Malta Securitisation

Malta Securitisation

In Malta securitisation has enjoyed the support of successive Maltese governments and local authorities. Structuring Maltese securitisation transactions is regulated by the Securitisation Act.

‘Securitisation, It’s Back’ [1] and the European Commission’s endorsement of securitisation transactions is testament to this fact in Europe, promoting securitisation transactions as a catalyst to stimulate credit, investment and job creation in Europe.[2]

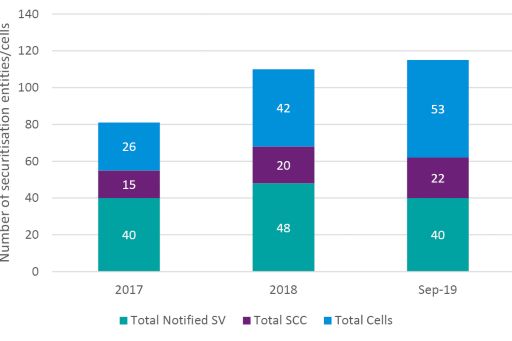

In Malta securitisation has enjoyed the support of successive Maltese governments and local authorities. Structuring Maltese securitisation transactions is regulated by the Securitisation Act.[3] This Act and its related statutes were purposefully drafted to make Malta a jurisdiction of choice for securitisation transactions. Their impact cannot be ignored, Malta reportedly is the fastest growing securitisation jurisdiction within Europe.[4]

The activities of a Malta securitisation vehicle (‘SV’) can achieve tax neutrality through the application of the general rules on the deduction of allowable expenses in terms of the Maltese Income Tax Act and rules on the deduction of allowable expenses in terms of the Malta Securitisation Transactions (Deductions) Rules.6 In turn Non-Maltese resident originators and investors can typically also achieve tax neutrality under the general provisions of the Income Tax Act and Duty on Documents and Transfers Act.[7]

The structuring of securitisation transactions using Maltese securitisation vehicles offer the following additional advantages:

• no restrictions on the type of securitisation assets;

• securities issued by an SV may be listed on a regulated market, whether in

Malta or outside;

• SVs are excluded from the scope of AIFMD by virtue of the Securitisation Act;

• SVs may issue securities backed by underlying alternative investments and target funds to purchase their securities;

• all forms of securitisation transactions are permitted, covering outright acquisition of the securitisation assets, assumption of risks and the taking control of whole businesses;

• non-EU licenced fund managers may use securities issued by SVs, backed by units in non-EU funds, as a route to accessing finance within the EU;

• transfers to SVs of securitisation assets are final, cannot be challenged / recharacterised;

• bankruptcy remoteness of the originator is provided for expressly by statute;

• the Securitisation Act restricts litigious recourse against an SV;

• legal formalities for transfer of securitisation assets to an SV are simplified; securitisation investors and creditors are granted preferred claims by law;

• light touch regulatory oversight;

• swift incorporation of SVs, requiring only a day or two to complete registration from the submission of the constitutive documents in the case of limited companies or partnerships.

KPMG Malta can assist you in structuring and implementing securisation transactions, in establishing Malta securitisation vehicles and with their ongoing obligations thereafter.

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.