The COVID-19 pandemic has permanently changed the way we work and the places where we work, with many of these changes likely to persist even as the pandemic subsides.

Home office has become a new normal in many companies. But remote work brings several risks, especially if performed from a country other than the employer‘s registered seat. Many assignments have been stopped, canceled or extended. These commitments need to be reassessed after each change.

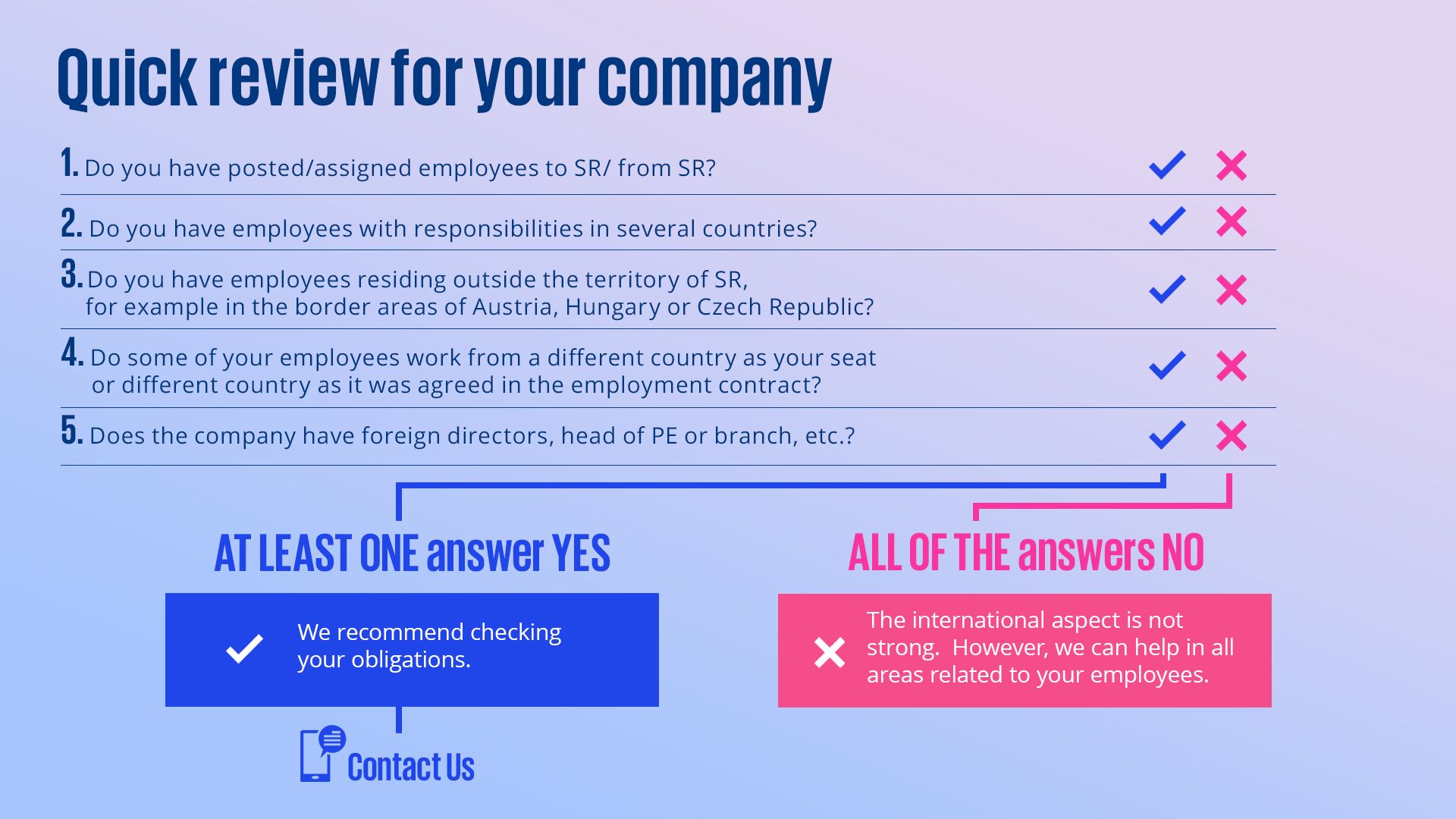

Are you aware of all your obligations?

Legislative regulation in cross-border situations is complex. This includes the income tax legislation, labor law, social and health security, EU legislation, and local legislation in the home and host country. The legislation is being constantly amended and the obligations are still increasing.

What are the risks of non-compliance?

- Fines levied against the company or employee, in the case of audits or inspections.

- Higher or lower net income paid to the employees.

- Cash flow issues.

- Impact on employees’ trust and their dissatisfaction.

- Potential impacts on corporate income taxes („PE“ risks).

How we can help

Our solutions:

- Review the set-up of assignments or home office in cross-border situations and its compliance with the legislation.

- Review the calculation of taxes, contributions, or travel allowances.

- Assist with other payroll and reporting obligations.

- Make sure that you keep payroll for all individuals where it is needed (even if they are legally employed by another entity).

- Assist with set-up of prepayments in more complex situations.

- Preparation of documentation, employment contracts, assignment letters.

- Assistance in the case of audits or inspections.

- Training for your HR or payroll department.

Contact us

Should you wish more information on how we can help your business or to arrange a meeting for personal presentation of our services, please contact us.