Profiles of the fraudster: Technology and weak controls fuel fraud

Profiles of the fraudster

A look at the people who commit fraud, the sorts of fraud they commit and the manner in which the frauds are detected.

Fraud is a global scourge which harms corporate reputations, costs millions and ruins lives. We know it is a heavy economic and moral burden on society, but do we know who the typical fraudster is? Are there defining traits, features, or behaviours that could help you to identify individuals within your organisation who may be more likely to perpetrate fraud? How they are committing the frauds, and with whom? And, perhaps most importantly, are there ways we can use this information to combat fraud? KPMG has reported on fraud trends for many years and this is the third report that profiles international fraudsters.

This report, Global profiles of the fraudster: Technology and weak controls fuel the fraud, is based on an detailed analysis of 750 fraudsters across 81 countries who were investigated between March 2013 and August 2015.

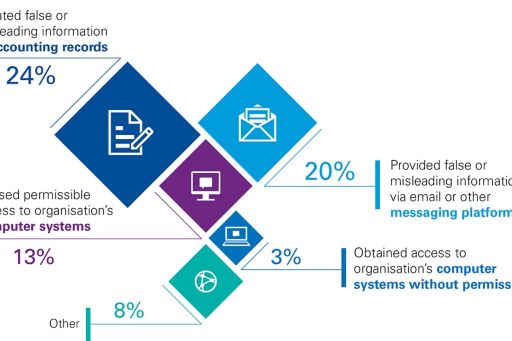

In this survey, we look at the types of people who commit fraud, the sorts of fraud they commit and the manner in which the frauds are detected. The results show that technology was found to be a significant enabler for the fraudsters investigated (24 percent); by contrast, the survey reveals that technology is likely not being used enough to prevent or detect fraud. For example, it showed proactive analytics plays an astonishingly minor role in combating fraud, with only 3 percent of the fraudsters being detected in this manner. Another key finding is that weak internal controls remains a major contributing factor for the frauds, up from 54 percent in 2013 to 61 percent in the recent survey.

Other findings indicate that a typical fraudster is:

- between the ages of 36 and 55 (69 percent of fraudsters investigated)

- predominantly male (79 percent), with the proportion of women on the rise at 17 percent, up from 13 percent in 2010

- a threat from within (65 percent are employed by the company)

- holds an executive or director level position (35 percent)

- employed in the organisation for at least six years (38 percent)

- described as autocratic (18 percent) and are three times as likely to be regarded as friendly as not

- esteemed, describing themselves as well-respected in their organisation

- likely to have colluded with others (62 percent of frauds, down just slightly from 70 percent in the 2013 survey)

- motivated by personal gain (60 percent), greed (36 percent) and the sense of ‘because I can’ (27 percent).

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.