The insurance innovation imperative: the appetite for innovation

Insurance innovates: the appetite for innovation

The link between innovation and growth is undeniable. If one were to assume that organizations with innovation budgets and well-articulated enterprise-wide strategies for innovation represent the ‘leading edge’, then the signs suggest that more advanced organizations are already preparing for the innovation-driven competitive battle that is to come.

Insurers and intermediaries know that innovation has the potential to enhance their current business and operating models. They know they need to innovate faster than their competitors to defend and grow their business. In fact 83 percent of respondents to our innovation in insurance survey believe their organizations future success is closely tied to its ability to innovate. However, with with disrupters already banging on their doors, we also found many in the insurance industry are still focused on operational innovation rather than strategic – growth oriented – innovation.

The innovation imperative: structural change is on the horizon

A shift in mindset is underway as insurance providers recognize they need to be more customer-centric than product-centric. The potent combination of data and digital is also driving increased innovation in the industry, leaving it ripe to undergo significant structural change in the coming decade.

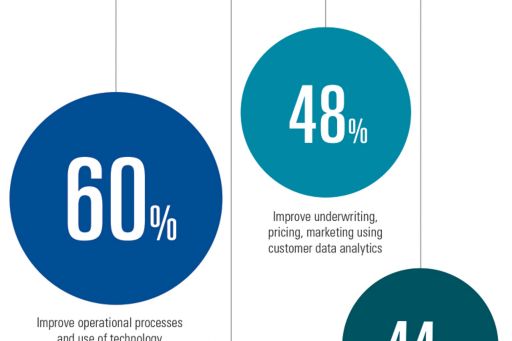

Sixty percent of respondents said “improving operational processes and the use of technology” was one of their top three opportunities over the next two years. More than half said “digital technology and its integration into business objectives” was a top opportunity, and 48 percent said “using customer data and analytics to improve underwriting, pricing and marketing”.

Yet, our research and experience suggest that some respondents may be overly-focused on incremental, operational innovation rather than market-shaping innovation with 31 percent saying their growth strategy for the next 2 years is focused enhancing existing products and services.

The appetite to innovate: shifting into a higher gear

A number of insurers and intermediaries have, however, recognized that they need to evolve more radically and are now looking to shift their innovation into a high gear. Respondents with an formalized innovation strategy were twice as likely to say that their primary focus was in developing propositions to appeal to new customer needs and new segments. And 93 percent of those with innovation budgets said they will be increasing them over the next 2 years.

Our research found mid-sized firms were significantly more focused on developing new products than both their smaller and larger peers. Given that these organizations may enjoy the scale to invest in new developments while remaining more nimble, suggests that mid-sized firms may have an opportunity to disrupt both their larger and smaller competitors.

Actions to consider

- Understand what you want to achieve from your innovations, and then plan how to combine resources, data, technology and capabilities

- Go beyond operational improvements to focus on growth

- Ensure your innovation budget has a long enough runway to allow longer-term ideas to evolve

- Encourage a ‘fail often, fail fast, learn safely’ culture with appropriate incentives and metrics