Regulatory requirements as well as investor and stakeholder expectations require a dedicated decarbonization strategy to position your real estate portfolio as a sustainable investment.

The targets of the Paris climate agreement can only be reached by assessing and implementing CO2 reduction paths, which will secure the long-term value of your real estate assets.

We support you in analyzing your initial CO2 situation and in developing CO2 reduction targets to achieve net zero emissions. Reduction scenarios on portfolio level and targeted strategies for specific real estate assets are established, with the optimal scenario considering your investment and cash flow planning.

Possible concerns

- Do you know the current CO2 footprint of your real estate portfolio?

- Do you meet the current regulatory requirements and are you prepared for future tightening?

- What is the CO2 footprint of your portfolio compared to your peer group?

- Are your operating properties or investment real estate assets compliant with your sustainability strategy?

- Do you own properties at risk of becoming "stranded assets" with negative value consequences?

- How can you optimally manage the trade-off between achieving CO2 reduction targets and meeting return or payout ratio expectations?

- What are the investment requirements to meet the targets of your CO2 reduction path? Where are these investments on the timeline?

- Do you have the information, data, and measurement systems in place to capture your baseline, to define goals and to measure progress?

- Does your current decarbonization strategy enable you to achieve your sustainability goals?

Our solutions

We support you in developing and defining your decarbonization strategy so that you meet the requirements put forward by external stakeholders - such as regulators, investors and tenants - as well as your own strategic sustainability goals.

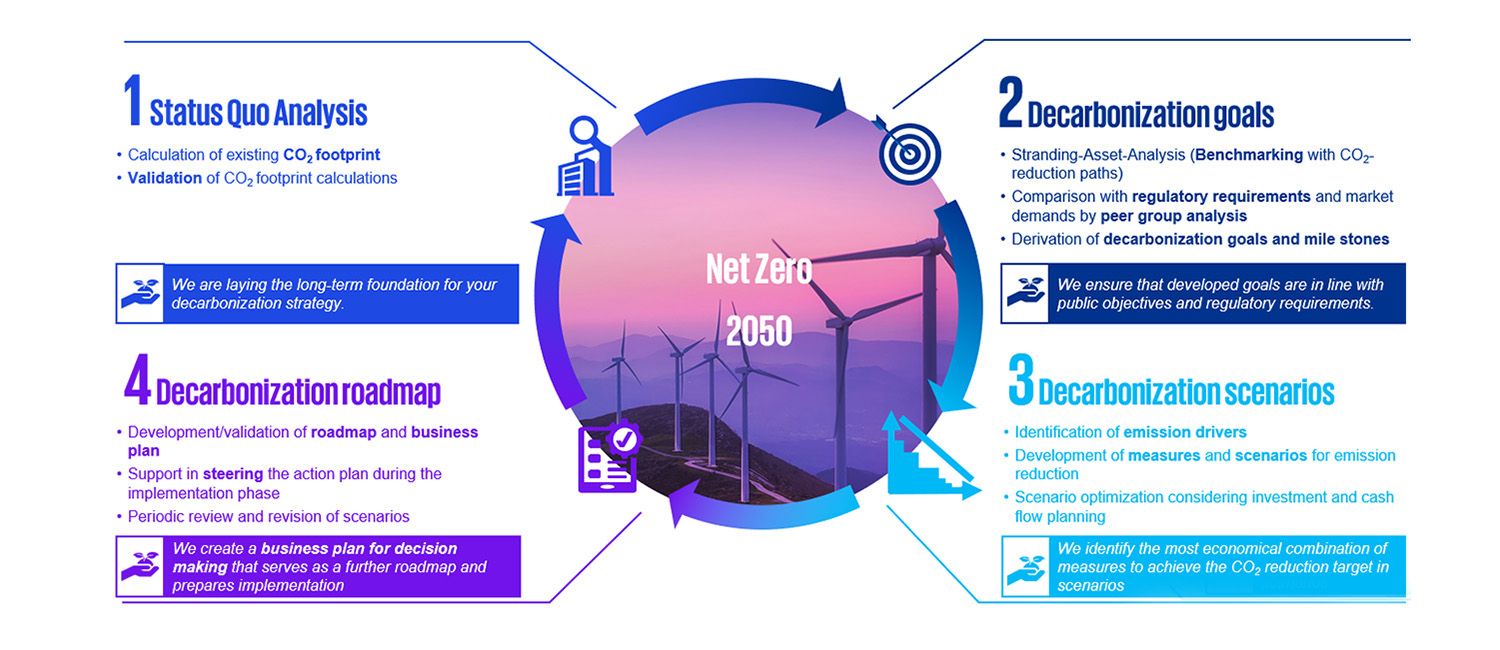

The net zero strategy is tailored to your needs in four modular phases based on the maturity of your sustainability strategy:

1. Status quo analysis

- Calculation of the existing CO2 footprint

- Validation of already performed CO2 footprint calculations

2. Determination of decarbonization targets

- Stranding asset analysis through benchmarking using CO2 reduction paths.

- Comparison with regulatory requirements, market expectations, and investor requirements through peer group analysis.

3. Portfolio clustering

- Derivation of decarbonization targets and definition of milestones

- Decarbonization scenarios

- Identification of emission drivers Development of measures and scenarios for emission reduction (incl. investment costs, CO2 and energy saving potential). Scenario optimization considering your existing investment planning (dependent on the life cycle of the portfolio properties) and your cash flow planning

4. Decarbonization roadmap

- Development of a roadmap and business plan of the developed scenarios.

- Support in steering the action plan in the implementation phase.

- Periodic review and possible revision of the decarbonization scenarios.

Net Zero Strategy in four modular phases