File (“MF”). The compliance thresholds for preparing CbCRand MF are yet to be announced by MOF.

It is expected that the threshold of CbCRcould be EUR 750 million (TWD 27 billion) which is following the OECD suggested, The due date for submitting CbCRis required within 12 months

after the last day of the reporting fiscal year of the Multinational Enterprises (MNEs). For MNEs with calendar year, the deadline for filing of CBCR for FY 2017 is before the end of FY 2018. Meanwhile, when filing annual income tax return, constituent entities of MNEs in Taiwan will be mandatory to disclose the relevant information of the ultimate parent entity (“UPE”) or the surrogate parent entity that will be responsible for submitting the CbCR.

In addition, the compliance threshold of MF is expected to be lower compared with the threshold of CbCR, which is expecting to be announced by MOF. If Taiwanese constituent entities of a MNEs group meet the compliance threshold, MF will be required to be prepared along with the annual income tax return and submitted within 12 months after the last day of the reporting fiscal year. For entities of MNEs group with calendar year, MF for FY 2017 is required to be prepared on or before 31 May, 2018 which is due to file the annual income tax return, and must be submitted before the end of FY 2018.

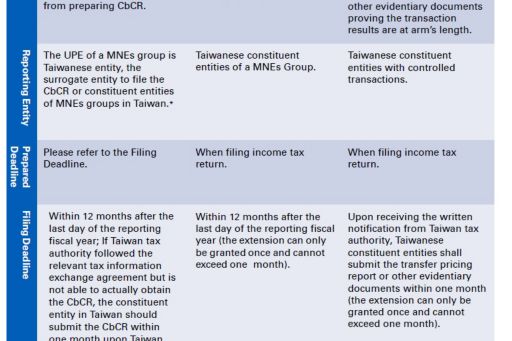

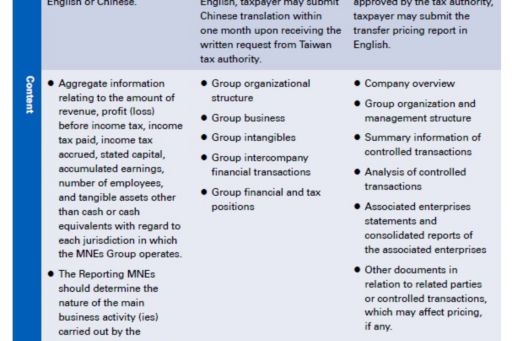

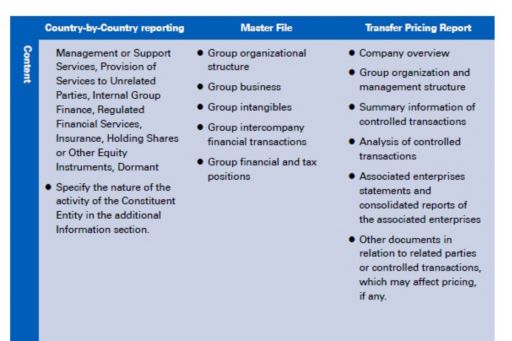

The main content of the three-tiered transfer pricing documentation rules is summarized as follows:

KPMG Observation

On November 13, 2017, Taiwan MOF announced the amendments to the three-tiered transfer pricing documentation in TP Assessment Rules. The amendments are in line with international trends, and the information of Taiwanese MNEs will be more transparency among different jurisdictions. MNEs groups will inevitably encounter the increases of regulatory compliance requirements and tax audit risk. Therefore, proactive actions are suggested as follows:

Notifying the filing deadline of each jurisdiction

The transparency of transfer pricing information disclosure in each jurisdiction have reached to the similar degree. The information for tax audit is no longer limited to merely obtain local transfer pricing documents. As the major countries in which Taiwanese MNEs groups operate including China, Southeast Asia and major European countries, these tax jurisdictions have already adopted the three-tiered transfer pricing documentation based on BEPS Action Plan 13 since FY 2016, and most of jurisdictions required MNEs to file or prepare the CbCRand MF by the end of this year (FY 2017). It is suggested that MNEs groups need to be fully familiar with the regulations of each jurisdiction in which they operate and prepare the CbCRand MF in accordance with the filing deadline.

Identifying the information and scope of the disclosure requirements of CbCRand MF in each jurisdiction

Given that the threshold, the disclosed information and reporting entity may be different from jurisdiction to jurisdiction, Taiwanese MNEs groups shall govern the information centralized in order to identify the detailed regulations for CbCRand MF in each jurisdiction, as well as manage the differences regarding the disclosures of required information among different jurisdictions.

Systematizing information by the headquarters of MNEs group and further employing the three-tiered documentation as a transfer pricing governance tool

Comprehensive information of MNEs groups will be fully disclosed due to the international trends of transfer pricing development, therefore, MNEs groups shall take more proactive actions to re-assess group’s existing transfer pricing policy to mitigate the related tax risk. It is suggested that the headquarters of MNEs groups shall centralized the information and take a systematic approach to prepare group’s three-tiered transfer pricing documentation to avoid any inconsistency in transfer pricing policies or disclosures that may cause any disputes while tax authorities engage tax audit. In addition, it is also well advised that the MNEs groups shall efficiently employ the three-tier documentation structure as the tax governance tool to review the transfer pricing policy.

KPMG Global Transfer Pricing Services Team

Sherry Chang

Lead Partner, Tax department

Anita Lin

Director, Tax department

e-Tax alert

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。