Hong Kong’s New R&D Regime Takes Off

Hong Kong’s New R&D Regime Takes Off

Hong Kong Tax Alert - Issue 19, November 2018

Recap of the New R&D Regime

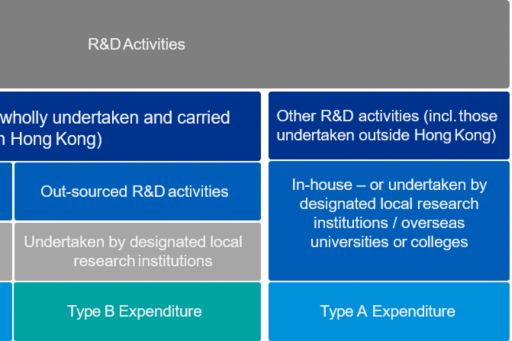

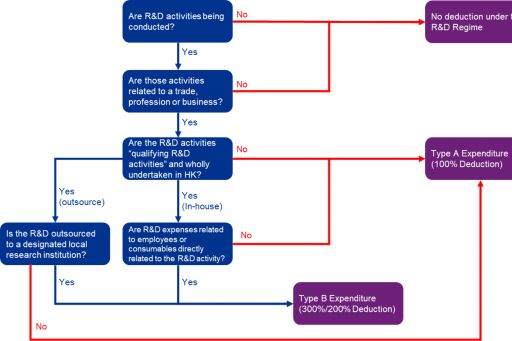

The new rules classify R&D expenditure into two broad categories (Type A and Type B) which are deductible subject to meeting certain conditions. Type A expenditure qualifies for a basic 100% tax deduction. Type B expenditure qualifies for an enhanced two-tiered tax deduction (300% for the first HK$2m and 200% for any remaining amounts). Details of the new tax incentive are summarized in the Appendix to this alert (also click here for our Hong Kong Tax Alert Issue 7 May 2018).

Amendments to the original Bill

The legislation largely retained its original form aside from a minor amendment. The amendment relates to payments made by a taxpayer to another local institution under a R&D subcontract arrangement.

The amendment provides retrospective recognition for payments made to local institutions which have been designated by the Commissioner for Innovation and Technology (“CI&T”) as a “designated local research institution”. That is, payments made to a local institution, which at the time of payment was not a designated local research institution, will be eligible for the concession as long as the local institution is designated as a designated local research institution within 6 months from the date of payment.

Concerns over the uncertainty and complexity in applying the new tax incentive

During the consultation and legislative process, some professional bodies and industry organizations raised concerns that the complicated qualifying criteria would make it difficult to assess whether expenditure would constitute Type B expenditure and thus be eligible for the enhanced R&D tax deduction. The government’s response was that the criteria are a matter of fact to be considered on a case-by-case basis. This is not entirely satisfactory because experience in other parts of the world has shown that similar R&D definitions can be interpreted very differently by different tax authorities and much will depend on the attitude of the tax authorities in assessing claims.

The IRD will release a Departmental Interpretation and Practice Notes (“DIPN”) shortly to elaborate on and clarify the provisions of the new law and the level of proof required from taxpayers to enable the IRD to assess any enhanced tax deduction claim. It is hoped that the DIPN will set out a reasonable degree of flexibility in terms of documentation requirements and will fulfil the Government’s intention of encouraging R&D activity in Hong Kong.

One area whereby the Hong Kong legislation appears to be problematic is the limited range of payments qualifying for enhanced deductions – only employment costs, costs of consumables and payments to “designated research institutions” qualify. To address these concerns, a range of organizations, including those operated for commercial gain, may apply for this designation, and the DIPN will contain guidance on the procedures and criteria for application. Clearly, a transparent and efficient approach in line with the commercial requirements of business will be required for the scheme to be truly effective. Similarly, we hope that employment costs can be interpreted in a way that takes into account the way that global groups share resources on major projects.

What taxpayers should do to get prepared and things to consider

Many organizations in Hong Kong are already conducting R&D activities, and such costs are usually embedded within their salaries and wages, expenditures or capital assets. Under the new R&D regime, payments to designated local research institutions, direct wages and consumables could qualify for the enhanced tax deduction.

Taxpayers should review and assess which R&D activities they currently undertake meet the qualifying criteria for an enhanced tax deduction. Taxpayers conducting R&D should ensure that their internal systems and processes can correctly identify these qualifying activities and quantify the relevant costs. Taxpayers may also want to ensure that their current business model is consistent with the relief, e.g., that R&D employment costs are being borne by the entity benefiting from the IP rights that are being created.

Taxpayers should not overlook the documentary requirements for making an enhanced tax deduction claim. It is important that contemporaneous documentation of processes, risks and results are kept in accordance with the IRD’s documentation requirements. Assistance from relevant experts may be required to prepare enhanced tax deduction claims.

Appendix

Diagram 1 – Key features of the enhanced tax deductions under the new R&D regime:

Diagram 2 – Roadmap of Type A and Type B Expenditure under the enhanced R&D tax deductions regime:

KPMG observations

The passing of this welcome tax incentive keeps Hong Kong in line with other jurisdictions in positioning itself as an international R&D hub and aiming to attract more R&D activities to be carried out in Hong Kong. However, the success of this initiative will depend on how it is implemented, and particularly the extent to which the tax authorities encourage or discourage claims through their interpretation of the criteria and the documentation requirements they introduce. We hope that the IRD will soon issue clear guidance in this regard. In the meantime, taxpayers should evaluate the work they are currently doing to improve processes and innovation in their businesses to establish whether they may be able to claim enhanced deductions.

For more information and assistance, please contact your usual tax advisor or one of our tax advisors.

© 2024 KPMG Huazhen LLP, a People's Republic of China partnership, KPMG Advisory (China) Limited, a limited liability company in Chinese Mainland, KPMG, a Macau (SAR) partnership, and KPMG, a Hong Kong (SAR) partnership, are member firms of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

The KPMG name and logo are trademarks used under license by the

independent member firms of the KPMG global organisation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance.