GI Alert: Doubled benefit in the R&D tax relief from 2018 – a greater incentive for entrepreneurs

Doubled benefit in the R&D tax relief from 2018

The second act on innovation was signed by the President of Poland – starting from 2018 entrepreneurs will be given the opportunity of an increased deduction of 38 PLN from each 100 PLN spent on R&D works. This results in a reduction of CIT payables.

The second act on innovation was signed by the President of Poland – starting from 2018 entrepreneurs will be given the opportunity of an increased deduction of 38 PLN from each 100 PLN spent on R&D works. This results in a reduction of CIT payables.

R&D tax relief – increased benefits

The act provides for a significant increase in the bonus in the form of an additional deduction of eligible costs from the tax base amounting to:

- 100 percent for all categories of eligible costs for all enterprises (for 2017 this was set at 50 percent for SMEs and at 30-50 percent for large enterprises);

- 150 percent for all categories of eligible costs for taxpayers having the status of a research and development center (R&D Center).

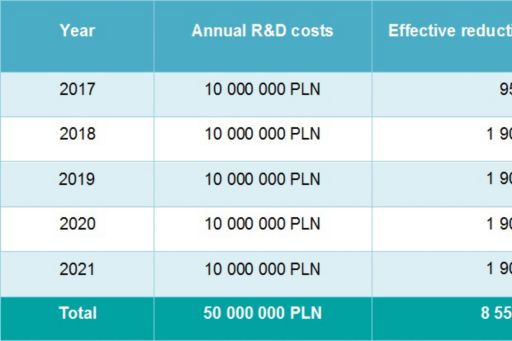

Examples of the benefits that the relief can bring in a five-year period:

Extension and clarification of the catalogue of eligible costs

The act extends and clarifies the catalogue of eligible costs, including:

- employee salaries will be eligible for the relief in the part relating to R&D activity (elimination of the “employment for the purpose of…” provision which has been a source of interpretative uncertainties);

- remuneration of individuals engaged in R&D activities under service or specific task contracts was included in the catalogue of eligible costs;

- new categories of eligible costs have been added:

- the purchase of specialized R&D equipment, which is not a fixed asset,

- the purchase of services enabling the use of research equipment for R&D,

- costs of R&D carried forward as an intangible asset.

Additional benefits for R&D Centers

Taxpayers having the status of an R&D Center will receive additional benefits in the form of:

- increased bonus – 150 percent of eligible costs;

- expanded catalogue of eligible costs:

- depreciation of structures, buildings and premises constituting a separate property, used in R&D activities,

- studies, opinions, consulting and equivalent services, researches, technical knowledge and patents or licenses for protected inventions purchased from entities other than scientific units.

- possibility of obtaining a CBR status for entities earning revenues of PLN 2.5 million or more.

Other, selected amendments introduced by the act

- enabling R&D tax relief for taxpayers with permission to operate in a SEZ;

- extending the tax exemption of companies whose sole business consists of financial investment activities, for income from the sale of shares in entities conducting R&D, purchased between 2016 and 2023;

- facilitating the development of scientific careers, combined with the development and implementation of commercial solutions in enterprises – this change is intended to encourage scientists and companies to increase cooperation.

How can we help?

The Grants & Incentives team at KPMG is part of the international KPMG R&D Incentives Network. Our experts have many years of experience in identifying and applying for grants and claiming incentives for R&D worldwide.

We offer a fully comprehensive approach enabling companies to benefit from the new tax relief for R&D:

- assistance in obtaining the status of an R&D Center;

- mapping the operations and costs eligible for deduction;

- assistance in the process of accounting separation of eligible costs;

- calculation of the R&D tax relief amount;

- preparation of the annual R&D report and filing of the R&D declaration;

- assistance in adjusting the company’s organizational, legal and accounting processes for the effective use of incentives.

Our many years of experience in claiming support for R&D projects and cooperation with scientific and technical experts offers our customers an efficient service for claiming tax relief for R&D.

© 2024 KPMG Tax M Michna Sp.K, a Poland limited company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.