Creating a supply chain fit for purpose

Creating a supply chain fit for purpose

Operating in today’s omni business environment requires a supply chain it for purpose. The optimal structure is fully integrated with the front-end of the business and possesses the flexibility and agility to react to constant change in customer needs and market dynamics.

Erich L. Gampenrieder, Head of Global Operations, KPMG in Germany, refers to this as ‘demand-driven, supply chain 2.0’. “Technology is enabling supply chain 2.0, but it is the rising expectations of consumers that are really driving it forward,” says Gampenrieder. “For some time, companies have focused purely on generating cost efficiencies, but they now realize that the main purpose of supply chains is to balance cost with keeping their customers happy and provide a better consumer experience.” In Gampenrieder’s view, only a small minority of companies has achieved this level of supply chain sophistication.

Although executives acknowledge the need to move to demand driven supply chains, it is easier said than one. When asked what factors were most critical to building a successful omni business, the omni leaders in the study ranked having ‘agile and demand-driven supply chains’ and ‘full integration between front- and back-end systems’, as two of the top three criteria. However, for a quarter of the omni leaders, these two criteria also presented a significant challenge.

"The bigger challenge is joining up the front-and back-ends to create seamless omni channel connectivity"

Andrew Underwood, Head of Supply Chain for KPMG in the UK,

sheds further light on the need for next- generation supply chains. “The

omni-channel mandate is clear to everyone and many companies are making good progress on the front-end. For many, however, the bigger challenge is joining up the front- and back-ends to create seamless omni-channel connectivity and become able to fulfill cost-effectively on any channel that receives customer orders.”

To help reduce complexity, Gampenrieder and a team of KPMG supply chain experts have developed a set of five core pillars, called Demand-Driven Supply Chain 2.0. “Each of the pillars captures the essential requirements for what omni business consumer companies need to do to create supply chains that are agile, flexible and demand-driven,” explains Gampenrieder.

First pillar — Align the supply chain strategy with the wider corporate strategy and integrate it with customer-facing functions. This includes establishing common performance metrics, creating a reward system thatfocuses on filling customer needs, and collaborating with suppliers. Second pillar — Share information and ensure visibility across the supply chain. Every player along the end-to-end chain needs to know what the customer wants and values and be able to trace the status of materials,orders, parts, and finished products. Third pillar — Increase supply chain flexibility and agility. Flexibility means you react to events that you have pre-planned for, where you have prepared a mitigation plan. Agility enables you to manage the unexpected. Fourth pillar — Structure the supply chain to address local and global competition and evolving government regulations, such as royalties, taxes, customs, and transfer pricing and anti-profit shifting initiatives. Fifth pillar — Segment and tailor supply chains to meet customer expectations. Companies can do this by setting different end-to-end supply chains around customer values, demand-specific patterns and manufacturing and supply capabilities. |

A delicate balancing act

To develop next-generation supply chains, consumer companies wrestle with finding the right balance between speed and quality.

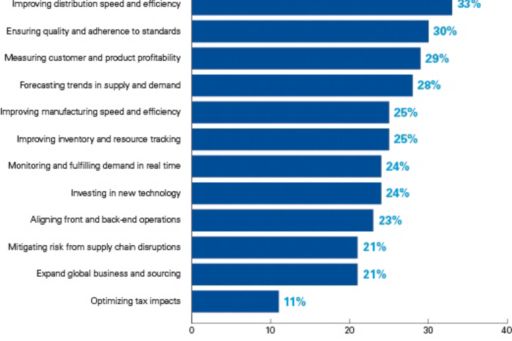

This balancing act is reflected in our survey’s top two supply chain priorities: improving distribution speed and efficiency (33 percent) and ensuring quality and adherence to standards (30 percent).

Top supply chain priorities

Better performance through advanced analytics

To take their supply chains to the next level, companies are making better use of data and analytics. Our survey showed that executives are giving high priority to a range of analytical initiatives, such as measuring customer and product profitability (29 percent), forecasting supply and demand trends (28 percent), improving inventory and resource tracking (25 percent), and monitoring and fulfilling demand in real time (24 percent).

Underwood agrees that measuring profitability should be high on the corporate agenda. “Companies are trying to connect the front-, middle- and back-offices in whatever way they can to fulfill different customer channels. Not all of that is being done very efficiently,” he says. He believes consumer companies can do a much better job of managing their costs and boosting profitability by conducting deeper analysis. “Over the last few years, I am seeing more companies taking the terabytes of data that exist around products, customers, channels, sales, pricing and commercials and putting it all together in a meaningful way.”

Gampenrieder adds, “The first question here is not which additional data should be gathered, but which question do we want to answer. The second is how the ecosystem that we need to build looks to benefit from the analytics capabilities that currently exist.”

Underwood sees the ability to forecast supply and demand trends as crucial for future success. “We continue to see what is known as demand sensing, which is taking a much more detailed view of future demands around retailers, in particular,” he says. “These forecasting methods combine point-of-sale information with other inference points, such as weather conditions, sporting events and national holidays. All of those combined will be able to give you a much more accurate picture of future demand so that you can plan better.”

Overcoming supply chain hurdles

"The top supply chain challenge is the level of required investment or ROI uncertainty."

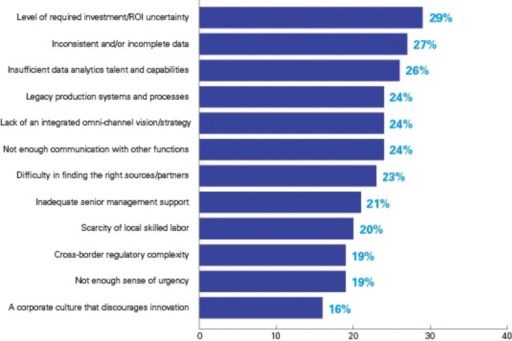

The top three supply chain challenges have to do more with investment and data requirements, than with the systems themselves (although legacy systems ranked fourth). Twenty nine percent of the surveyed executives said their top supply chain challenge is the level of required investment or ROI uncertainty. Closely following that challenge is inconsistent or incomplete data (27 percent), or insufficient data analytics talent and capabilities (26 percent). But KPMG’s Gampenrieder thinks that the issue goes beyond resources and analytics, and that ultimately, it is about the ability to make a convincing business case to senior management.

Biggest supply chain challenges

“Supply chain directors, especially those in the middle layers, can have an extremely hard time explaining the benefits to senior executives, who might not have a good understanding of the supply chain. They just struggle to translate the benefits in a compelling way,” says Gampenrieder.

To avoid this problem, he recommends using a value-based management approach, in which you take a classical value tree and show the impact across a range of value drivers. “For example, if we improve forecast accuracy, what will that mean for future sales growth, for inventory cost savings, and so forth? The idea is to make it easy for a senior executive to see what will change if we do something new,” he says

Jeanne Johnson sees a further complication arising from the transition to an omni business. “The decision for creating an omni business is on a bigger, more existential scale than restructuring the supply chain to increase efficiencies,” says Johnson. “It’s going to take real stakeholder and investor confidence, as companies transform their business models. For companies, one of the biggest concerns is that they’re doing this without a measurement paradigm. The leading omni-channel businesses today are still feeling their way through the changes, and they are helping to define these new success metrics.”

Underwood advises that the supply chain function has to start seeing itself as a business partner that plays a pivotal role in fulfilling consumer demand. “Working more effectively with the commercial function is fundamental,” he says. The two functions should agree that they need to be able to invest not just to meet the demands of today, but to also meet the demands of tomorrow.”

Ensuring supply chain integrity and quality

Having the highest integrity and quality across all business, social, and environmental dimensions, is critical for customers, especially to Millennials. The most important way to ensure integrity and quality is through closer collaboration among suppliers, manufacturers and retailers. Forty percent of the survey respondents said that this would be a top tactic for their companies over the next two years. Similarly, 25 percent said they plan to seek alternative high-quality suppliers or sources, 23 percent will create better sight lines beyond tier one and tier two suppliers, and 23 percent will monitor supplier work practices. Kruh believes that creating better sight lines is crucial. “Many companies are only familiar with the top two levels of their supply chains,” says Kruh. “Risks lurk at the deeper levels.”

Companies are also leveraging data and information to improve integrity and quality. The second-most popular cited tactic was making better use of data and analytics (32 percent), followed by development of more detailed forecasts (29 percent). One fifth said they would use third-party organizations to manage traceability programs and audits (21 percent).

All together now

Companies are also using data and analytics to improve Coordination with their supply chain partners. Thirty-eight percent of the companies surveyed said they are using data and analytics to improve collaboration with their supply chain and other functions, and 35 percent said they are sharing information, both inside and outside of the company more readily.

“It’s no surprise that data analytics is a top priority for improving collaboration,” says KPMG’s Underwood. “It is at the heart of the supply chain integrity question, and it’s a real challenge for organizations to access information across the end-to-end supply chain.”

One of the riskiest issues is the ability to trace data as products make their journeys through the supply chain. Because of the multiple tiers through which a product can pass, the information can get lost if it’s not connected. “The whole process is disjointed and the level of trust and cooperation is low. I think it can be vastly improved,” says Underwood.

The survey also shows that in addition to analytics, companies are embracing organizational solutions such as the creation of cross-functional teams with clear remits (35 percent), realigning performance incentives (32 percent), and elevating the role of the supply chain director (25 percent).

Underwood believes that performance incentives and reward systems also need to be realigned to drive different behaviors and achieve different outcomes throughout the supply chain. For instance, the primary objective of the sales and marketing function may not be aligned with procurement’s main goal. So finding an incentive scheme that puts both teams on the same page is critical.

As more companies elevate the role of the supply chain director, Underwood believes it will drive collaboration even further. “The importance of the supply chain function, including procurement, is becoming much clearer to organizations. They are starting to see the value of bringing these executives to the c-suite level, which is encouraging. But it is probably not happening as quickly as we’d all like to see.”

Building an omni-channel business page